Managing your business finances shouldn’t feel like solving a puzzle. If you’re a freelancer, contractor, or small business owner, you already juggle enough responsibilities. The last thing you need is complicated accounting software getting in your way. That’s where FreeAgent steps in.

FreeAgent is designed to take the stress out of accounting by simplifying tasks like invoicing, expense tracking, and tax returns. Whether you’re chasing unpaid invoices or preparing for your Self Assessment, this tool gives you a clear picture of your business finances – without the jargon.

What makes it stand out? It’s not just the user-friendly interface or time-saving automations. FreeAgent also comes packed with UK-specific features tailored to your tax obligations, helping you stay compliant and organized year-round ✅

In this review, you’ll get a closer look at what FreeAgent really offers, including:

- Core features that help automate your workflow

- Real-world pricing breakdown

- Pros and cons from the lens of accountants and users alike

- Customer reviews and FreeAgent alternatives

By the end, you’ll know if FreeAgent fits your unique business needs, or if another solution might serve you better.

Let’s dig in.

What Is FreeAgent?

FreeAgent is a cloud-based accounting software built specifically for freelancers, contractors, and small businesses. Unlike bulky systems made for corporate finance teams, FreeAgent focuses on simplicity without compromising the essential tools you need to run your business efficiently.

You access FreeAgent entirely online, meaning you don’t need to install anything or manage updates. It’s always up to date, backed by secure servers, and ready to use on desktop or mobile.

Who is FreeAgent best for?

FreeAgent is ideal if you’re:

- A UK-based freelancer, contractor, or small business

- Looking for HMRC-compliant tools (including VAT and Self Assessment)

- Managing your own books without an in-house accountant

- Wanting easy-to-use software with little to no learning curve

Whether you’re sending invoices on the train or reconciling your bank transactions with your morning coffee, FreeAgent helps you stay on top of your finances without eating up your time.

💡 Tip: FreeAgent is especially popular among users with NatWest, RBS, or Ulster Bank business accounts, who can access it completely free of charge.

Next up, let’s explore the features that set FreeAgent apart from the crowd.

Who Is FreeAgent Best For?

Find out if FreeAgent fits your business needs

FreeAgent is designed for UK-based freelancers, contractors, and small business owners who want to take control of their finances without hiring an accountant.

It’s a great fit if you:

- Work as a sole trader, limited company, or partnership

- Need to track income, expenses, and taxes with ease

- Want VAT and Self Assessment tools that are HMRC-compliant

- Prefer a simple, visual dashboard instead of spreadsheets

- Like having access to accounting tools on the go via mobile app

If you’re not running a large corporation but still want a powerful accounting tool tailored to your needs, FreeAgent is likely a smart choice.

Software specification

Core Features That Matter in 2025

FreeAgent comes packed with features tailored to simplify small business accounting. Every tool is designed to help you spend less time on admin and more time doing what you love.

Let’s break down the core features that make FreeAgent a favorite among freelancers and small business owners 👇

Invoicing and Payments

FreeAgent makes it easy to stay on top of your cash flow by helping you create, send, and track invoices in minutes.

- Create branded, professional invoices with your logo

- Set up recurring invoices for ongoing clients

- Send automated reminders for overdue payments

- Accept online payments via Stripe, PayPal, or GoCardless

💡 You can even track when your client opens the invoice – no more guessing!

Expense Tracking

Keep your business expenses organized with FreeAgent’s smart tools. You can log purchases, snap receipts, and categorize transactions with ease.

- Upload receipts via mobile app or email

- Auto-categorise expenses by type (e.g. travel, office, software)

- Track mileage and apply HMRC-approved rates

- Rebill expenses directly to clients when invoicing

This keeps your records tidy and makes expense reporting painless when tax season rolls around 🔍

Time Tracking

Need to bill clients by the hour or manage time on projects? FreeAgent includes simple time-tracking tools built right into your account.

- Log time manually or use a built-in timer

- Assign time to specific clients or projects

- Convert tracked hours into invoices in one click

- Review weekly time summaries to stay on schedule

Perfect for freelancers and service-based businesses that need clear visibility into billable hours.

Tax Management

One of FreeAgent’s biggest strengths is its focus on UK tax compliance. It offers built-in tools to help you stay on top of your obligations all year long.

- Automatically generate VAT returns (compatible with MTD)

- Prepare and file Self Assessment tax returns

- Get real-time estimates of how much tax you owe

- Submit returns directly to HMRC from within the app

✅ This is a game changer if you’re used to scrambling with spreadsheets before deadlines.

Project Management

If you work on multiple projects or clients at once, FreeAgent gives you a clear view of performance and profitability.

- Track income and expenses by project

- Monitor time logged and budgeted hours

- View project health and profit margins

- Easily invoice per project or client

It’s not a full-blown project management app, but it’s incredibly useful for service-based businesses that bill by project.

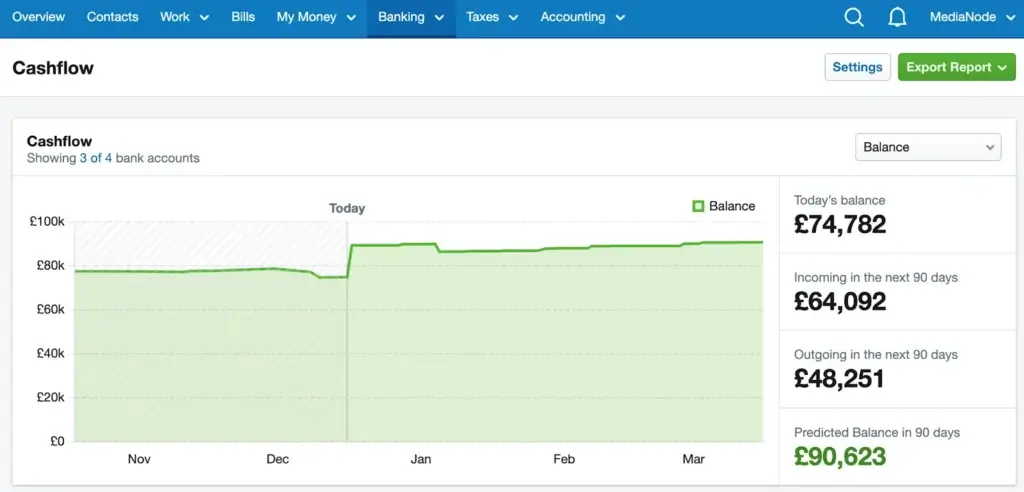

Bank Integration

FreeAgent helps you stay on top of your business finances with seamless bank connections.

- Link your business bank accounts securely

- Automatically import and categorize transactions

- Reconcile payments with a few clicks

- View cash flow in real-time from your dashboard

💡 Bank feeds support most major UK banks and credit card providers.

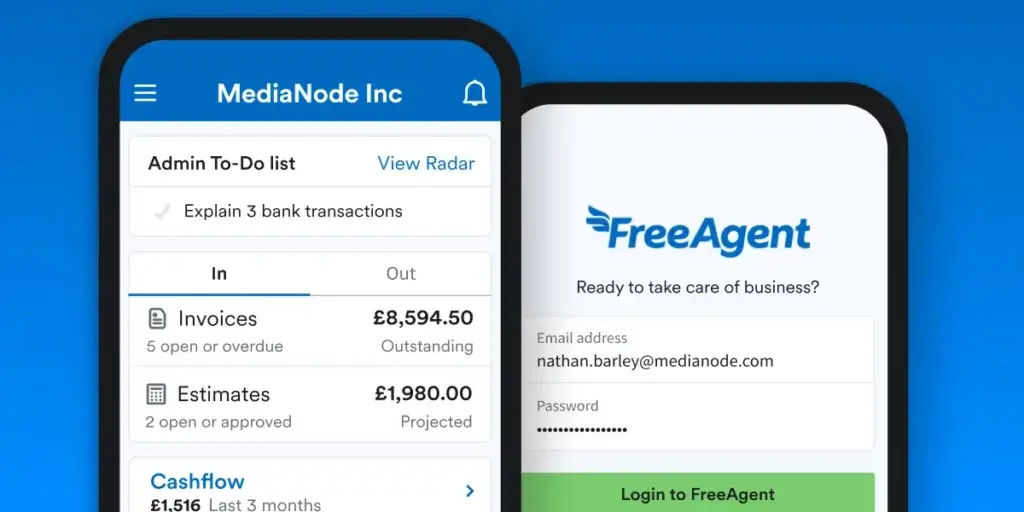

Mobile App

Running your business on the move? FreeAgent’s mobile app (available on iOS and Android) gives you the freedom to manage your finances from anywhere.

- Create and send invoices

- Upload receipts instantly

- Check bank balances and cash flow

- Track time and log mileage

The app is especially handy if you’re often out in the field, visiting clients, or working remotely.

With all these features combined, FreeAgent gives you a 360-degree view of your business finances – without requiring any accounting background.

Pros and Cons

A balanced view: what you’ll love and what to consider

No accounting software is perfect, and FreeAgent is no exception. While it shines in many areas, it does have a few limitations depending on your business needs.

Here’s a balanced breakdown of the main pros and cons to help you decide if it’s the right fit for you:

Positive

✅ User-friendly dashboard

✅ Excellent for UK taxes

✅ Great for freelancers and contractors

✅ Mobile app is genuinely useful

✅ Automation saves time

Negative

❌ Limited scalability

❌ No multi-currency bank accounts

❌ Payroll is UK-only

❌ Fewer third-party integrations

❌ Basic project management

✅ Pros

- User-friendly dashboard

The interface is clean, visual, and simple to navigate – even if you’ve never touched accounting software before. - Excellent for UK taxes

Supports HMRC compliance, including VAT (with Making Tax Digital), Self Assessment, and Corporation Tax filing. - Great for freelancers and contractors

Designed with solo business owners in mind, offering tools tailored to how you work and bill clients. - Mobile app is genuinely useful

You can send invoices, log expenses, or check your cash flow while you’re on the move. - Automation saves time

Features like recurring invoices, expense auto-categorization, and bank feed syncing reduce admin work. - Free for NatWest/RBS/Ulster Bank users

If you bank with any of these, you get full access to FreeAgent at no additional cost. - Responsive customer support

Get help via live chat or email, with a well-organized knowledge base for quick answers.

💡 Many users report that FreeAgent’s support team feels like an extension of their business.

❌ Cons

- Limited scalability

It’s great for small teams but lacks deeper features needed for growing or multi-departmental businesses. - No multi-currency bank accounts

You can invoice in foreign currencies, but your bank feeds must be in GBP. - Payroll is UK-only

The payroll module is restricted to UK businesses, limiting its use for global operations. - Fewer third-party integrations

Compared to tools like Xero or QuickBooks, FreeAgent integrates with a smaller app ecosystem. - Basic project management

You can track hours and budgets per project but don’t expect full task management or collaboration tools.

If you’re a UK-based freelancer or small business owner, FreeAgent hits all the right notes. But if your business is scaling quickly or operating internationally, it might be worth comparing it with more advanced tools.

User Experience

User Interface and Operational Simplicity

When it comes to day-to-day use, FreeAgent earns high marks from freelancers and small business owners who value clarity, simplicity, and time-saving features. Its focus on usability is one of its biggest selling points.

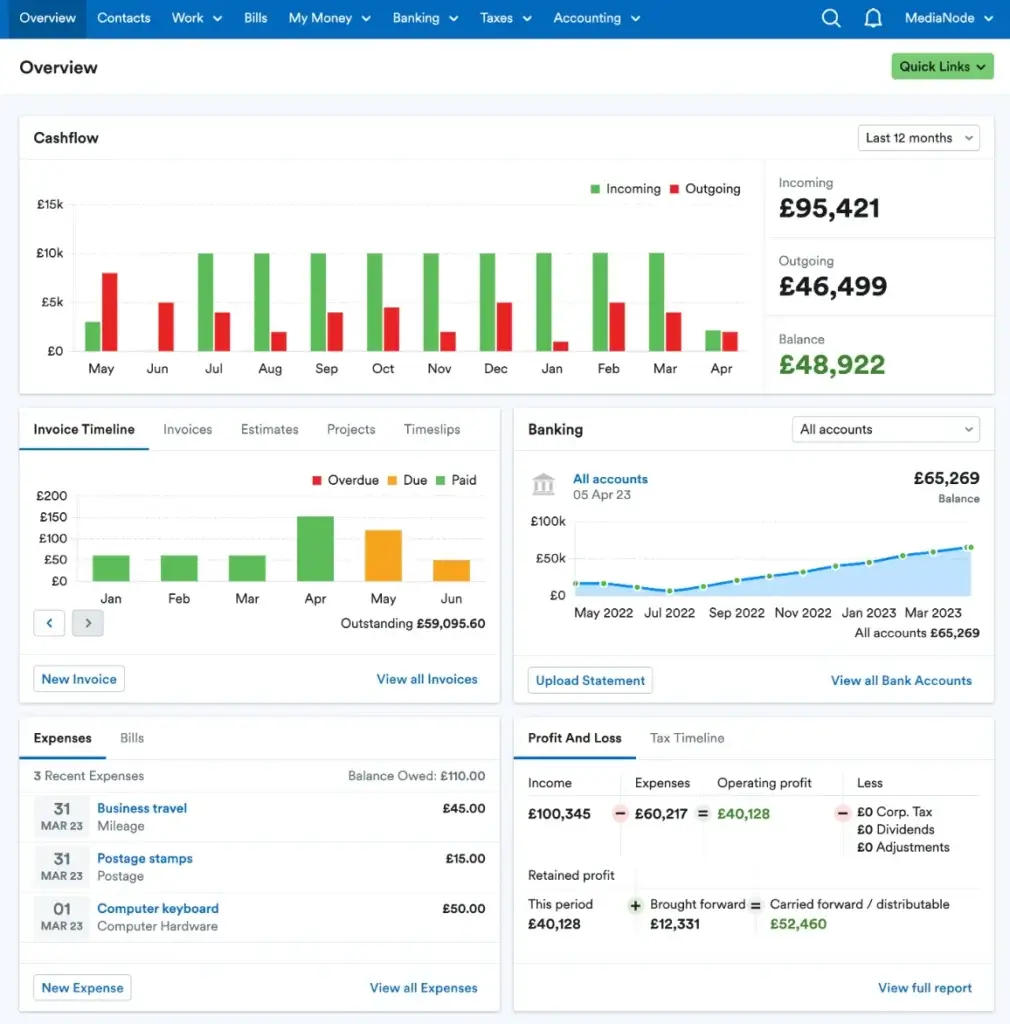

A clean, visual dashboard

Right after logging in, you’re greeted with a dashboard that gives you a real-time overview of your cash flow, upcoming tax deadlines, unpaid invoices, and account balances. It’s not cluttered or overwhelming – just the essentials you need to stay in control.

Everything is color-coded and visually organized, which makes it easy to interpret even if you’re not comfortable with accounting terms.

💡 One standout feature is the “Tax Timeline” – it shows upcoming deadlines and estimated liabilities so you’re never caught off guard.

Setup and onboarding

Getting started with FreeAgent is smooth. During signup, the software walks you through setting up your business profile, connecting your bank account, and customizing invoice templates. There are step-by-step prompts, and you can skip parts and return later if needed.

You don’t need to be an accountant to get started. Most users are up and running within 30–60 minutes.

Day-to-day usability

Once you’re set up, FreeAgent simplifies your daily accounting tasks:

- Raise invoices with a few clicks

- Upload expense receipts directly from your phone

- Reconcile bank transactions with automatic suggestions

- Log mileage and track time without extra tools

Whether you’re logging in daily or just checking in weekly, the layout keeps things fast and frustration-free.

🔍 The search and filter tools are particularly useful when you’re managing multiple clients or projects.

Customer support

FreeAgent offers email and live chat support, with friendly and knowledgeable reps based in the UK. Most users report quick responses and helpful guidance, especially during tax season.

There’s also an extensive Help Centre, loaded with guides, tutorials, and video walkthroughs. You’ll rarely feel stuck.

Overall user sentiment

Across review platforms, FreeAgent users praise its:

- Easy navigation and minimal learning curve

- Helpful tax tools built for UK regulations

- Strong customer support experience

- Mobile app convenience for freelancers on the move

Of course, some users mention that features like payroll or international tools could be more robust, but overall satisfaction remains high.

👍 If you’re looking for a tool that feels more like a helpful assistant than a cold accounting engine, FreeAgent delivers that experience.

Integrations and Ecosystem

Connect FreeAgent to your favorite apps

While FreeAgent isn’t known for having the largest integration marketplace, it does offer a focused set of connections that work well for freelancers, small business owners, and accountants looking to streamline their workflow.

The integrations cover essentials like payment processing, time tracking, CRM, and data import/export. If you rely on a specific tool to run your business, FreeAgent might already support it.

Key integration categories

💳 Payment Gateways

- Stripe – Accept card payments directly through invoices

- PayPal – Add PayPal links to invoices for quick client payments

- GoCardless – Automate Direct Debit collection for recurring invoices

These integrations help you get paid faster and reduce manual follow-ups.

⏱️ Time Tracking

- Toggl Track – Sync time entries directly into FreeAgent projects

- Timely – Automatically log time spent on work and import it into your account

Perfect for service-based businesses or agencies billing by the hour.

📦 Inventory & E-commerce

- WooCommerce (via plugins like Zapier or OneSaaS) – Sync orders and sales data

- Shopify – Can be integrated via third-party automation tools

While not built-in, these integrations can automate sales tracking for online stores.

🧾 Receipt Scanning

- Dext (formerly Receipt Bank) – Send scanned receipts to FreeAgent

- AutoEntry – Import bills and receipts automatically

Ideal for reducing manual data entry and improving expense tracking accuracy.

⚙️ Automation & Workflow

- Zapier – Connect FreeAgent with 3,000+ other apps like Google Sheets, Trello, or Slack

- Pandle Sync – For users transitioning from other UK accounting tools

Zapier is especially useful for automating repetitive tasks between platforms.

How to connect apps

Most integrations are connected through FreeAgent’s Settings > Connections menu or by authenticating directly through the third-party app. Some (like Zapier) may require light setup or custom workflows, but FreeAgent provides helpful documentation for every connection.

💡 You can also invite your accountant or bookkeeper to collaborate in your account without needing third-party tools.

If you rely on a larger software stack with deep CRM or inventory needs, FreeAgent might feel a bit limited. But for core small business tools, the integrations it offers are solid, reliable, and easy to set up.

Pricing and Plans

How much does Microsoft Dynamics 365 cost?

FreeAgent keeps its pricing simple and transparent, offering just one main plan that includes all features. Whether you’re invoicing clients, filing taxes, or tracking expenses, you get everything with a single monthly or annual subscription – no confusing tiers or paywalls.

If you bank with NatWest, Royal Bank of Scotland, or Ulster Bank, you may even qualify for a completely free account🎉

Here’s a breakdown of FreeAgent’s current pricing as of 2025:

| Plan | Monthly Price | Best For | Included Features |

| Standard Plan | £14.50/month (first 6 months), then £29/month | Freelancers & small business owners | All features: invoicing, tax, bank feeds, expenses, time tracking |

| Annual Plan | £145/year (first year), then £290/year | Users wanting to save with upfront payment | Same as monthly plan, 2 months free |

| Free Plan | £0/month | NatWest, RBS, Ulster Bank business account holders | Full FreeAgent access at no cost |

🔍 What’s included in every plan?

- Unlimited invoices and clients

- VAT, Self Assessment, and Corporation Tax tools

- Time tracking and project profitability

- Expense management and mileage tracking

- Mobile app access

- Bank integrations and live feeds

- Multi-currency invoicing

- Live chat support

💡 There are no hidden fees or locked features. You get the full FreeAgent experience regardless of how you pay.

🆓 Free trial

Not ready to commit? You can try FreeAgent free for 30 days, with no credit card required. It’s a great way to explore the software and see how it fits your workflow before subscribing.

Whether you’re just starting out or want to switch from another accounting tool, FreeAgent’s flat pricing structure makes it a predictable and budget-friendly choice.

Alternatives to FreeAgent

Compare top competitors

FreeAgent stands out for its UK-specific features, simplicity, and value – but how does it stack up against other top contenders in the accounting software world?

Here’s a head-to-head comparison with three other popular tools: Zoho Books, FreshBooks, and QuickBooks. If you’re still deciding which platform is best for your business, this side-by-side breakdown will help clarify the differences.

🧮 FreeAgent vs Zoho Books

| Feature | FreeAgent | Zoho Books |

| Target users | UK freelancers & small businesses | Global SMEs & freelancers |

| Tax compliance | Strong for UK (VAT, MTD, Self Assessment) | Global tax support with regional configurations |

| UI and usability | Very simple, visual dashboard | Feature-rich but steeper learning curve |

| Customization | Basic customization | Highly customizable workflows and automations |

| Pricing | Fixed plan, free for some UK bank users | Multiple affordable tiers |

✅ Choose FreeAgent if you need UK tax tools with no learning curve.

💡 Choose Zoho Books if you want more automation and international scalability.

🔗 Read the full Zoho Books review

🧮 FreeAgent vs FreshBooks

| Feature | FreeAgent | FreshBooks |

| Invoicing | Strong with recurring billing & payment links | Very strong, with sleek templates and client portals |

| Time tracking | Built-in with project links | Built-in and highly polished |

| Expense tracking | Robust, with receipt uploads and mileage | Robust, includes vendor tracking |

| Tax support | Excellent for UK taxes | Limited outside North America |

| Mobile experience | Full-featured mobile app | Excellent mobile UX with extra client access tools |

✅ Choose FreeAgent if you’re UK-based and want tax + projects in one place.

💡 Choose FreshBooks for client-facing invoicing and beautiful time logs.

🔗 Read the full FreshBooks review

🧮 FreeAgent vs QuickBooks

| Feature | FreeAgent | QuickBooks |

| Market focus | UK freelancers & micro businesses | All business sizes, global reach |

| Payroll | UK payroll included (limited) | Advanced payroll (extra cost) |

| Reporting | Simple but clear | Deep reporting and forecasting |

| Integration ecosystem | Smaller set of integrations | Large marketplace of third-party apps |

| Learning curve | Beginner-friendly | More complex features may require onboarding |

✅ Choose FreeAgent if you want simplicity and UK compliance.

💡 Choose QuickBooks if you run a growing business or need advanced reporting.

🔗 Read the full QuickBooks review

Security and Compliance

Your financial data deserves top-tier protection

When it comes to your financial data, security isn’t optional – it’s a must. FreeAgent takes this seriously, offering enterprise-level security measures and compliance with UK regulations to keep your data safe and your business protected 🔐

Here’s how FreeAgent handles security and compliance so you can use it with peace of mind.

🔒 Data Encryption & Hosting

All data transmitted to and from FreeAgent’s servers is protected using 256-bit SSL encryption – the same level used by major banks.

- Your data is encrypted both in transit and at rest

- Servers are hosted in UK-based, ISO 27001-certified data centers

- Daily backups ensure your information is never lost or compromised

💡 This means your financial data is safe even if your device is lost or stolen.

✅ GDPR Compliance

As a UK-based company, FreeAgent is fully compliant with the General Data Protection Regulation (GDPR). They only collect the data needed to provide services and never share it with third parties without your consent.

You can also:

- Export your data at any time

- Request account deletion and data erasure

- Review privacy settings directly within your profile

- This gives you full control over your data, in line with GDPR requirements.

🧾 HMRC-Approved for Making Tax Digital (MTD)

FreeAgent is officially recognized by HMRC as compatible with the UK’s Making Tax Digital initiative. That means you can:

- Submit VAT returns directly to HMRC

- File Self Assessment tax returns online

- Stay compliant with evolving UK tax regulations

FreeAgent removes the stress of tax filings and ensures your submissions are secure and accurate.

🔐 Account Security Features

- Two-factor authentication (2FA) is available for all accounts

- Admins can manage user roles and permissions

- All access is logged and monitored to prevent unauthorized activity

Even if multiple users access your account (e.g., accountant, bookkeeper), you stay in control of who can do what.

Regular Security Audits

FreeAgent’s internal security team performs routine audits and penetration testing to identify and patch vulnerabilities before they can be exploited.

If there’s ever a risk or incident, they maintain clear transparency and fast response protocols.

In summary, FreeAgent ticks all the boxes when it comes to small business accounting security in the UK. With encryption, data sovereignty, GDPR controls, and MTD support, it’s designed to protect your business from day one.

Conclusion

Is FreeAgent the Right Accounting Tool for You?

If you’re a UK-based freelancer, contractor, or small business owner looking for stress-free accounting, FreeAgent is a smart choice. It combines powerful features with ease of use, helping you manage everything from invoicing to tax returns without needing to be an accountant.

✅ Ideal for:

- Sole traders and limited companies

- Users who want HMRC-compliant tools

- Businesses that value automation and simplicity

While it may not scale for larger teams or global operations, FreeAgent hits the sweet spot for solo professionals and lean businesses who need clarity, compliance, and control – all in one intuitive platform.

Give the 30-day free trial a go and see if FreeAgent fits your workflow. For many, it’s the tool that finally makes accounting feel… manageable.

Have more questions?

Frequently Asked Questions

1. Is FreeAgent really free for some users?

Yes. If you have a business current account with NatWest, Royal Bank of Scotland, or Ulster Bank, you get full access to FreeAgent for free – no limitations or hidden fees.

2. Can I use FreeAgent if I’m not based in the UK?

FreeAgent is designed with UK tax laws in mind, including HMRC, VAT, and Self Assessment. While you can technically use it outside the UK, it’s not optimized for international tax systems.

3. Does FreeAgent support Making Tax Digital (MTD)?

Yes. FreeAgent is fully MTD-compliant and recognized by HMRC. You can file VAT returns and Self Assessment directly from your account.

4. Does FreeAgent have payroll features?

Yes, but only for UK-based businesses. You can run payroll, submit RTI to HMRC, and generate payslips. It’s included in the standard plan.

5. Can I connect my bank account to FreeAgent?

Absolutely. FreeAgent integrates with most major UK banks. It automatically imports transactions and helps you reconcile them quickly.

6. Is FreeAgent easy to use for non-accountants?

Yes. It’s built specifically for users with no accounting background. The dashboard is intuitive, and helpful articles are available throughout the platform.

7. Can I manage multiple clients or projects?

Yes. FreeAgent supports multiple clients, and you can track income, expenses, and time by project. It’s great for freelancers and agencies.

8. Does FreeAgent offer mobile access?

Yes. FreeAgent’s mobile app (iOS and Android) lets you send invoices, track expenses, view cash flow, and more – all on the go.

9. Can I invite my accountant or bookkeeper to FreeAgent?

Yes. You can add your accountant or bookkeeper as a user with custom permissions, making collaboration seamless.

10. What kind of customer support does FreeAgent offer?

FreeAgent provides live chat and email support, backed by an extensive Help Centre with guides, tutorials, and tax tips for UK businesses.