Choosing the right accounting software can feel overwhelming, especially when you’re juggling invoices, taxes, and cash flow all at once. If you’re running a small business or working solo, you need a platform that’s simple but powerful enough to handle your books without the jargon or complexity.

That’s where Kashoo steps in.

In this review, you’ll get a complete look at Kashoo’s features, pricing, strengths, and limitations. Whether you’re an independent freelancer or managing a small team, this guide will help you decide if Kashoo is the right fit for your accounting needs.

We’ve done the digging so you don’t have to.

Let’s dive into what Kashoo actually is and how it stacks up against the competition 👇

What is Kashoo?

Kashoo is a cloud-based accounting platform designed specifically for freelancers, small business owners, and solopreneurs who need a no-fuss, easy-to-learn accounting tool.

Unlike more complex platforms that try to do everything, Kashoo focuses on the essentials:

- Invoicing

- Expense tracking

- Financial reporting

- Tax management

- Multi-currency support

- Bank connection and reconciliation

Its simple interface is built with non-accountants in mind, making it easy to stay compliant, organized, and on top of your finances, without needing to hire a CPA.

Kashoo is best known for:

- Straightforward, clean UI with minimal learning curve

- Quick setup and configuration

- Excellent customer support via live chat and email

- Integration with payment processors like Stripe

While it doesn’t offer everything under the sun (like payroll or inventory tracking), it does exactly what it promises – gives you control over your small business finances without overwhelming you.

Who Is Kashoo Best For?

Find out if Kashoo fits your business needs

Kashoo is designed for people who want to spend less time managing books and more time running their business. It’s a great fit if you’re looking for simplicity without sacrificing essential accounting functionality.

Here’s a closer look at who benefits most from Kashoo:

✅ Kashoo is ideal for:

- Freelancers & solopreneurs who want an easy way to invoice and track expenses

- Small business owners managing their own books without an in-house accountant

- Consultants & contractors who need clean reports for tax filing and client billing

- Non-accountants seeking user-friendly tools with minimal jargon

- International clients that require multi-currency support 🌍

If you need straightforward accounting with minimal setup, Kashoo hits the sweet spot.

❌ Kashoo may not be for you if:

- You run a large business with complex workflows or multiple departments

- You require features like inventory tracking, time tracking, or payroll

- You prefer a wide range of third-party integrations (Kashoo’s are limited)

- You need robust automation and customization

💡 Kashoo is perfect for those who want to “just get it done” without the headaches of a learning curve. But if you’re scaling fast or need advanced workflows, you might want a more full-featured solution like QuickBooks Online or Xero.

Software specification

Core Features That Matter in 2025

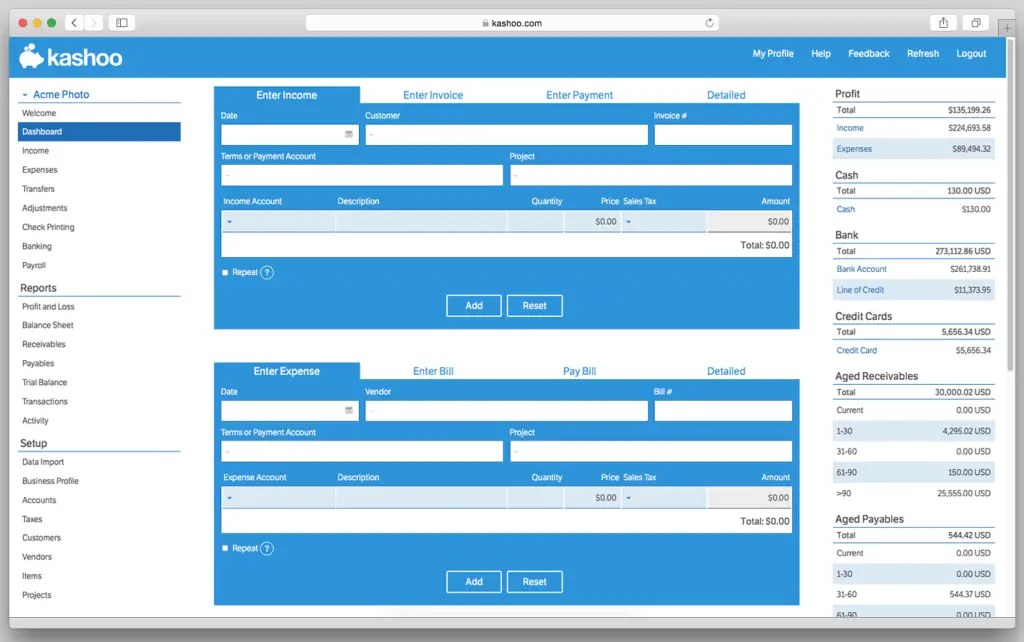

Kashoo keeps things simple while still offering the core accounting features every small business needs. You won’t find bloated dashboards or complex settings here – just straightforward tools that help you stay organised and compliant 📊

Here’s what Kashoo offers under the hood:

🔧 Key Features

- Smart Invoicing:

Create, customise, and send professional invoices in seconds. Accept credit cards via Stripe for faster payments. - Expense Tracking:

Automatically categorise expenses and upload receipts from your device for smooth recordkeeping. - Real-Time Reporting:

View profit and loss statements, income reports, and balance sheets to keep a pulse on your business. - Bank Integration & Reconciliation:

Connect to over 5,000 banks for automatic transaction imports. Match transactions and reconcile with ease. - Multi-Currency Support:

Handle foreign clients and vendors with built-in currency conversion and exchange rate updates 🌐 - Tax-Ready Financials:

Organize income and expenses by tax categories to make tax season stress-free. - Unlimited Users:

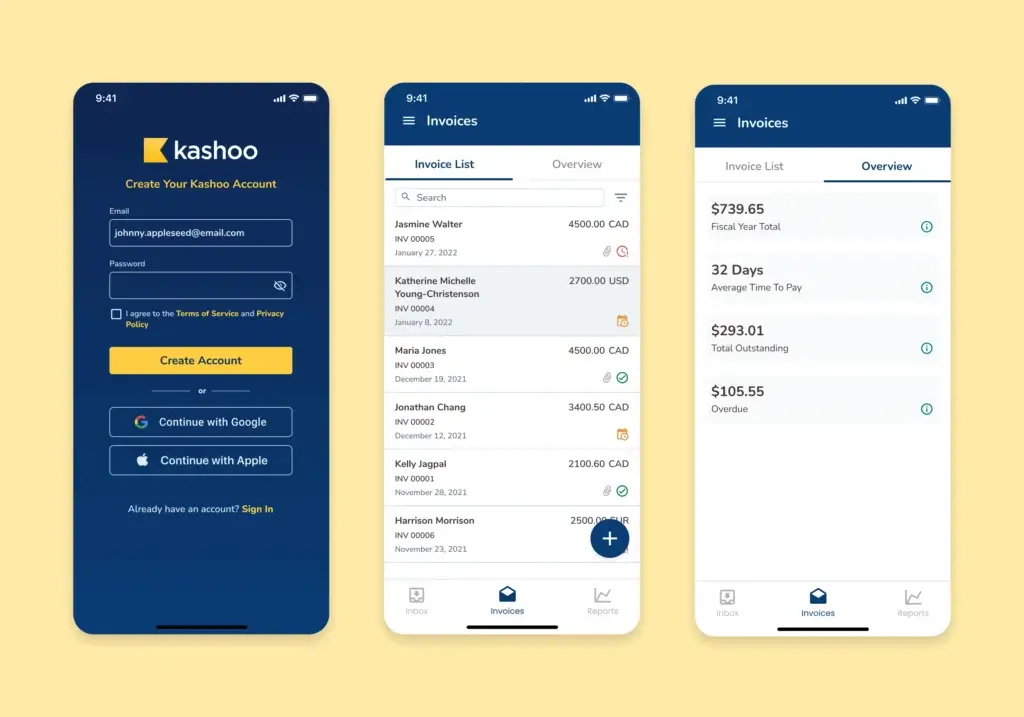

Invite collaborators at no extra cost – ideal if you’re working with a bookkeeper or assistant. - Mobile App (iOS only):

While the iOS app is well-rated and supports on-the-go accounting, Android users will find limited functionality.

💡 Recommended visual: Screenshot of the Kashoo dashboard showing income and expense summary (include alt text: “Kashoo dashboard overview with income vs. expenses graph”).

While Kashoo doesn’t come loaded with extras like inventory tracking or project time logging, its lean approach keeps your accounting focused and clutter-free.

Pros and Cons

A balanced view: what you’ll love and what to consider

No accounting software is perfect; it’s all about finding the right match for your business needs and comfort level.

Kashoo is a strong choice for small business owners and freelancers who value simplicity, clarity, and control over their books. But like any platform, it comes with trade-offs.

Here’s a breakdown of what works well and where Kashoo might fall short:

Positive

✅ User-Friendly Interface

✅ Fast Setup

✅ Unlimited Users

✅ Responsive Customer Support

✅ Multi-Currency Support

✅ No-Nonsense Pricing

Negative

❌ Limited Features

❌ Mobile App Limited to iOS

❌ Few Integrations

❌ Basic Reporting

✅ Pros

- User-Friendly Interface

Clean layout and intuitive tools make it easy for non-accountants to manage finances. - Fast Setup

Get started in minutes without lengthy onboarding or complex configurations. - Unlimited Users

Add collaborators (like your accountant or assistant) without paying extra. - Responsive Customer Support

Email and live chat support are praised for being fast and helpful 💬 - Multi-Currency Support

Great for international transactions or global client billing. - No-Nonsense Pricing

Transparent, flat-fee pricing with no hidden charges.

❌ Cons

- Limited Features

No time tracking, inventory, or payroll functions included. - Mobile App Limited to iOS

Android users may feel left out with restricted functionality 📱 - Few Integrations

Connects with Stripe and some banks, but lacks integration with most major apps. - Basic Reporting

Reports are clear but not as customizable as those in tools like QuickBooks or Xero.

💡 If you need something simple and straightforward, Kashoo delivers. But if you’re growing fast or need deeper automation, it may feel a bit too bare-bones.

User Experience

User Interface and Operational Simplicity

Kashoo is built for simplicity, and it shows the moment you log in. The layout is clean, uncluttered, and free from jargon. Whether you’re sending an invoice, connecting a bank, or reviewing your income, the entire experience feels designed for someone who just wants to “get it done.”

It doesn’t overwhelm you with dashboards or complex menus – and that’s a big win if you don’t speak accounting fluently.

✨ What You’ll Like

- Quick Learning Curve

You can figure out how to use Kashoo in under an hour – no training videos required. - Minimalist Design

The interface is refreshingly simple and keeps distractions to a minimum. - Instant Navigation

Key actions like invoicing, expense entry, and reporting are accessible in just one or two clicks. - Smart Automation

Auto-importing bank transactions and expense categories makes your workflow more efficient 🔄 - Great for Mac & iOS

Kashoo’s iOS app mirrors the desktop experience beautifully. It’s responsive, clean, and easy to use on the go.

👎 What Could Be Better

- Android App Limitations

Android users will find the mobile experience far more limited, which could be frustrating if you’re not in the Apple ecosystem. - No Dashboard Customization

You can’t tweak your home view or add custom widgets. - Limited Visual Reports

Reports are functional but plain – don’t expect colorfull charts or interactive graphs.

💡 A recommended visual here: screenshot of Kashoo’s invoice editor or bank reconciliation screen with alt text: “Kashoo interface showing bank feed import and transaction match options.”

If your priority is speed, ease, and clarity, Kashoo’s user experience is hard to beat.

Integrations and Ecosystem

Connect Kashoo to your favourite apps

Kashoo keeps things simple, but that simplicity also extends to its ecosystem – for better or worse.

If you rely heavily on third-party apps or need your accounting software to sync with a broader toolset, you might find Kashoo’s integration options a bit limited.

🔌 Key Integrations

- Stripe

Accept online payments from clients directly through your invoices 💳 - BluePay

Another payment gateway option for processing transactions. - Bank Feeds

Connect with over 5,000 financial institutions in the U.S. and Canada to import bank transactions automatically.

💡 That’s pretty much the extent of Kashoo’s direct integrations. It doesn’t currently support plug-and-play connections with popular tools like:

- Shopify

- PayPal

- Zapier

- Gusto (for payroll)

- Trello, Slack, or project management tools

🧩 Workarounds

While Kashoo doesn’t support a native integration marketplace, you can use CSV exports to move data between platforms. It’s not seamless – but it’s functional if you’re tech-savvy and don’t mind some manual steps.

Bottom line:

If you only need basic bank syncing and payment collection, Kashoo covers the essentials. But if you’re building a complex tech stack with automated workflows, its closed ecosystem may feel restrictive.

Pricing and Plans

How much does Kashoo cost?

Kashoo keeps its pricing refreshingly simple. Instead of confusing tiers and usage-based pricing, you get two straightforward options depending on your business size and accounting needs.

There’s also a 14-day free trial, so you can test-drive the platform before committing.

💵 Kashoo Pricing Overview

| Plan | Monthly Price | Best For | Included Features |

| TrulySmall Accounting | $20 | Freelancers & solopreneurs | Invoicing, expense tracking, bank connections, basic reporting |

| Kashoo Accounting | $30 | Small businesses with more needs | Everything in TrulySmall plus advanced reports, multi-currency, and better customization |

🟢 TrulySmall Accounting

This plan is tailored for freelancers, consultants, and solopreneurs who need simple accounting features without overpaying for tools they won’t use. It’s ideal if you just want to:

- Send professional invoices

- Track expenses and receipts

- Connect to your bank

- Run basic profit and loss reports

You’ll appreciate how lightweight and focused it is. However, you won’t get advanced analytics or multi-currency options here.

🔵 Kashoo Accounting

This upgraded plan is for growing small businesses that need a bit more horsepower under the hood. It includes everything from the TrulySmall plan, plus:

- Advanced financial reports (cash flow statements, categorised expenses, income trends)

- Multi-currency support – perfect if you work with global clients or vendors

- More flexibility to customize categories and transactions

If your business is scaling or you’re handling more complex finances, this plan ensures you’re not held back by basic functionality.

⚠️ No Hidden Fees

Kashoo’s pricing is transparent. You’ll never be charged for:

- Adding more users

- Uploading more transactions

- Accessing support

💡 Whether you’re just starting or scaling up, Kashoo keeps things affordable and predictable – no surprise fees at tax time.

Alternatives to Kashoo

Compare top competitors

Kashoo is a solid option for small business accounting – but it’s not the only one worth considering.

If you’re looking for features like inventory tracking, project time management, or a more robust ecosystem of integrations, one of these alternatives might be a better fit for your business.

Here are some top Kashoo competitors to compare:

🥇 Zoho Books

Zoho Books is a great step up if you’re looking for advanced automation, client portals, and workflow customization. It’s part of the larger Zoho suite, making it perfect for businesses already using tools like Zoho CRM or Zoho Projects.

- Powerful automation with custom rules

- Built-in inventory and project tracking

- Strong mobile apps for both iOS and Android

- Best for: growing businesses that want scalability and control

👉 Read our full Zoho Books review here

🧾 FreshBooks

If you’re in a service-based industry – like design, coaching, or consulting – FreshBooks might be your go-to. It combines invoicing, time tracking, and project management in one sleek platform.

- Excellent for client billing and hourly work

- Built-in time tracking and project tools

- User-friendly UI with colorful visuals

- Best for: freelancers and small teams that bill by the hour

👉 Dive into the FreshBooks review here

💼 QuickBooks Online

If your accounting needs are growing fast, QuickBooks is the industry heavyweight. It’s ideal for companies that want full accounting functionality, deep reporting, and an app-rich ecosystem.

- Comprehensive reporting and forecasting tools

- Integrates with virtually every major app

- Scales well for larger teams and multi-entity businesses

- Best for: established businesses needing deep financial control

👉 Learn more in our QuickBooks Online review

🧩 Still Not Sure?

We’ve tested and compared all the leading tools – from entry-level solutions to full-featured platforms.

Check out our full Accounting Software Comparison Guide to see how Kashoo stacks up against the rest.

💡 Whether you’re just starting out or scaling fast, finding the right fit comes down to how you work – and what you need your software to do for you.

Security and Compliance

Your financial data deserves top-tier protection

When it comes to accounting software, security isn’t optional – it’s essential 🔐

You’re trusting a platform with your sensitive financial data, client details, and tax information. So, how does Kashoo measure up?

🔒 How Kashoo Keeps Your Data Safe

- Bank-Level Encryption

Kashoo uses 256-bit SSL encryption, the same standard used by major banks, to protect data in transit. - Secure Data Centers

Your data is stored on servers located in Tier 3 secure data centers, with firewalls and continuous monitoring. - Automatic Backups

Kashoo performs regular automated data backups, minimizing the risk of data loss in the event of hardware failure or cyber threats. - Access Controls

You can invite users with role-based permissions, ensuring that team members only access what they need. - Two-Factor Authentication (2FA)

While not currently enforced by default, Kashoo allows optional 2FA for enhanced account protection.

🧾 Compliance & Privacy

- GDPR-Compliant for users in the EU

- Canadian-based, adhering to PIPEDA privacy standards

- No selling or misuse of your data – Kashoo states clearly that your information will never be shared with third parties without your consent

💡 Kashoo doesn’t just protect your books – it protects your peace of mind.

If compliance and data protection are high on your checklist, Kashoo covers the essentials well. However, if you require enterprise-grade certifications like SOC 2 or HIPAA, you may need to explore higher-tier alternatives.

Conclusion

Is Kashoo the Right Accounting Tool for You?

If you’re looking for an accounting tool that keeps things simple, fast, and stress-free, Kashoo might be exactly what you need.

It’s built for freelancers, consultants, and small business owners who want to stay on top of invoicing, expenses, and tax prep – without diving into complex accounting software or spending hours in spreadsheets.

Kashoo stands out for:

- Its easy-to-use interface

- Transparent, flat-fee pricing

- Solid core features like bank connections, real-time reports, and multi-currency support

- Friendly, responsive customer service

That said, it’s not built for everyone.

If you need features like inventory management, advanced automation, time tracking, or dozens of integrations, you’ll likely outgrow Kashoo quickly. For that, tools like Zoho Books, FreshBooks, or QuickBooks Online may serve you better.

💡 Bottom line?

Kashoo is a fantastic choice if you value simplicity, reliability, and straightforward accounting without all the noise.

Have more questions?

Frequently Asked Questions

1. Is there a free version of Kashoo?

No, Kashoo doesn’t offer a forever-free plan. However, you can start with a 14-day free trial to explore its full feature set before committing.

2. What platforms support Kashoo?

Kashoo is web-based and works on all major browsers. It also has a dedicated iOS app, while Android support remains limited.

3. Can Kashoo handle multiple currencies?

Yes. The Kashoo Accounting plan includes full multi-currency support, which is ideal for handling global clients and vendors 🌍

4. Does Kashoo support payroll?

No, Kashoo doesn’t offer built-in payroll functionality. You’ll need to handle payroll through a separate tool or consider an alternative like QuickBooks.

5. Is Kashoo good for freelancers?

Yes. The TrulySmall Accounting plan is designed specifically for freelancers and solopreneurs who need basic tools like invoicing, expense tracking, and reporting.

6. Can I add my accountant to Kashoo?

Yes. Kashoo supports unlimited users at no extra charge. You can invite your accountant and assign them role-based permissions.

7. Does Kashoo offer customer support?

Yes. You can reach Kashoo’s support team via live chat and email, and users consistently report quick, helpful responses 💬

8. Is Kashoo secure?

Yes. Kashoo uses bank-level 256-bit SSL encryption, secure data centers, and automated backups. It’s also GDPR- and PIPEDA-compliant for data privacy.

9. Can I cancel my subscription anytime?

Yes. Kashoo offers flexible monthly or annual billing, and you can cancel whenever you like – no contracts or cancellation fees.

10. What’s the difference between TrulySmall Accounting and Kashoo Accounting?

TrulySmall Accounting includes the essentials (invoicing, bank feeds, basic reports), while Kashoo Accounting adds advanced reporting, multi-currency support, and greater customisation options.