Introduction

Finance professionals know how time‑consuming and error‑prone manual accounting can be. When you’re closing the books every month across multiple entities, reconciling intercompany transactions and preparing consolidated reports can feel like an endless cycle of spreadsheets and emails. Nominal aims to break this cycle by using AI agents to automate core accounting workflows and deliver real‑time insights. This comprehensive review explores what Nominal offers, how it compares to alternatives, and whether it suits your finance team’s needs.

What Is Nominal? Overview and Unique Value

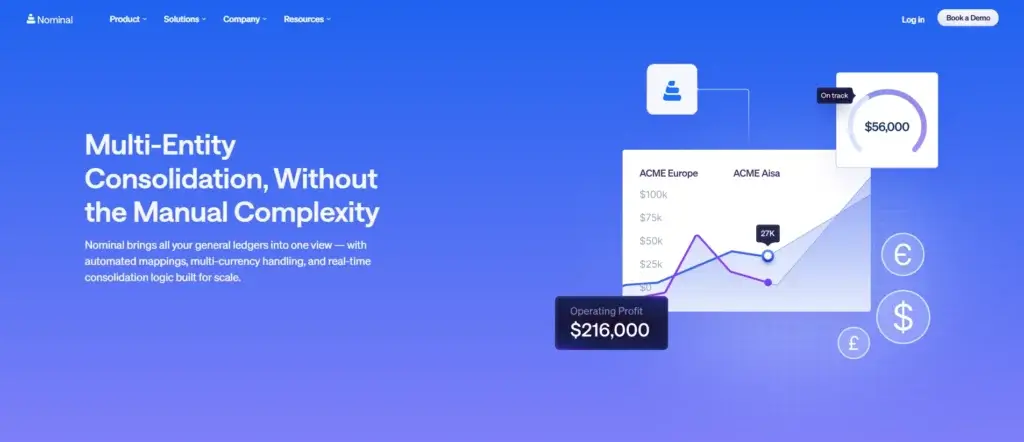

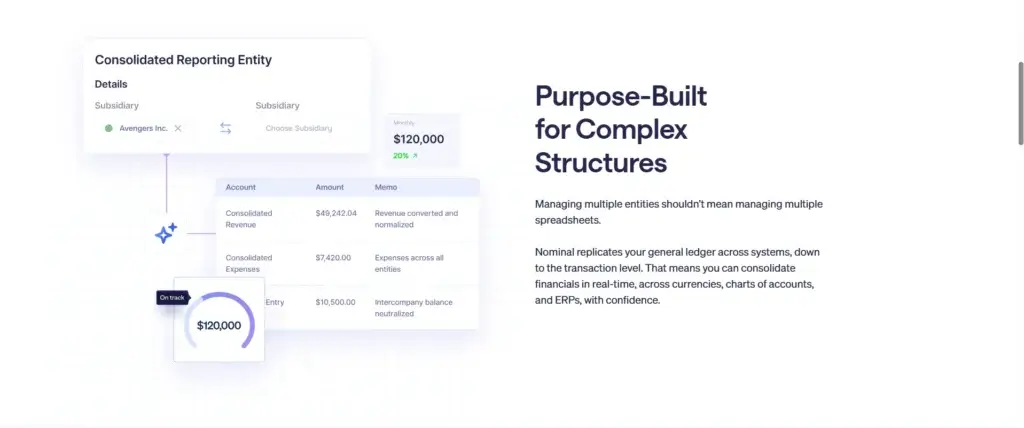

Nominal is an AI‑driven financial operations platform designed for mid‑market and enterprise organizations. It transforms traditional accounting tasks into intelligent workflows using generative AI. Rather than relying on manual spreadsheets or rigid ERP modules, Nominal layers AI automation on top of your existing systems. This means you can automate reconciliations, eliminations, and reporting without migrating data or rebuilding your general ledger.

Nominal’s key promise is to give finance teams more time for analysis and strategy by handling routine tasks. Whether you manage multiple subsidiaries or need to comply with complex accounting standards, Nominal’s AI agents aim to consolidate data, ensure accuracy, and provide insights faster than manual processes.

Software specification

Key Features and Capabilities of Nominal

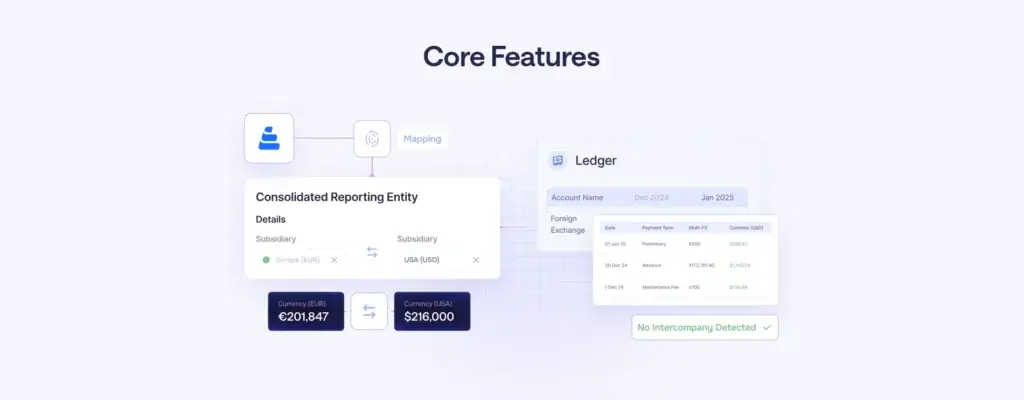

AI Agents for Intercompany Reconciliation and Consolidation

Nominal’s intercompany agents automatically detect and match transactions between entities, eliminating duplicate entries and producing clean consolidated financials. Instead of spending hours cross‑referencing ledgers, you tell Nominal to perform eliminations, and the system does the rest. For finance teams managing global subsidiaries, this feature reduces the risk of intercompany mismatches and ensures audit‑ready trails.

Autonomous Accounting Workflows

Generative workflows are at the heart of Nominal. You define business logic. For example, “generate journal entries when a vendor invoice posts” or “route approvals when expenses exceed a threshold”, and Nominal’s trigger agents handle the sequence. There is no need for complex IT projects; you can configure workflows in plain language. Once set up, AI agents execute the tasks, send alerts, and update your ERP.

Narratives, Variances & Insights

Raw numbers rarely tell the full story. Nominal’s financial analysis agents translate variance analyses into plain‑language narratives and deliver CFO‑level dashboards. Instead of scrambling to explain why expenses spiked or revenue dipped, you can use Nominal’s AI to generate narrative reports that highlight the drivers behind variances.

Nominal also offers an AI agent chat feature. You can ask questions like “Why did operating expenses increase last quarter?” and receive context‑rich answers backed by data. This conversational approach makes financial analysis more accessible across the organization.

AI‑Driven Close Management

Closing the books at month end often requires dozens of tasks, approvals, and cross‑department coordination. Nominal’s close management feature organizes every task into a checklist. Each task includes deadlines, responsible users, and dependencies. Trigger agents update task status automatically based on general ledger events, while reviewers can add comments and sign off within the platform.

This collaborative environment reduces email chains and increases visibility. If a task is delayed, stakeholders can see the bottleneck and address it promptly. AI also performs reconciliations and flux analysis behind the scenes, so the closing process moves faster.

Automated Transaction Matching Across Accounts

Reconciliation is more than just matching bank statements; it involves aligning entries across subledgers, entities, currencies, and time periods. Nominal’s GL‑intelligent matching engine identifies transactions that share metadata or patterns and flags potential mismatches. This approach goes beyond rule‑based systems, using AI to handle timing differences and complex allocations. The result is faster reconciliation and fewer open items.

Security and Integrations

Nominal is built with enterprise‑grade security. The platform supports compliance with standards like ASC 842 and IFRS 16 and includes detailed audit trails for every entry. Integration options cover major ERPs and CRMs, including Oracle, SAP, Microsoft Dynamics, Salesforce, and NetSuite. You can also access Nominal’s data and functions via a custom API to build tailored integrations.

Pros and Cons

A balanced view: what you’ll love and what to consider

Positive

✅ Efficiency Gains

✅ Error Reduction

✅ Scalability

✅ Comprehensive Integrations

Negative

❌ Learning Curve

❌ Initial Setup Time

❌ Cost Considerations

❌ Dependence on Digital Infrastructure

✅ Pros

- Efficiency Gains: AI agents automate reconciliations, eliminations, and reporting, cutting down close times.

- Error Reduction: Automated workflows and intelligent matching minimize manual errors and inconsistent entries.

- Scalability: Designed to handle multiple entities and high transaction volumes without added IT overhead.

- Comprehensive Integrations: Works with popular ERPs, CRMs, and other systems, avoiding data silos.

- Audit Readiness: Provides detailed audit trails and compliance support for standards like ASC 842 and IFRS 16.

- Real‑Time Insights: Delivers narrative‑ready reports and dashboards, helping you explain variances quickly.

❌ Cons

- Learning Curve: Requires familiarity with accounting processes and some training to configure AI workflows effectively.

- Initial Setup Time: Implementing new workflows and integrating systems can be time‑intensive.

- Cost Considerations: Pricing may be high for small organizations or startups with limited budgets.

- Dependence on Digital Infrastructure: Requires reliable ERP and data connections to function optimally.

By weighing these pros and cons against your team’s needs, you can assess if Nominal offers a worthwhile return on investment.

Who Is Nominal Best For?

Find out if Nominal fits your business needs

Who Benefits from Nominal?

Nominal’s automation and consolidation capabilities serve a variety of industries:

- Growth Companies: Scale financial operations across subsidiaries without increasing headcount.

- Renewable Energy Firms: Manage complex asset structures, PPAs, and multi‑currency operations.

- Private Equity & Investment Firms: Consolidate portfolio company results and streamline reporting.

- Nonprofits and Educational Institutions: Track grants, budgets, and donations across programs.

- Manufacturing and Agriculture: Align supply chain finance with production and inventory data.

Practical Workflow Examples

- Multi‑Entity Consolidation: A private equity firm with five portfolio companies uses Nominal’s AI agents to eliminate intercompany loans and generate a consolidated balance sheet in minutes.

- Lease Accounting Compliance: A renewable energy company uses Nominal’s lease subledger to comply with IFRS 16, automating classification and calculation of right‑of‑use assets.

- Variance Reporting: A manufacturing company receives monthly variance reports with plain‑language narratives, helping managers understand why COGS increased or margins declined.

By automating these processes, finance teams can focus on strategic initiatives like forecasting and funding decisions.

User Experience

User Interface and Operational Simplicity

Ease of Use

Nominal’s interface combines dashboard tiles, charts, and workflow lists. Once you understand the layout, navigating between reconciliation modules and analytics dashboards is straightforward. However, configuring triggers and generative workflows requires a solid grasp of accounting processes. Nominal provides templates, but customizing them to fit your organization’s unique logic may involve trial and error.

Implementation and Onboarding

Implementing Nominal typically involves:

- Data Connection: Integrate your ERP or general ledger to import existing transactions.

- Workflow Setup: Define triggers, approvals, and reconciliation rules.

- User Training: Train finance teams to use dashboards, assign tasks, and interpret AI insights.

- Pilot Run: Test workflows with sample data before going live across entities.

Nominal’s onboarding team supports these steps, but internal coordination is crucial. Larger organizations may need a phased rollout across departments or entities.

Support and Resources

Nominal offers customer support via email and chat, along with knowledge‑base articles and video tutorials. Users can access webinars, white papers, and guides on topics like AI in accounting and best practices for multi‑entity consolidation. If you choose an enterprise plan, dedicated support and service level agreements (SLAs) may be included.

Integrations and Ecosystem

Connect Nominal to your favourite apps

Nominal is built to fit seamlessly into your existing financial ecosystem. Instead of forcing you to rebuild your tech stack, it connects to the systems you already use and enriches them with AI-powered automation. This makes integration one of it’s strongest advantages, especially for teams operating across multiple subsidiaries, ERPs, or data sources.

ERP Integrations

Nominal integrates with major ERP platforms used by mid-market and enterprise organizations. These connections allow replicate your ledgers, pull transaction-level detail, and automate reconciliation work across systems.

Supported ERPs include:

- Oracle NetSuite

- SAP

- Microsoft Dynamics 365

- Sage Intacct

- QuickBooks Enterprise

- Custom legacy ERPs via API

Through these integrations, Nominal imports your chart of accounts, journal entries, subledger activity, entity structures, and foreign currency data. This ensures that your consolidation engine runs on accurate, real-time information without the need to maintain separate spreadsheets or mapping files.

CRM and Revenue Systems

Revenue and customer data often live outside of the finance stack. Nominal connects to modern CRM platforms to ensure that revenue recognition aligns with bookings, contracts, and customer activities.

Typical CRM integrations include:

- Salesforce

- HubSpot

- Zoho CRM

- Custom CRM systems via API

These integrations give you a clear line from sales commitments to financial statements, improving the accuracy of revenue analysis, forecasts, and variance reporting.

Data Warehouses and Analytics Tools

For companies running large-scale analytics workflows, it can connect to cloud data platforms such as:

- Snowflake

- BigQuery

- Redshift

- Azure Data Lake

These connections allow you to unify operational, financial, and analytical data in one place. Nominal can push clean, normalized financial data to your warehouse, enabling more powerful BI dashboards and machine-learning models.

API and Custom Integrations

Nominal provides a modern API for organizations that run custom systems or require tailored workflows. You can build:

- Custom data pipelines

- Internal automations

- Extensions for specialized subledgers

- Connectors to proprietary industry software

This flexibility is valuable for companies with hybrid environments or legacy systems that aren’t supported by traditional plug-and-play connectors.

Security, Permissions, and Audit Trails

Security is built into the integration layer. All connections use encrypted channels, and you can restrict access at the entity, department, or role level. Nominal records an audit trail for every data interaction, including:

- Imported records

- Changes to mapping logic

- Adjustments posted through workflows

- User actions within dashboards

This is especially valuable during audits, when traceability becomes essential.

Why Integrations Matter for Multi-Entity Accounting

If your organization operates multiple entities, integrations are not optional. Nominal’s ability to replicate general ledgers across systems, currencies, and structures enables:

- Consistent chart-of-accounts mapping

- Unified reconciliation workflows

- Accurate eliminations

- Faster consolidation cycles

- Reliable multi-currency translation

The stronger your integration setup, the more value you receive from Nominal’s AI automation.

Pricing and Plans

How much does Nominal cost?

Nominal’s pricing varies based on the number of entities, users, workflow complexity, and integration needs. While the platform offers a 30-day free trial, full pricing is available only through a custom quote. Third-party sources suggest entry-level tiers starting around the mid-hundreds per month, but enterprise deployments scale based on volume and automation depth.

To help you evaluate Nominal more clearly, here is a structured comparison table aligned with your WP format:

| Plan | Key Features | Pricing |

| Free Trial | Full platform test environment, AI workflow samples, limited entity connections | $0 for 30 days |

| Pro Tier | AI agents, workflow automation, reconciliation tools, consolidation features, dashboards | Starts around $499/month (from external sources) |

| Enterprise | Advanced automations, multi-entity modeling, API integrations, dedicated support, SLA options | Custom pricing based on entity count and automation volume |

Custom Pricing Considerations

Nominal typically factors in:

- Number of legal entities

- Monthly transaction volume

- Required AI agents and workflow complexity

- Integration depth with ERP and CRM systems

- Security, compliance, and support needs

To get accurate pricing, request a custom demo and share details about your financial setup and consolidation workflows.

Alternatives

Nominal vs. Competitors

To understand where Nominal stands, it helps to compare it to other accounting and finance platforms. Many alternatives, such as QuickBooks Online, NetSuite, Sage Intacct, BlackLine, and FloQast, offer robust accounting and close management features. However, their AI capabilities and focus on generative workflows vary.

Comparison Table

| Feature Type | Nominal | QuickBooks Online | NetSuite |

| AI Automation | Built‑in AI agents for workflows and insights | No native AI; manual rules required | Limited AI in modules, external add‑ons |

| Multi‑Entity Consolidation | Single‑click consolidation with eliminations | Not natively supported | Requires advanced modules or third‑party tools |

| Implementation Complexity | Medium – configuration required, but no data migration | Low – basic setup for small businesses | High – full ERP deployment and customization |

| Pricing Structure | Custom pricing; free trial available | Starts around $35/month per user | Custom pricing; generally higher for enterprises |

Unique Strengths

- Nominal’s generative AI workflows set it apart from traditional accounting software.

- It focuses on complex, multi‑entity environments where consolidation and variance analysis are critical.

- Nominal’s narrative reporting reduces the time spent preparing executive summaries.

When Alternatives Make Sense

- QuickBooks Online is suitable for small businesses needing basic accounting and invoicing. Its simplicity and lower price point may appeal to solo entrepreneurs or small teams.

- NetSuite offers a comprehensive ERP with modules for inventory, manufacturing, and e‑commerce. If you need a full suite of business applications beyond finance, NetSuite may be more appropriate.

- BlackLine and FloQast specialize in close management and account reconciliation. They may be strong alternatives if your priority is month‑end close rather than broader AI automation.

Before choosing, evaluate your current systems, complexity, and resource availability. Each platform serves different markets, and the best choice depends on your organizational needs.

How To Decide

Deciding If Nominal Is Right for You

Key Considerations

- Company Size and Complexity: Nominal is best suited for mid‑market and enterprise companies with multiple entities or complex reporting requirements.

- Current Pain Points: Identify whether manual reconciliations, slow consolidations, or reporting delays are major issues.

- Existing Technology Stack: Ensure your ERP and CRM systems are compatible, and consider the cost of integration.

- Budget and ROI: Compare Nominal’s potential time savings and reduced audit risk against subscription costs.

Evaluation Checklist

- List all manual accounting processes and estimate hours spent on them.

- Determine the number of entities you need to consolidate and any relevant compliance requirements.

- Request a demo and trial from Nominal to test automation on your data.

- Speak with references or case studies in similar industries.

- Check for cultural fit—does your team embrace AI‑driven workflows?

Implementation Best Practices

- Start Small: Automate a single process or entity first to learn the system.

- Educate Stakeholders: Provide training sessions and share success metrics early.

- Iterate and Expand: Once you see success, expand to other subledgers or departments.

- Align With IT: Coordinate with IT teams to ensure secure integrations and data governance.

Conclusion

Final Thoughts

Nominal brings a fresh approach to finance automation by leveraging AI agents to handle tedious tasks and generate real‑time insights. Its ability to automate intercompany reconciliations, consolidate financials with one click, and explain variances in plain language can transform how finance teams operate. While there is a learning curve and investment required, the potential efficiency gains and audit‑readiness benefits are significant.

If your organization struggles with manual consolidations, complex close processes, or a lack of actionable insights, Nominal is worth exploring. Take advantage of the free trial and schedule a demo to see how AI‑driven automation could elevate your finance operations. By embracing a platform like Nominal, you empower your team to move beyond spreadsheets and focus on strategic decision‑making.

Have more questions?

Frequently Asked Questions

1. What makes Nominal different from traditional accounting software?

It use AI agents to automate workflows, reconciliations, and reporting across multiple entities, while many traditional systems rely on manual processes or rigid rule‑based automation.

2. Is it suitable for small businesses?

Nominal is primarily designed for mid‑market and enterprise organizations. Small businesses with simple accounting needs may find more affordable solutions like QuickBooks Online or Xero.

3. Does Nominal integrate with my existing ERP?

Yes. It offers integrations with popular ERP systems such as Oracle, SAP, Microsoft Dynamics, and NetSuite. Custom API access is available for other systems.

4. How long does it take to implement Nominal?

Implementation time depends on your complexity. A pilot for one entity may take a few weeks, while full multi‑entity rollouts can take several months, including training and workflow configuration.

5. Is there a free trial?

Yes, a 30‑day free trial is available, so you can test features before committing. Contact their sales team to set up a trial account.

6. How much does Nominal cost?

Pricing is custom. Third‑party sources suggest Pro plans start around $499 per month, but actual costs depend on factors like the number of entities and feature requirements.

7. What security measures does it have?

Nominal uses encryption, role‑based permissions, and audit logs to protect data. The platform supports compliance with accounting standards and provides audit‑ready trails.

8. Can Nominal handle lease accounting?

Yes. It includes generative subledgers that support lease accounting, enabling compliance with standards like ASC 842 and IFRS 16.

9. What industries use Nominal?

It is used by growth companies, renewable energy firms, private equity teams, nonprofits, educational institutions, and others needing complex consolidation and reporting.

10. How does Nominal improve financial reporting?

Automating data consolidation, generating plain‑language narratives, and providing real‑time dashboards. These features reduce the time spent preparing reports and help explain financial variances quickly.