Introduction: Why Accounting Features Matter More Than Ever

Choosing the right software starts with knowing what to look for. That’s where our guide to the 12 Key Features of Accounting Software You Shouldn’t Overlook in 2025 comes in.

With the right accounting software, you can stay in control of cash flow, avoid compliance headaches, and focus more time on growth. But not every tool is built the same.

Whether you’re a freelancer, small business owner, or scaling enterprise, the features inside your accounting software can make or break your workflow. The best platforms don’t just manage transactions. They automate, analyze, and integrate your financial data to give you a 360° view of your business health.

In this guide, you’ll find the 12 most essential features to look for in modern accounting software. These tools will help you reduce errors, save time, and prepare your business for the future.

1. Automated Bank Feeds & Reconciliation

Why It Matters: Saves time, reduces manual entry, and catches errors early.

One of the biggest time-drainers in accounting is manually importing bank transactions. Fortunately, automated bank feeds can do that for you.

With this feature, your software connects securely to your bank and credit card accounts. Transactions sync daily, so you’re always working with the most up-to-date numbers.

But that’s just the beginning. Modern tools like QuickBooks Online, Xero, and Zoho Books use smart reconciliation to match transactions against your invoices, bills, and receipts. Some even suggest matches using AI.

✨ What to Look For:

- Live sync with multiple bank and credit card accounts

- Auto-categorization of expenses using rules

- One-click reconciliation with built-in matching logic

- Alerts for mismatched or duplicate entries

👥 How This Helps You:

- Cut hours of data entry each week

- Get real-time cash flow visibility

- Reduce the risk of missing a payment or a fraudulent charge

Pro Tip: Look for tools that allow you to set custom rules. For example, automatically categorize all Uber charges as “Travel.”

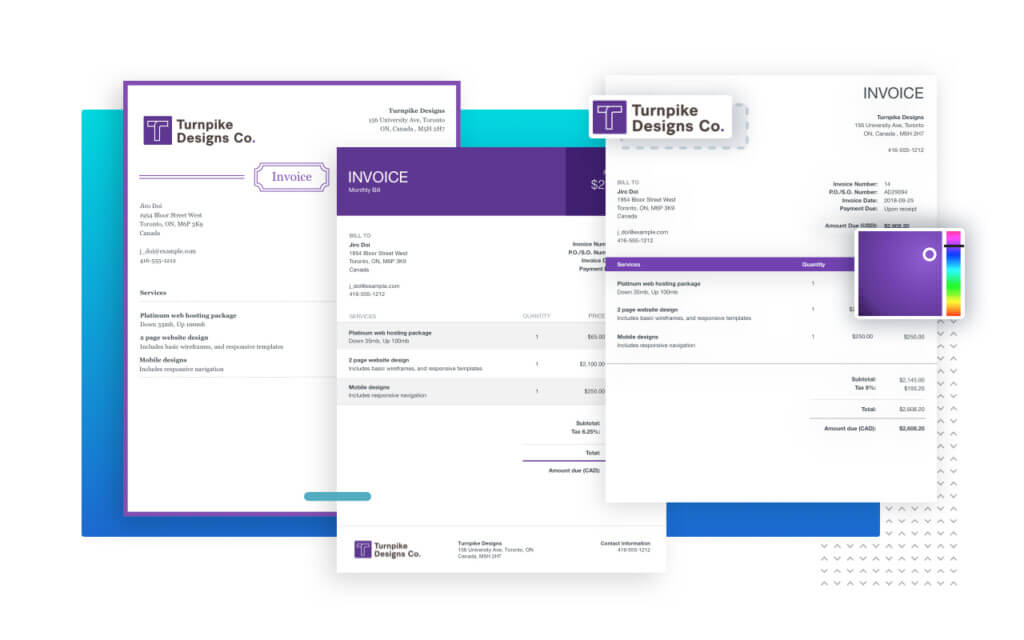

2. Invoicing & Billing Tools That Get You Paid Faster

Why It Matters: Cash flow is king, and late payments kill momentum.

When invoicing is slow or inconsistent, your business suffers. You wait longer to get paid, and it becomes harder to predict cash flow.

That’s why your accounting software needs powerful, flexible invoicing tools. You should be able to create branded invoices in minutes, set recurring schedules, and automatically follow up on unpaid bills.

Platforms like FreshBooks, Xero, and Zoho Books even allow your clients to pay directly via the invoice using credit cards, PayPal, or ACH.

✨ What to Look For:

- Custom invoice templates with your logo and colors

- Recurring invoicing for retainer clients

- Automatic late payment reminders

- One-click payment links inside each invoice

👥 How This Helps You:

- Speeds up cash collection

- Reduces manual follow-ups

- Makes your business look more professional

Did You Know? Businesses that accept online payments via invoice get paid 2x faster on average.

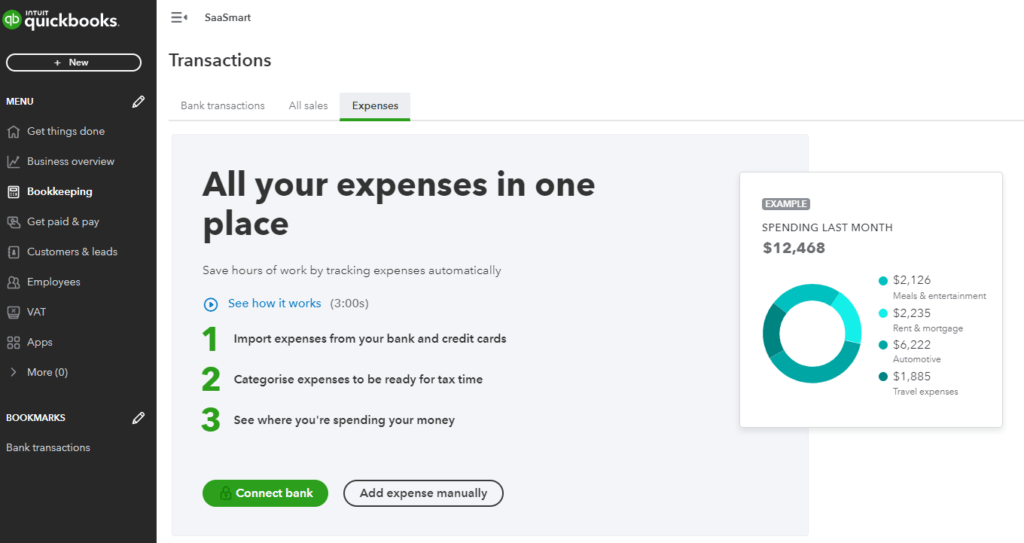

3. Expense Tracking & Receipt Capture

Why It Matters: Gives you a complete, real-time view of your business spending.

Keeping up with receipts and expense records can get messy fast. That’s why modern accounting software includes real-time expense tracking with built-in receipt capture via mobile apps.

You can snap a photo of a restaurant bill, categorize it on the spot, and store it safely in the cloud. No more lost receipts or scrambling during tax season.

Tools like QuickBooks Online, Zoho Books, and Wave let you automate this process using AI-powered OCR (optical character recognition). It reads and tags your receipts, matching them to the correct transactions automatically.

✨ What to Look For:

- Mobile receipt scanning with auto-fill

- Smart categorization of expenses

- Tax-ready documentation

- Real-time syncing with your general ledger

👥 How This Helps You:

- Stay on top of budgets and spending

- Capture deductions without missing a beat

- Avoid paper clutter and storage issues

Pro Tip: Choose software that allows custom expense categories for better reporting and insight.

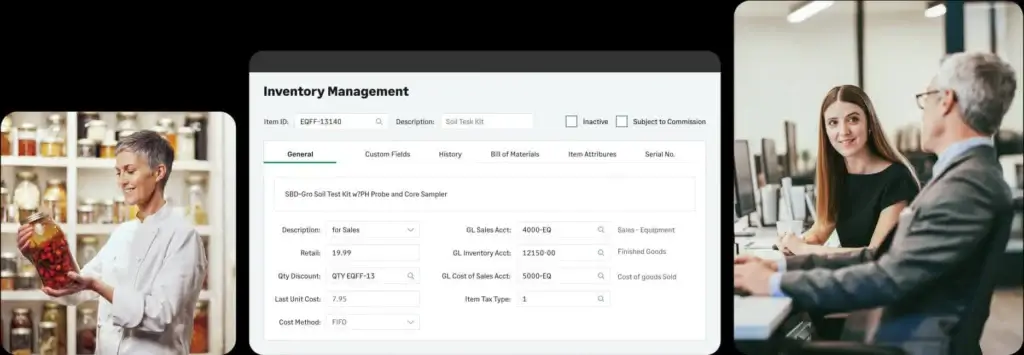

6. Inventory Management (If You Sell Products)

Why It Matters: Tracks product movement, reduces waste and supports accurate costing.

If your business manages physical goods, whether retail, eCommerce, or manufacturing, then inventory tracking is a must-have.

Your accounting software should help you monitor stock levels, record cost of goods sold (COGS), and avoid both overstock and shortages. Some tools, like Zoho Books, QuickBooks Plus, and Odoo, even support automatic reordering and warehouse-level tracking.

✨ What to Look For:

- Real-time stock level updates

- SKU tracking and batch/serial number support

- Automated low-stock alerts and reorder points

- Inventory valuation methods (FIFO, LIFO, weighted average)

👥 How This Helps You:

- Keep shelves stocked without overbuying

- Accurately calculate profit margins and COGS

- Sync sales with inventory automatically

Did You Know? Poor inventory tracking is one of the top causes of cash flow problems in product-based businesses.

7. Time Tracking & Project Accounting

Why It Matters: Ensures accurate billing and profitability tracking for client work.

If you run a service-based business or bill clients hourly, this feature is non-negotiable. Time tracking lets you log hours worked by task, team member, or project, then convert those hours directly into invoices.

Tools like FreshBooks, FreeAgent, and Harvest integrate time tracking with project accounting, so you can see which clients or projects are actually profitable.

✨ What to Look For:

- Built-in time tracking with mobile support

- Billable vs. non-billable hour tracking

- Project-based budgeting and expense tracking

- Automated timesheet-to-invoice conversion

👥 How This Helps You:

- Prevents underbilling and missed hours

- Tracks project profitability in real time

- Improves transparency for client billing

Pro Tip: Use project-level reporting to spot scope creep early, before it eats into your margins.

8. Tax Compliance & Audit Trails

Why It Matters: Keeps your business legally compliant and audit-ready at all times.

Tax laws are complex and changing constantly. The right software helps you stay compliant by calculating sales tax, VAT, or GST automatically based on your customer’s location and transaction type.

More advanced systems also create clear audit trails, documenting every change made to your financial records, ideal if you’re ever audited or need to produce historical reports.

✨ What to Look For:

- Automated tax calculation by jurisdiction

- Tax form generation (e.g., 1099s, VAT reports)

- Built-in audit trail with user history

- Integration with tools like Avalara or TaxJar

👥 How This Helps You:

- Reduces tax season stress

- Minimizes manual errors in filings

- Prepares you for audits with clear logs

Did You Know? Some cloud tools even track which user made each transaction change, perfect for internal controls.

9. Multi-Currency Support & Global Compliance

Why It Matters: Makes cross-border operations smoother, faster, and more accurate.

If you serve international clients or vendors, you’ll need software that handles multi-currency transactions, exchange rate updates, and compliance across tax jurisdictions.

Software like Xero Premium, Sage Intacct, and NetSuite supports global operations with automatic currency conversion and consolidated reporting.

✨ What to Look For:

- Multi-currency invoicing and expense logging

- Daily exchange rate sync

- Country-specific tax formats (e.g., GST, VAT, HMRC filing)

- Global consolidation, if you have multiple entities

👥 How This Helps You:

- Avoids costly exchange rate errors

- Ensures accurate international reporting

- Supports expansion into global markets

Pro Tip: If you’re growing internationally, make sure your software also handles multi-entity accounting with intercompany transactions.

10. Payroll Integration

Why It Matters: Eliminates double-entry and reduces payroll errors.

Your accounting software should work hand-in-hand with your payroll system. Whether built-in or via integration (like with Gusto, ADP, or Paychex), this connection ensures accurate salary recording, tax filing, and benefits tracking.

Tools like QuickBooks Online Payroll and Zoho Payroll even sync hours worked and automatically post journal entries.

✨ What to Look For:

- Automatic payroll journal entries

- Built-in tax withholdings and filings

- Direct deposit and paystub generation

- PTO, benefits, and contractor management

👥 How This Helps You:

- Ensures accurate books every pay cycle

- Saves time and reduces errors

- Keeps you compliant with wage laws

Did You Know? Integrated payroll can save up to 50% of your time during payroll runs, especially if you have contractors or variable pay rates.

11. Customizable Workflows & Automation

Why It Matters: Reduces human error and scales your back-office operations.

Modern accounting software should take repetitive tasks off your plate. Features like bank rules, automated invoicing, and custom workflows save hours of manual work each week.

Platforms like Sage Intacct, NetSuite, and Odoo go even further with drag-and-drop workflow builders or rule-based automation that handle approvals, alerts, and document routing.

✨ What to Look For:

- Recurring transactions and automated reminders

- Bank rules for transaction categorization

- Custom approval workflows

- Trigger-based actions (e.g., flag a large expense)

👥 How This Helps You:

- Minimizes manual work

- Standardizes processes across teams

- Keeps tasks moving, even when you’re away

Pro Tip: Set automated approval thresholds (e.g., expenses over $1,000 require manager review) to maintain oversight as your team grows.

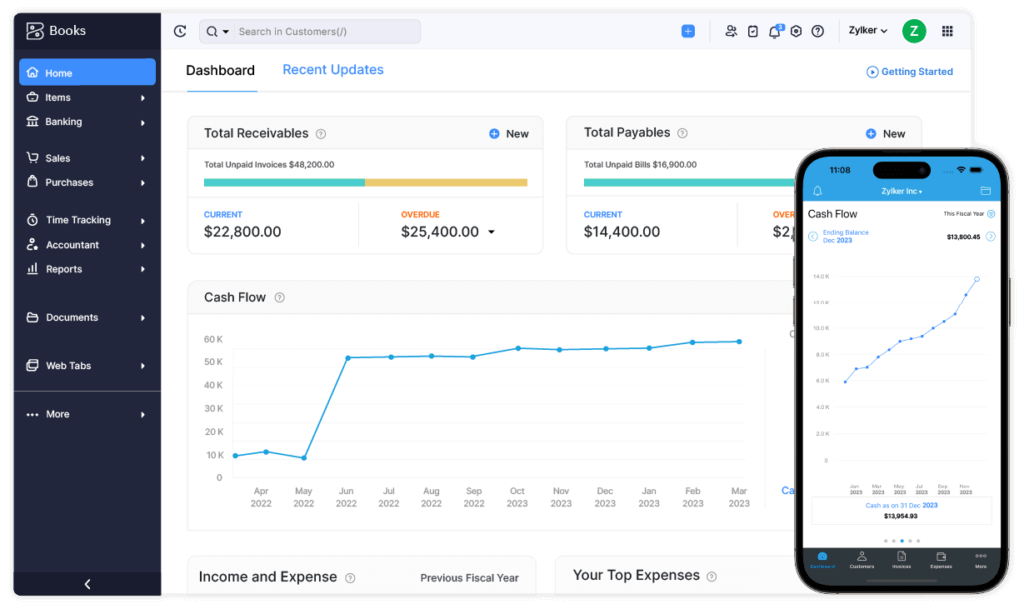

12. Mobile Access & Cloud Accessibility

Why It Matters: Gives you control over your finances, wherever you are.

You’re not always at your desk. And your accounting software shouldn’t be either.

Cloud-based platforms with mobile apps let you invoice a client, check your balance, or snap a receipt from your phone, tablet, or laptop, anytime, anywhere.

Tools like QuickBooks, Wave, Xero, and Zoho Books are built for mobile use and offer full feature access on the go.

✨ What to Look For:

- Mobile apps with full feature parity

- Secure cloud storage and backup

- Real-time data syncing across devices

- Offline access (for travel or low-connectivity zones)

👥 How This Helps You:

- Keeps you productive from the road

- Ensures your books are always current

- Provides flexibility for remote teams

Did You Know? Mobile-first businesses are 2x more likely to update their books weekly, leading to better cash flow decisions.

Quick Summary: 12 Essential Features to Look For

| Feature | What It Does | Why It Matters |

| 🔄 Bank Feeds & Reconciliation | Syncs bank/credit transactions in real time | Saves time and reduces manual entry errors |

| 💸 Invoicing & Billing | Creates and automates invoices with reminders | Improves cash flow and speeds up payments |

| 📷 Expense Tracking | Logs expenses with mobile receipt capture | Helps with tax deductions and spending control |

| 📊 Financial Reporting | Generates P&L, cash flow, and balance sheet reports | Delivers clear financial insights and KPIs |

| 📈 Budgeting & Forecasting | Builds budgets and forecasts based on trends | Supports planning and smarter business decisions |

| 📦 Inventory Management | Tracks stock levels, reorder alerts, and COGS | Prevents overstocking and improves margin accuracy |

| ⏱️ Time & Project Tracking | Monitors billable hours by task or project | Improves billing accuracy and project profitability |

| 🧾 Tax Compliance & Audit Trails | Automates sales tax and stores audit logs | Keeps you compliant and audit-ready |

| 🌍 Multi-Currency Support | Handles conversions and exchange rate updates | Supports global transactions and reporting |

| 💼 Payroll Integration | Links payroll to accounting for accurate records | Reduces duplication and ensures tax compliance |

| ⚙️ Automation & Workflows | Automates repetitive tasks and approvals | Boosts efficiency and reduces human error |

| 📱 Mobile & Cloud Access | Allows accounting access from anywhere | Improves flexibility for remote or hybrid teams |

How to Choose the Right Features for Your Business

Now that you’ve seen the must-have features, the next step is figuring out which ones truly matter for your business.

Not every company needs full-blown inventory controls or advanced budgeting tools. But missing key features you do need can create bottlenecks, reporting gaps, or even tax issues.

Here’s how to approach the decision:

🧩 Match Features to Your Business Type

| Business Type | Must-Have Features |

| Freelancers & Solopreneurs | Invoicing, expense tracking, time tracking |

| Service-Based Teams | Project accounting, billing, time tracking, reporting |

| Product-Based Retailers | Inventory, sales tax, COGS tracking, multicurrency |

| Growing SMBs | Budgeting, payroll, bank feeds, integrations |

| International Companies | Multi-currency, global compliance, advanced reporting |

| Enterprises | Consolidation, automation, workflow customization, audit logs |

💡 Other Factors to Consider:

- Scalability: Will the platform grow with you?

- Integrations: Does it connect to your CRM, POS, or payroll?

- User Access: Can multiple team members collaborate securely?

- Ease of Use: Is the interface beginner-friendly or more advanced?

- Support: Are there tutorials, chat support, or an accountant-friendly interface?

Pro Tip: Most platforms offer 14–30 day free trials. Take advantage of those to test the features with your real-world workflow before committing.

Final Thoughts

At the end of the day, your accounting software is more than just a financial tool. It’s the engine that keeps your business informed, compliant, and growing.

Choosing the right platform comes down to finding the features that align with your workflow, reduce manual work, and deliver real-time insights. Whether you’re a solo freelancer or scaling toward multiple entities, the features we covered above form the foundation of a healthy, future-proof accounting system.

Start with your core needs. Add features as you grow. And always look for tools that make your work easier, not harder.

Frequently Asked Questions

1. What are the most important features in accounting software?

Bank feeds, invoicing, expense tracking, financial reporting, and tax compliance are essential for most businesses.

2. Which features are best for small businesses?

Small businesses benefit most from invoicing, bank reconciliation, basic reporting, and payroll integration.

3. Do I need inventory tracking if I’m a service business?

Not usually. Inventory is critical for product-based businesses but unnecessary for service firms.

4. How do I know if I need multi-currency support?

If you invoice or receive payments internationally, look for software that supports exchange rate automation and foreign currency reports.

5. Can I automate invoice reminders and late fees?

Yes, most modern tools allow you to set up recurring invoices, due date reminders, and auto-applied late fees.

6. Is cloud-based accounting software secure?

Reputable platforms use bank-level encryption, two-factor authentication, and secure backups to protect your data.

7. What types of reports should the software generate?

At a minimum: Profit & Loss, Balance Sheet, and Cash Flow. Bonus if it includes budgeting, forecasting, and tax reports.

8. Do all platforms offer mobile access?

Not all do, but leading tools like QuickBooks, Zoho Books, and Xero have full-featured mobile apps.

9. What’s the benefit of audit trails?

Audit trails provide transparency by tracking every change in your financial data, critical during audits or reviews.

10. How can I test the software before purchasing?

Use the free trial period to test invoicing, reporting, and syncing features. Try importing real bank data to simulate daily usage.