Introduction

What to evaluate when assessing outreach & sales-engagement platforms

Core features: sequences, multichannel, CRM sync

You should look for features such as:

- Ability to build automated sequences across email, LinkedIn, calls and other channels.

- Personalisation capabilities (dynamic fields, conditional logic, time-delays) to optimise outreach and avoid spam flags.

- Native or seamless integration with your CRM (for example, HubSpot, Pipedrive, or Salesforce) so that lead data, campaign responses and replies flow into your system.

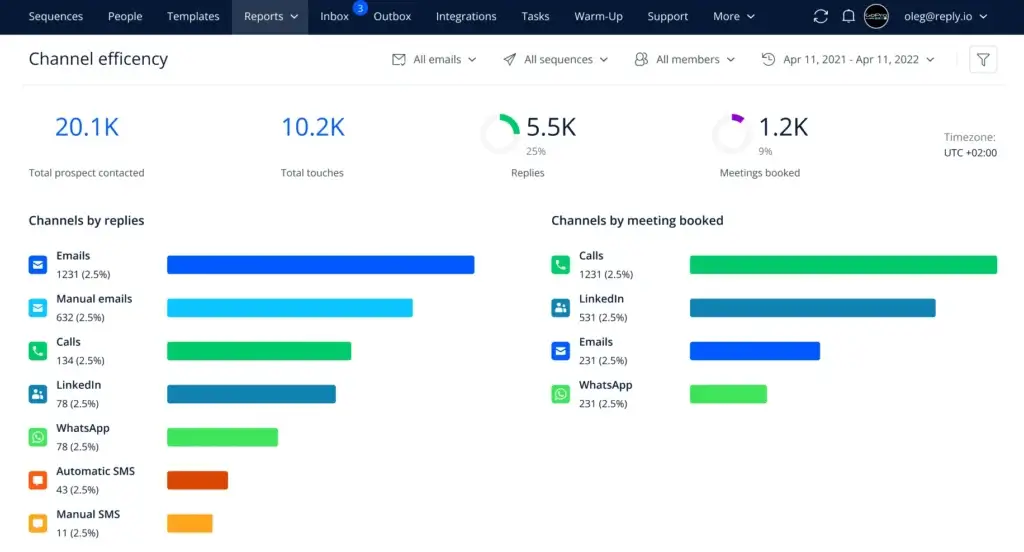

- Analytics and reporting so you can measure opens, clicks, replies, meetings booked, bounce rates and adjust accordingly.

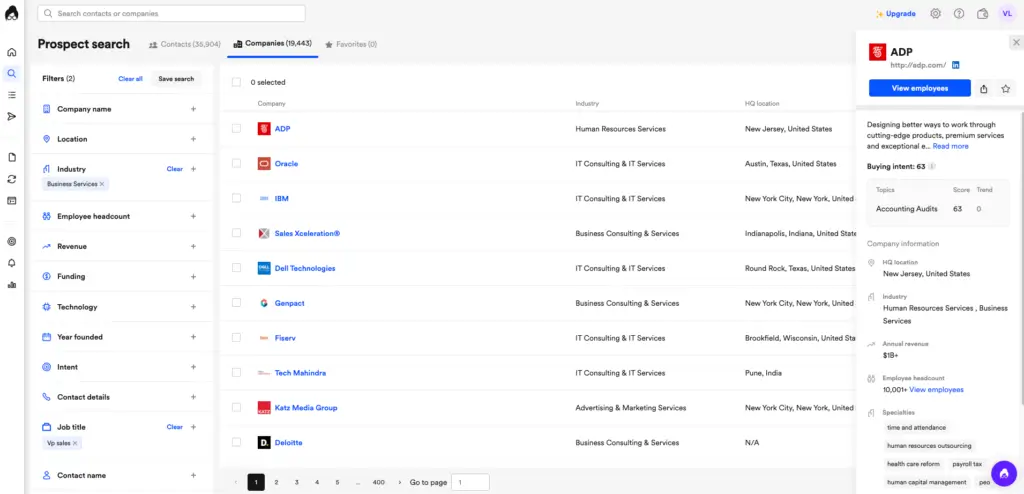

Data & intelligence: intent signals, enrichment, lead lists

Outreach tools are only as good as the data they use and the insight they provide. Key evaluation criteria:

- Access to enriched contact and account data (emails, direct dials, technographics, firmographics).

- Intent-signal tracking (which companies are actively researching your solution or adjacent technologies).

- Real-time filtering and list-building capabilities (job title, company size, technology stack, geography).

- Data quality (accuracy, freshness, regional coverage, global reach) to avoid wasted outreach effort.

Costs, scalability and ease of use

- Platform pricing: per-seat vs per-account, user tiers, credit-based models. Many teams find per-seat licensing expensive as they scale.

- Setup and onboarding complexity: If a tool takes weeks to configure, your time-to-value suffers.

- Scalability: How well the platform supports high-volume outreach or multiple inboxes (for agencies).

- User experience: The easier the UI and workflow, the faster your team will adopt it.

Use-case fit: size of team, agency vs in-house, outbound volume

- A solo founder or small SDR team may prioritise simplicity and cost-effectiveness.

- Growth or mid-market teams may need full multichannel workflows and rich integrations.

- Agencies often need multi-inbox support, white-labelling, robust deliverability tools and flexible pricing.

- Consider your outbound volume: if you run 10,000+ touches per month, you’ll want a platform that can handle that and manage sender reputation, warm-up, etc.

Spotlight on six strong alternatives to Outreach.io

Overview & key features

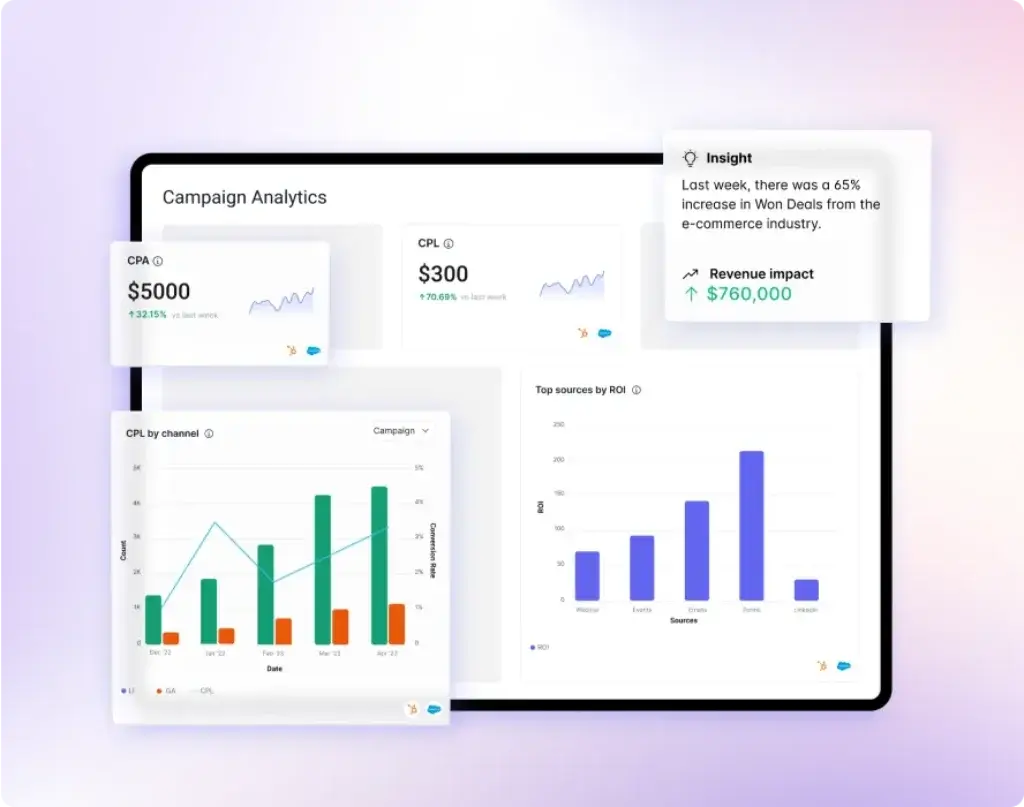

Alta AI positions itself as an “AI Revenue Workforce” rather than just a tool. Their agents (e.g., “Katie” the AI SDR, “Luna” the AI RevOps agent) perform tasks such as prospecting, research, outreach and analytics. They emphasise 24/7 automation of revenue operations.

Major features:

- Automated generation of outbound pipeline, qualification of inbound leads, scheduling of meetings and freeing your sales team to focus on closing.

- Real-time data analysis, alerting when key metrics change or when high-intent prospects surface.

- Deep integration with go-to-market, RevOps and leadership workflows.

Pros & Cons

Positive

✅ Specialized AI Agents for Every Role

✅ Precision Targeting with Intent Data

✅ Native Outreach with AI Personalization

✅ Built-in Revenue Analytics

Negative

❌ Limited non-CRM integrations

❌ No SMS or phone dialer support

❌ Less Flexible Than No-Code Tools

❌ Premium Features Require Higher Tiers

Strengths

- High level of automation and intelligence designed for revenue teams rather than simple email sending.

- Good fit if you are building a modern, AI-enabled outbound stack and want fewer manual tasks.

- Early-stage yet innovative, promising strong value for teams willing to adopt next-gen workflows.

Limitations

- As a newer platform, it may not yet have the ecosystem maturity or global data coverage of larger players.

- May require internal alignment and change management to fully exploit the “AI workforce” concept rather than traditional outreach tools.

Ideal user

Revenue teams seeking advanced automation, AI-enabled workflows and a high-growth mindset, not those who simply want a low-cost email sequencer.

| Black Friday Deal

| Black Friday Deal

Limited-Time Black Friday Deal: Get SmartReach AI for Life!

Grab the exclusive Lifetime Deal before it’s gone – includes monthly outreach tokens + early access perks.

Overview & key features

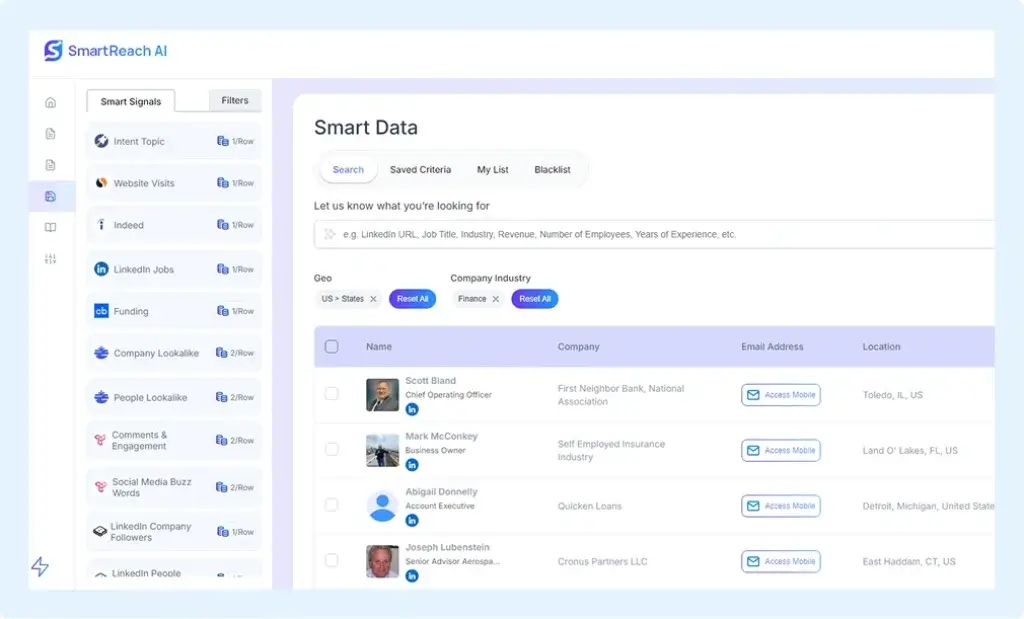

SmartReach AI is targeted at teams who want a unified platform that combines lead-generation, intent data, research automation and multichannel sequences. According to reviews:

- Builds hyper-relevant lead lists using multiple data sources, filters by tech stack, geography, job title etc.

- Smart AI Agent automates research, surfaces buyer intent signals and prioritises outreach timing.

- Multichannel sequences (email, LinkedIn, WhatsApp) and strong personalisation at scale.

Pros & Cons

Positive

✅ AI-Powered List Building

✅ Smart AI Research Automation

✅ Buyer Intent Signal Integration

✅ Strong Multichannel Support

Negative

❌ No Built-In Email Sending

❌ CRM Syncing Requires Setup

❌ No Built-In Dialer for Voice Outreach

Strengths

- Robust automation driven by AI research and intent signals, helping you reach the right leads at the right time.

- Good combination of data, multichannel outreach and workflow support.

- Pricing described as budget-friendly in some reviews.

Limitations

- Does not include built-in email delivery (you may need another tool), which might complicate the stack for some teams.

- Set-up and integration still require some discipline and configuration.

Ideal user

Teams prioritizing outbound list-building, intent-signal targeting and multichannel sequencing, and willing to integrate delivery tools as needed.

Overview & key features

Lusha has established itself as a popular choice for quick access to contact and company data (emails, phone numbers), often via browser extension or CRM plugin. Key points:

- Simple to use, intuitive interface, useful for individual contributors and small SDR teams.

- Good integration with LinkedIn, CRM systems for enrichment.

- Suitable for manual prospecting or smaller outbound campaigns.

Pros & Cons

Positive

✅ User‑friendly interface

✅ Accurate data

✅ Time‑saving tools

✅ Intent data and AI insights

Negative

❌ Limited free credits

❌ Higher costs for advanced features

❌ Data coverage gaps

❌ Dependency on external platforms

Strengths

- Low complexity, fast learning curve, immediate value.

- Effective for smaller teams, rapid lead lookup and enrichment.

- Good if your primary need is data rather than full multichannel automation.

Limitations

- Credit-based pricing and limited built-in automation means scaling can become expensive or inefficient.

- Data accuracy and depth may lag in niche industries or global markets.

- Not a full replacement for a full outreach / sequence engine.

Ideal user

SDR teams or small outbound operations that need reliable contact data and enrichment as a complement to their email or LinkedIn workflows.

Overview & key features

Reply.io is recognized as a dedicated multichannel sales engagement tool emphasizing cold email, LinkedIn, warm-up and sequencing. From older reviews:

- Enables email search, warm-up, LinkedIn automation (though limited) and sequence building.

- Used by teams that want an Outreach.io style capability but with simpler pricing or less enterprise complexity.

Pros & Cons

Positive

✅ Ease of use

✅ Powerful automation

✅ AI‑driven personalization

✅ Deliverability tools

Negative

❌ Pricing complexity

❌ Learning curve for advanced features

❌ Software bugs and browser extension glitches

❌ Limited integrations with certain tools

Strengths

- Strong sequence capability and workflow support for cold-email and LinkedIn outreach.

- Established player, good fit for teams focused on outreach rather than deep intelligence.

- Lower barrier to entry compared to large enterprise platforms.

Limitations

- LinkedIn automation may be more limited or extension-based (with restrictions).

- For full-stack intelligence (e.g., intent signals, enrichment) you might still need other tools.

Ideal user

Outbound teams primarily using email and LinkedIn sequences who need a reliable tool for cadence management, warm-up and scaling outreach without the cost of full enterprise suites.

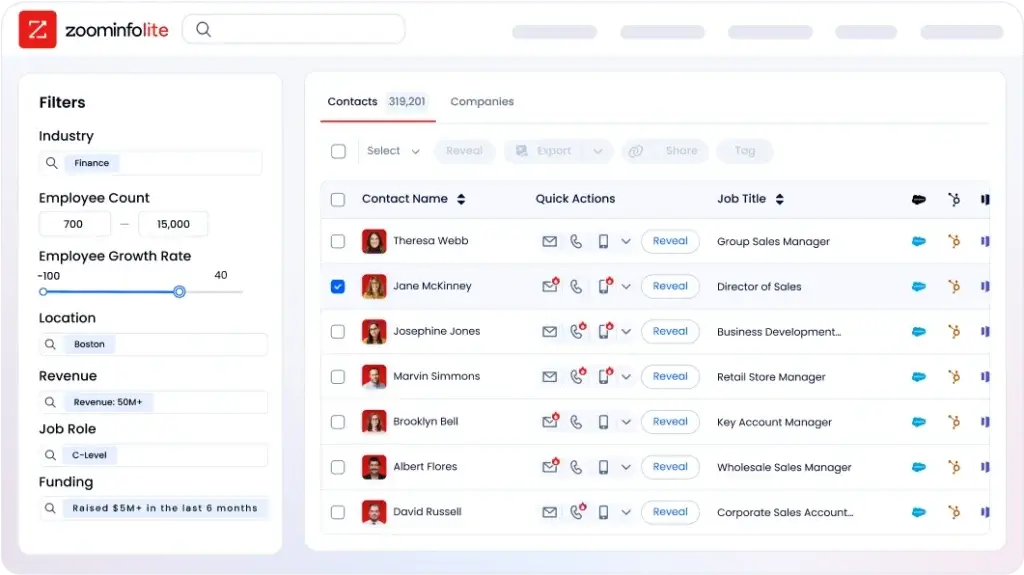

Overview & key features

ZoomInfo stands out as a comprehensive GTM intelligence platform rather than simply an outreach engine. Features:

- Huge database: more than 300 million contacts and 100 million company profiles (depending on region).

- Intent-data, enrichment, CRM sync, company insights, AI-assisted workflows.

- Integrates broadly with CRMs and marketing platforms; used by large sales teams and enterprises.

Pros & Cons

Positive

✅ Extensive database

✅ Powerful filtering

✅ High data accuracy in the US

✅ Rich intent data

Negative

❌ High price point

❌ Complex credit system

❌ Steep learning curve

❌ US‑centric data

Strengths

- Best-in-class data coverage, strong for enterprise and global teams.

- Rich intelligence beyond just outreach: technographics, firmographics, buying signals.

- High integration capability, fits into mature RevOps stacks.

Limitations

- Price point tends to be high, often placing it out of reach for smaller teams.

- Learning curve and setup complexity can be greater than simpler tools.

- For basic outreach needs it may be over-engineered.

Ideal user

Mid-market to enterprise sales and marketing teams that require large-scale data, full intelligence workflows and are willing to invest in both cost and setup to support high volume outbound and account-based selling.

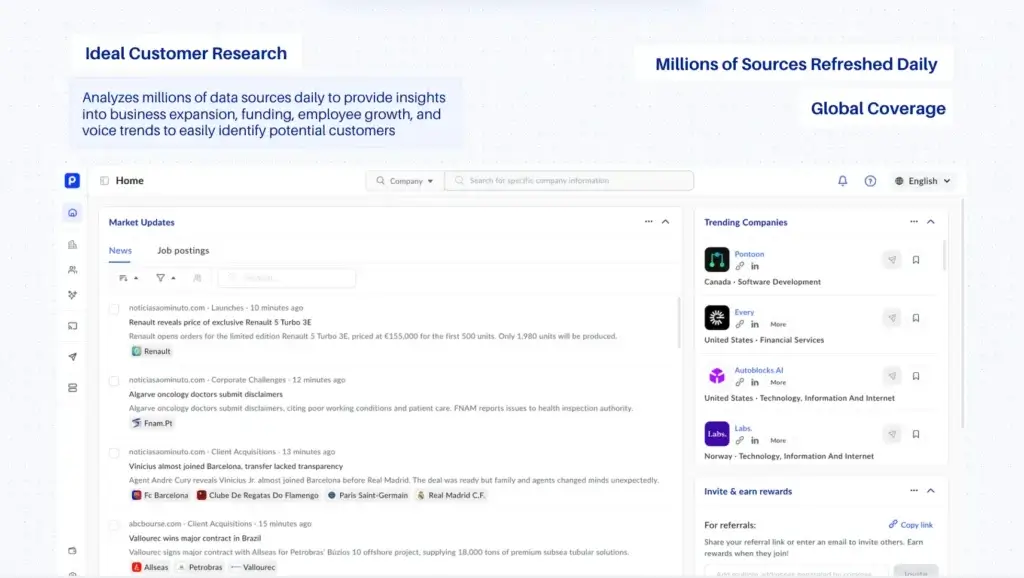

Overview & key features

Pubrio is a newer entrant focusing on AI-driven B2B data, intent and outreach automation. Features include:

- Access to 500 + million company/contact records globally with advanced filtering.

- Automated multichannel outreach, sequence management, intent signals, and managed services.

- Flexible service style (you can get research, lead generation, event coordination) as part of the offering.

Pros & Cons

Positive

✅ Comprehensive APAC coverage

✅ High data accuracy

✅ Actionable intent and technology signals

✅ Built‑in multi‑channel automation

Negative

❌ Learning curve for advanced filters

❌ Limited integrations (currently)

❌ Relatively new platform

❌ Credit‑based pricing

Strengths

- Very good fit for teams needing a lead-gen + sequence combo in one platform.

- Good global reach and filtered data capabilities for more niche markets or non-US-centric usage.

- Strong appeal for modern teams who want one tool for discovery, enrichment and outreach.

Limitations

- Emerging products may lack the long track record of larger players.

- As with any newer platform, you should verify data coverage and support for your specific geographies or verticals.

Ideal user

Growing outbound teams or agencies that want to combine discovery, intent-signals, enrichment and automation in one platform, especially if targeting global markets or non-US segments.

Comparison table of the best Outreach.io alternatives

| Feature Type | Alta AI | SmartReach AI | Lusha | Reply.io | ZoomInfo | Pubrio |

| Primary Focus | AI-driven revenue workforce automation | Lead list + intent data + multichannel outreach | Contact/enrichment data | Sequence & warm-up platform | Enterprise-grade data & intelligence | AI lead-gen + outreach automation |

| Multichannel Outreach | Yes, via agents | Email/LinkedIn/WhatsApp | Limited (mostly data) | Email + LinkedIn | Yes (via modules) | Yes (built in) |

| Intent / Rich Intelligence | High | High | Low-Medium | Medium | High | High |

| Ease of Setup & Cost | Medium-High | Medium | Low | Low-Medium | High (cost & complexity) | Medium |

| Best Fit | Growth/RevOps teams ready for automation | Outbound teams with intent focus | SDRs needing data quickly | Email/LinkedIn driven teams | Enterprise sales + ABM teams | Global/outbound teams + agencies |

How to choose the right Outreach.io alternatives for your business

Match the tool to your outbound volume and workflow

If you send thousands of outbound touches per month with multichannel elements, you’ll need a platform built for high-volume automation and deliverability management. If you’re sending a few hundred personalized emails per month, a lighter tool may suffice.

Consider data quality and intent-signals for your market

If your ICP is global, niche or highly technical (tech-stack, job titles, geographies), prioritize platforms with strong enrichment and intent data. For simpler markets, a tool focused on outreach sequences might be enough.

Factor in CRM/stack integration and setup cost

Consider how each platform will plug into your existing tech stack (CRM, email tool, calendar, analytics). What is the implementation cost in time and resources? How steep is the learning curve?

Pilot and test deliverability, sequences and bounce-rates

Always run a pilot campaign to test deliverability, bounce-rates, sequence performance and workflow fit. A tool may promise features but your actual sending domain, team size, data hygiene and processes will influence results. Monitor metrics like open rate, reply rate, meetings booked and cost per qualified lead.

Conclusion

Switching from Outreach.io to a different platform may give you better fit, cost-efficiency, simpler workflows or stronger data intelligence, depending on your specific needs. The six alternatives above provide a range of capabilities from pure contact data (Lusha) through full automation and intelligence suites (Alta AI, SmartReach AI, ZoomInfo, Pubrio). Match your choice to your team size, outbound volume, data needs and budget. Refining your outreach stack wisely will enable you to build a more efficient pipeline, personalize at scale and maintain stronger deliverability.

Frequently Asked Questions (FAQs)

1. What exactly does an “Outreach.io alternative” mean?

It means a software platform that offers similar functionality to Outreach.io, such as automated sequences, multichannel outreach, CRM sync and analytics, but potentially with different price points, data capabilities or workflows.

2. Can I simply keep using Outreach.io and add one of these tools?

Yes, many teams do a hybrid approach, keeping Outreach.io for certain workflows and adding a plugin tool for data, intent-signals or automation. But if Outreach.io is over-complex or costly for you, migrating entirely may make sense.

3. Is data quality more important than sequence capability?

It depends on your strategy. If you already have strong data and just need better sequencing, focus on that. If your pipeline suffers because your lead data is poor or lacks intent signals, then you’ll benefit more from tools that prioritise richness of data.

4. How do I compare pricing between these tools?

Look beyond headline prices, check whether inboxes are limited, whether data credits are capped, whether outbound volume is restricted, whether warm-up or deliverability features cost extra. Consider total cost of ownership including setup, training, additional integrations and deliverability management.

5. Will switching tools impact deliverability?

Yes, switching tools can affect your sending reputation, inbox warm-up status and performance metrics. Make sure you manage domains, warm-up new inboxes, monitor bounces/spam complaints, and phase migration to avoid disruption.

6. Which tool is best for a small SDR team of 3-5 people?

For small teams you may prioritise ease of setup, cost-effectiveness and minimal training. Tools like Lusha (for data) + a simpler sequencer might suffice, or Reply.io could be a good fit. For more ambition, SmartReach AI or Pubrio could scale.

7. Which tool is best for enterprise / ABM outreach?

For enterprise-scale GTM operations with large account lists, technographic targeting, global coverage and integration into RevOps, ZoomInfo or Alta AI would be strong candidates.

8. Do these tools replace CRM systems?

No, these outreach and intelligence tools complement your CRM. They feed data, sequences and analytics into your CRM but generally do not replace it. Your CRM remains the system of record for leads, pipeline and forecasting.

9. What about GDPR, CAN-SPAM and compliance issues?

You must still ensure your outreach processes comply with applicable laws. When choosing a tool, check its data-privacy compliance (GDPR, CCPA), what opt-out/unsubscribe features it has, and how it handles bounce/spam.

10. How long does it take to see results after switching to a new tool?

Results vary, but typically you should plan for a 4-12 week ramp. Time is needed for setup, list building, sequence testing, inbox warm-up, deliverability verification and workflow optimization. Expect incremental improvements rather than instant wins.