Managing vendor payments and keeping track of bills can be a full‑time job, especially if you run a growing business. You’re juggling invoices from suppliers, contractors, and freelancers while trying to maintain healthy cash flow. Melio enters this space as an all‑in‑one accounts payable and receivable platform designed to simplify bill payments, automate invoicing, and integrate with your existing accounting software. This comprehensive review evaluates Melio’s pricing, features, pros and cons, and compares it with other top accounts payable solutions so you can decide if it fits your workflows.

Software specification

How Melio Works: Key Features Overview

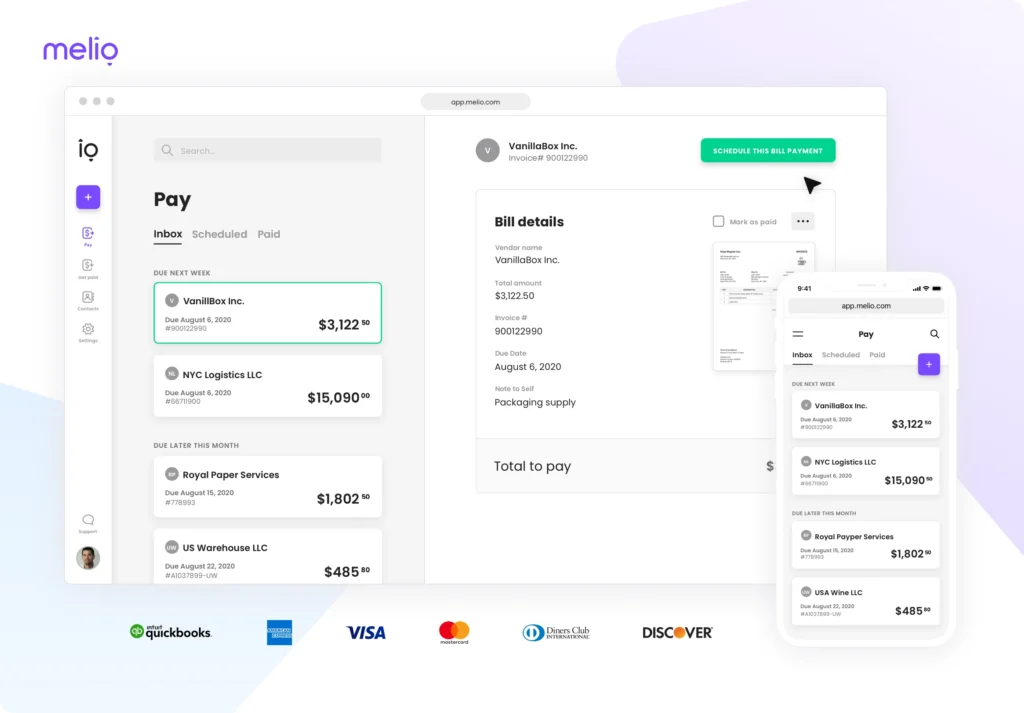

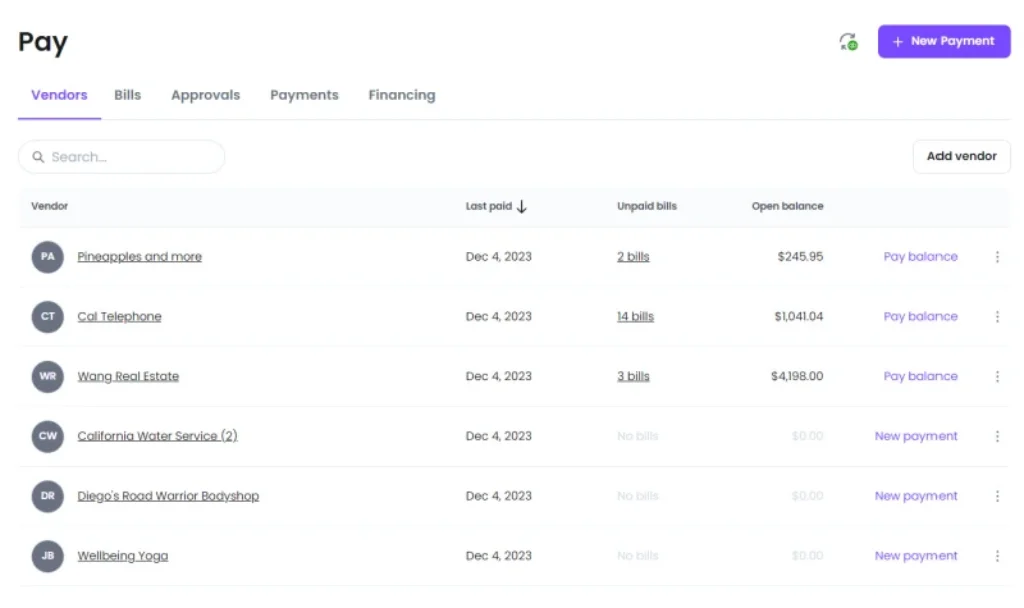

Melio functions as a digital payment hub that connects your bills, vendors, and accounting software in one place. You upload or import invoices, choose how you want to pay, and track transactions without the manual data entry that often bogs down small finance teams. This section breaks down the core features that make Melio appealing to businesses of all sizes.

Bill Management & Payment Tracking

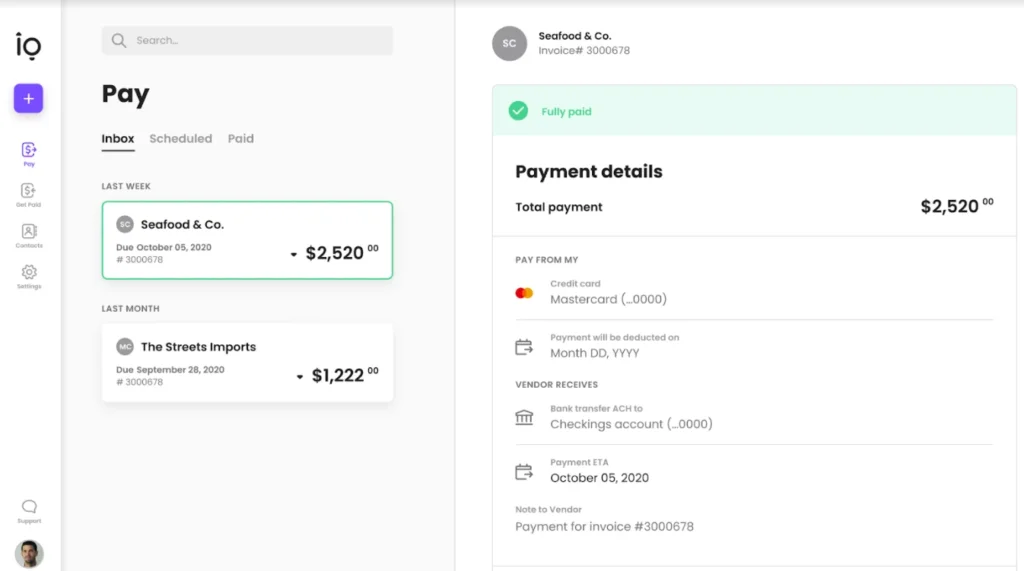

Melio’s bill management tools help you stay organized. You can import bills from QuickBooks, Xero, Gmail, Amazon Business, or upload PDFs directly. Optical character recognition (OCR) captures the invoice data, so you spend less time typing. The platform then displays all your scheduled, paid, and outstanding bills in a clean dashboard. This bird’s‑eye view lets you see which vendors are owed and how much, ensuring nothing slips through the cracks.

Melio also tracks each payment’s status in real time. If you schedule a payment, you’ll get notifications when it’s approved, processed, and received. This transparency is useful when you need to confirm payment dates with vendors or adjust your cash flow projections.

Payment Methods & Flexibility

What sets Melio apart is its flexibility. You can pay bills via several methods without the vendor needing a Melio account:

- ACH bank transfer: Free for standard transfers; same‑day transfers incur a 1% fee (capped at $30). Payments take two to three business days under the free option.

- Credit or debit card: Pay any vendor—even those who don’t accept cards—while earning points, miles, or cashback; the fee is 2.9% of the transaction amount.

- Paper checks: Melio mails checks on your behalf. The first two checks are free each month; additional checks cost $1.50, and fast checks cost $20.

- International wire transfer: You can send USD payments to more than 80 countries for a flat $20 fee.

- Instant transfer: Get funds delivered in minutes for a 1.5% fee (capped at $50).

Being able to choose between free bank transfers and paid expedited options allows you to prioritize either cost savings or speed based on the urgency of the invoice. Paying by credit card can be valuable when you want to earn rewards or extend your payment terms without affecting your vendor relationships.

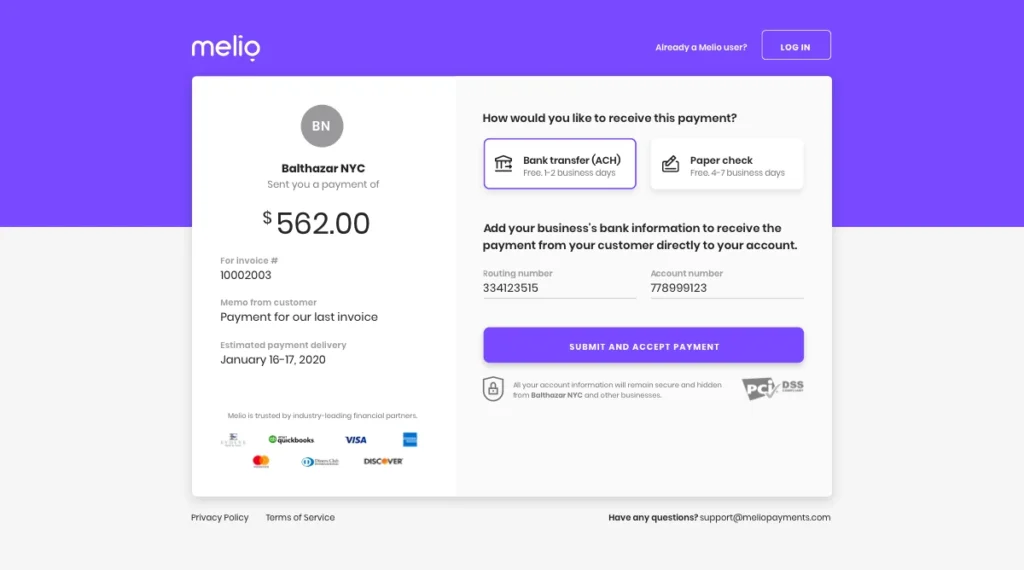

Accounts Receivable & Invoicing Tools

Besides paying vendors, Melio helps you get paid faster. You can create branded invoices with your logo and send them directly from the platform. Each invoice comes with a shareable payment link so customers can pay you by bank transfer or card. Your customers don’t need to set up a Melio account; they simply use the payment link, and the funds arrive in your bank account.

Melio’s Pay Inbox collects incoming invoices from suppliers. You can ask vendors to email their invoices directly to your unique Melio email address, and they’ll appear in your dashboard ready for approval. Automated bill capture further reduces manual data entry.

Integrations & Mobile App

Melio syncs with leading accounting platforms such as QuickBooks Online, QuickBooks Desktop, Xero, and FreshBooks. Two‑way sync ensures that bills, payments, and vendor data update in real time across platforms, minimizing reconciliation work. You can also connect Shopify, Stripe, Amazon Business, Gusto, and Zapier to streamline your workflows.

For teams that work on the go, the Melio mobile app (available on iOS and Android) offers full visibility into pending and completed payments. The app allows you to upload bills by snapping a photo, approve payments with a few taps, and receive push notifications about upcoming due dates. Being mobile‑friendly means you can manage accounts payable from anywhere without waiting until you’re back at a desk.

Pros and Cons

Advantages and Drawbacks of Melio

No tool is perfect. Here’s a balanced look at Melio’s strengths and weaknesses.

Positive

✅ All-in-one platform

✅ Highly scalable

✅ Cloud-based access

✅ Deep reporting & analytics

Negative

❌ High upfront costs

❌ Steep learning curve

❌ Implementation time

❌ Customisation complexity

✅ Benefits & Advantages

- Free base plan: You can pay bills and send invoices without a subscription. Only pay for premium features or faster delivery when needed.

- User‑friendly interface: Melio’s dashboard is intuitive, with a minimal learning curve. Navigation is straightforward, even for non‑accountants.

- Multiple payment options: Flexible ACH, card, and check payments mean vendors get paid how they prefer; you can optimize cash flow and earn credit card rewards.

- Two‑way accounting sync: Seamless integration with QuickBooks and Xero reduces manual reconciliation and errors.

- Custom approval workflows: Multi‑level approvals ensure internal controls while keeping payments moving quickly.

- Mobile access: A fully functional mobile app lets you manage bill pay from anywhere.

❌ Drawbacks & Limitations

- Limited advanced reporting: Melio doesn’t offer robust financial reporting like full accounting platforms; you’ll still need separate software for analytics and budgeting.

- International limitations: Payments to vendors overseas are processed in USD only. If you need multi‑currency capability, you may need a different solution.

- Per‑use fees add up: While ACH transfers are free or inexpensive, card and expedited payment fees can add up if used frequently.

- Customer support constraints: Support is available via email and live chat during extended business hours (not 24/7). Higher-tier plans include phone callbacks, but real‑time help is limited on the free plan.

- Not a full accounting system: Melio lacks features like full financial reporting, payroll, and tax management, so it complements rather than replaces accounting software.

Advanced Tools

Melio Key Features in Depth

Beyond basic bill pay, Melio offers a range of features designed to streamline your accounts payable processes and improve collaboration across your finance team.

Approval Workflows & Team Management

On Core and higher plans, you can create multi‑level approval workflows. Define approval rules by vendor, transaction amount, or user role. For instance, purchases over a certain threshold may require approval from both the finance manager and CEO. You can also invite external accountants at no extra charge, allowing them to approve or manage payments without sharing sensitive login credentials.

Roles and permissions help maintain internal control. Assign user roles such as owner, admin, or accountant, and restrict access to specific vendors or tasks. In Unlimited plans, you have advanced roles and unlimited seats, which is particularly useful for larger teams with complex hierarchies.

Easy Bill Capture & Automated Reminders

Uploading invoices by email or photographing them with the mobile app triggers Melio’s AI‑powered bill capture. The system extracts key details: vendor name, invoice number, due date, and amount, reducing manual entry. You can attach supporting documents or notes to each bill for easy reference.

Automated reminders keep your payments on track. Melio sends notifications for upcoming due dates, approvals needed, or payments that are still pending. This reduces late fees and helps preserve vendor relationships.

Pay by Card & Pay Over Time

A standout feature is the ability to pay vendors with your credit card—even if they only accept bank transfers or checks. Melio processes the card payment and pays the vendor via ACH or check, allowing you to earn credit card rewards and keep cash in your bank longer. This feature is useful for smoothing cash flow without straining vendor relationships.

Melio also partners with Credit Key to offer a pay‑over‑time option. Instead of paying a supplier in one lump sum, you can apply for a line of credit and repay over one to twelve months. The first month often has a fixed fee as low as 2.55% instead of traditional interest. This flexible financing tool can be a lifesaver when you need to manage large, unexpected expenses.

International Payments & Multi‑Currency Support

For businesses with global vendors, Melio supports international payments to more than 80 countries. All transactions are sent in USD, so your vendors will receive USD deposits; they may incur conversion fees with their bank. While Melio doesn’t support local currency payments, the flat $20 fee and ability to pay by wire or Mastercard make cross‑border payments straightforward for small businesses.

If you frequently pay vendors in foreign currencies, you might need a platform that offers true multi‑currency support. However, for occasional international bills, Melio’s international feature is simple and transparent.

Security & Compliance

When dealing with financial transactions, security is crucial. Melio adheres to industry‑leading standards:

- SOC 2 Type 2 certification: Demonstrates robust internal controls for data security and privacy.

- ISO 27001, 27017 & 27018 certifications: Global standards for information security management and cloud security.

- PCI Level 1 certification: Ensures card data is processed under strict compliance standards.

- Two‑factor authentication and encryption: Protects access to your account and secures sensitive data.

- Audit trail: Maintains detailed logs of payment activities, aiding compliance with accounting standards and audits.

These measures minimize the risk of fraud or unauthorized access, giving you peace of mind when handling sensitive financial data.

Business Fit

Who Should Use Melio?

Melio is geared toward small and midsize businesses that need a straightforward, cost‑effective way to pay vendors and manage invoices. It’s particularly suitable for:

- Professional services firms such as marketing agencies, law offices, and consultancies that need to pay freelancers and subcontractors quickly and keep records organized.

- Retail and e‑commerce businesses that handle multiple vendors and suppliers and need to manage cash flow efficiently.

- Construction and trade companies that juggle partial payments, multiple contractors, and complex invoices.

- Healthcare providers and clinics with regular vendor payments but limited back‑office staff.

- Nonprofits and charities that require transparency and documentation for audits.

- Freelancers and solo entrepreneurs who want to streamline bill payments and get paid faster without adding another expensive subscription.

If your business processes high volumes of international payments, requires deep financial analytics, or needs a full enterprise resource planning (ERP) solution, Melio might not suffice. In those cases, more robust platforms such as BILL, NetSuite, or SAP Concur could be better fits.

Pricing and Plans

How much does Melio cost?

Melio uses a simple pricing structure that gives you flexibility based on your payment volume and team size. The Go plan lets you start for free, and you only pay for additional ACH transfers or optional expedited services. Higher-tier plans add automation, user management, and advanced approval controls.

Below is a clear breakdown of all available plans.

| Plan | Key Features | Monthly Cost |

| Go (Free) | 5 free ACH/mo, basic invoicing, 10 QB/Xero syncs, 1 user | $0 |

| Core | 20 free ACH/mo, unlimited syncs, W-9/1099 tools, team access | $10/user |

| Boost | 50 free ACH/mo, QB Desktop, advanced approvals, priority support | $10/user + premium features |

| Unlimited | Unlimited ACH, unlimited users, premium support & onboarding | Custom |

| Platinum | High-volume pricing, API access, enterprise integrations | Custom (invite-only) |

| Transaction Fees | ACH $0–$0.50, card 2.9%, fast check $20, intl USD transfer $20 | Pay-as-you-go |

Go Plan (Free)

The Go plan is best if you need a lightweight way to pay vendors and send invoices. You get 5 free standard ACH payments each month, basic invoicing tools, and limited QuickBooks or Xero syncs. After the free monthly ACH quota, each ACH payment costs just $0.50.

Core Plan

The Core plan is built for businesses ready to manage more bills and add team members. It unlocks unlimited accounting syncs, 20 free ACH transfers monthly, custom user roles, vendor tax form management, and batch scheduling.

Boost Plan

Boost is ideal for accounting teams or companies with more complex approval structures. It includes 50 free ACH transfers, QuickBooks Desktop integration, advanced approval routing, and priority support with optional callback requests.

Unlimited & Platinum Plans

If you want maximum flexibility, the Unlimited plan removes user limits and ACH limits, making it suitable for high-volume teams. Platinum is invite-only and tailored to enterprises processing more than $300k in monthly card payments. It offers custom pricing, API access, and enterprise integrations.

Transaction Fees

Even with paid plans, certain transactions follow a simple pay-as-you-go fee structure:

- ACH: free or up to $0.50, depending on usage

- Card payments: 2.9%

- Fast paper check: $20

- International USD transfers: $20

- Instant transfer: 1.5% (capped at $50)

This setup lets you pay only for the speed or convenience you need, while keeping your overall cost structure predictable.

Melio vs. Alternatives

Compare top competitors

The market for accounts payable software is growing, and several competitors offer overlapping features. Understanding how Melio stacks up helps you make an informed choice.

Comparison Table – Melio vs. Bill.com vs. Ramp

| Feature | Melio | Bill.com | Ramp |

| Pricing model | Free base plan, per‑transaction fees | Monthly subscription + per‑use fees | Free corporate card program |

| ACH transfers | 5–Unlimited free ACH payments (depends on plan) | Unlimited ACH included in subscription | Unlimited ACH free |

| Credit card payments | Available for 2.9% fee | Available, fees vary | Corporate card offered; bill pay uses card automatically |

| International payments | USD only, $20 fee | Supports multi‑currency & local payouts | Limited, primarily US |

| Accounting integrations | QuickBooks, Xero, FreshBooks, Shopify, Gusto | QuickBooks, Xero, Sage Intacct, Oracle NetSuite | QuickBooks, Xero, Netsuite via partner apps |

| Approval workflows | Customizable on higher plans | Extensive workflows with dynamic rules | Card rules & departmental controls |

| Reporting & analytics | Basic payment reporting | Robust cash flow and spend analytics | Built‑in spend and budget tracking |

| Mobile app | Yes, full functionality | Yes, includes invoice approval | Yes, focuses on card management |

Overview of Notable Competitors

- Bill.com: Offers comprehensive accounts payable and receivable features, multi‑currency payments, and deep integrations. It charges monthly subscription fees and per‑transaction fees, making it better suited for mid‑sized and large businesses.

- Ramp: Combines corporate cards with spend management and bill pay. Companies earn cashback on card spending and can automate approvals. Best for tech‑forward teams seeking unified expense management.

- Plooto: Focuses on automating ACH payments and integrates with QuickBooks and Xero. Flat pricing may be attractive if you process many transactions each month.

- Plastiq: Lets you pay any bill with a credit card, even if the vendor doesn’t accept cards. Fees are generally higher than Melio’s, but it supports more countries.

- QuickBooks Bill Pay: Offers basic payment features within QuickBooks. If you’re already using QuickBooks Online, you can send payments directly without a separate platform, though features are more limited.

When comparing alternatives, consider the frequency and volume of your payments, international needs, and whether you want an all‑in‑one spend management platform or a simple accounts payable tool. Melio stands out for its free entry point, user‑friendly interface, and credit card payment flexibility.

Setup and Use Tips

Getting Started with Melio

Setup & Onboarding

Creating a Melio account takes only a few minutes. You can sign up using your Google login, Intuit (QuickBooks) credentials, or email. During setup, you’ll specify whether you’re a business owner or an accountant managing multiple clients. You’ll also enter basic details like your business name, address, and industry. Next, connect your bank account to send and receive payments. Melio uses Plaid to verify your bank, keeping your credentials secure.

Once you’re in, you can start adding vendors and bills:

- Import from accounting software: If you’re using QuickBooks or Xero, sync your account to automatically pull in vendor data and outstanding bills.

- Upload invoices: Drag and drop PDF invoices or forward them to your unique Melio email address for automatic capture.

- Add vendors manually: If a vendor isn’t already in your system, you can add their payment method (ACH or check) and contact details.

Tips for Implementation & Best Practices

- Use OCR for bill capture: Whenever possible, upload invoice files or photos. Melio’s OCR will populate fields, but double‑check for accuracy.

- Set up approval workflows early: Even if your team is small, establishing approval rules ensures consistency and prevents unauthorized payments.

- Schedule payments strategically: Plan ACH or card payments based on invoice due dates and cash flow needs. Scheduling ensures you never miss a due date and can help you take advantage of early payment discounts.

- Sync daily with your accounting software: Frequent syncing keeps your ledger current and reduces reconciliation headaches.

- Educate vendors: If vendors are unfamiliar with digital payments, assure them they’ll still receive funds via their preferred method (ACH or check). They don’t need a Melio account to get paid.

Support

Customer Support & User Feedback

Melio offers several support channels to assist users, though availability varies by plan.

Support Channels & Availability

- Help Center: Comprehensive articles and step‑by‑step guides cover setup, payments, integrations, and troubleshooting.

- Email support: All users can submit a support ticket and typically receive responses within one business day.

- Live chat: Available Monday to Friday from 9 AM to 8 PM EST for immediate assistance.

- Phone callbacks: Reserved for Boost and Unlimited plans—users can request a call when complex issues arise.

- Melio Academy: A resource hub with webinars, tutorials, and continuing education modules for accountants.

While support is generally responsive, some users report delays or difficulty reaching live agents. Upgrading to a higher plan can improve response times if your business depends on faster assistance.

User Reviews & Satisfaction

Reviews from platforms such as GetApp, Capterra, and Trustpilot consistently highlight Melio’s ease of use and integration with QuickBooks as major strengths. Users appreciate the free ACH transfers and the ability to pay by card when vendors only accept checks. Many reviewers mention that Melio saves them hours each week compared with manual bill payments.

However, feedback also notes areas for improvement. Some users encounter occasional payment delays or glitches when syncing with accounting software. Others mention limited customer support hours and a lack of detailed reporting. Overall satisfaction remains high, especially among small businesses seeking a cost‑effective solution for payables.

Conclusion

Is Melio Right for You?

Melio delivers a compelling mix of affordability, flexibility, and user friendliness that makes it a strong contender in the accounts payable market. The free Go plan is a major draw: you can automate bill payments, send invoices, and sync with popular accounting tools without a subscription fee. Paying vendors with your credit card, even when they don’t accept cards, helps optimize cash flow and earn rewards. Approvals, reminders, and easy bill capture further streamline your finance workflows.

That said, Melio isn’t a one‑size‑fits‑all solution. Businesses needing deep financial reporting, multi‑currency payments, or enterprise‑level integrations may find it lacking. Transaction fees for card payments and faster transfers can add up, and customer support is limited on lower plans. If you require advanced analytics or handle large international volumes, alternatives like Bill.com or Ramp may be a better fit.

Ultimately, Melio suits small and midsize businesses seeking to modernize their bill payments without the complexity or cost of traditional accounting suites. Take advantage of the free plan or free trials to see how it integrates with your workflow. By testing its features firsthand, you can determine if Melio offers the right balance of convenience and control for your business.

Have more questions?

Frequently Asked Questions

Is Melio completely free to use?

Melio offers a free Go plan that lets you pay bills and send invoices without a subscription fee. You get five free ACH transfers each month; after that, a small per‑transaction fee applies. Paid plans add automation and team features.

Can I pay vendors by credit card even if they don’t accept cards?

Yes. Melio allows you to pay any vendor with a credit or debit card. The platform processes your card payment and then pays the vendor via ACH or check. This helps you earn rewards and extend payment terms, though a 2.9% fee applies.

How long do Melio payments take to arrive?

Standard ACH payments take two to three business days. Same‑day ACH transfers (1% fee) arrive within one business day if scheduled before 2 PM ET, while instant transfers (1.5% fee) arrive within minutes.

Does Melio integrate with QuickBooks and Xero?

Absolutely. Melio offers two‑way sync with QuickBooks Online, QuickBooks Desktop, Xero, and FreshBooks. You can import bills, sync payment statuses, and keep your accounting software updated automatically.

Can I schedule recurring vendor payments?

Yes. Melio lets you schedule one‑time or recurring payments. You choose the payment method and set the date, and Melio will send reminders and process the payment automatically.

What are the limits on how much I can send via Melio?

There are generally no limits on standard ACH payments. However, same‑day ACH and instant transfers may have limits based on your transaction history and plan. You can contact support for higher limits if needed.

How secure is Melio’s payment platform?

Melio is certified SOC 2 Type 2, ISO 27001, ISO 27017, and ISO 27018. It uses bank‑level encryption and two‑factor authentication. Card processing is PCI Level 1 certified, ensuring your data is protected.

Does Melio support international payments?

Yes, Melio supports USD payments to more than 80 countries for a flat $20 fee. However, it doesn’t support paying vendors in local currencies, so currency conversion will occur on the recipient’s end.

How does the pay‑over‑time feature work?

Through a partnership with Credit Key, Melio offers lines of credit that let you pay vendors upfront and repay over one to twelve months. A fixed fee (often starting around 2.55% for one‑month loans) applies instead of traditional interest.

Are there alternatives better suited for large enterprises?

Larger organizations with complex workflows or global operations may prefer platforms like Bill.com, Tipalti, or SAP Concur. These tools provide more robust reporting, multi‑currency payments, and deeper integrations at higher price points.