📘 Introduction: Why Xero Deserves Your Attention

If you’re running a business, you already know that managing finances is more than just bookkeeping. It’s about staying in control of your cash flow, making smart decisions, and being ready when tax season rolls around.

This is where Xero comes in.

Xero is one of the most popular cloud-based accounting platforms on the market today. It’s designed for small to mid-sized businesses that want a simple, flexible, and powerful way to handle their finances, without needing an accounting degree.

Whether you’re a freelancer trying to track expenses or a business owner handling payroll across multiple countries, Xero gives you the tools to automate tasks, collaborate in real time, and get full visibility into your numbers.

💡 Quick Fact: Xero connects with over 1,000 banks and integrates with 1,000+ apps, making it a true hub for your business finances.

In this review, you’ll get a detailed look at how Xero performs across the areas that matter most:

- Ease of use and interface

- Invoicing and expense tracking

- Bank reconciliation and reporting

- Integrations and automation

- Pricing, security, and more

By the end, you’ll know whether Xero is the right fit for your business or if you should explore other options in our Top Accounting Software list.

Who Is Xero Best For?

Find out if Xero fits your business needs

Xero isn’t for everyone, and that’s a good thing. It’s built with specific users in mind, and knowing where you fit can save you hours of trial and error.

✅ Great for:

- Small to midsize businesses with 1 to 50+ employees

- Freelancers and consultants who invoice clients regularly

- Agencies and startups that need project tracking and financial visibility

- Businesses working internationally with multi-currency needs

- Remote teams that need cloud access and shared control with accountants

If you work with clients, send invoices, manage expenses, or want a simple way to see your profit in real-time, you’ll likely feel right at home with Xero.

🚫 Might not be ideal if you:

- Want a completely free accounting tool (look at Wave instead)

- Need highly customized enterprise-level reporting

- Prefer hands-on phone support over online help centers

- Have complex inventory or manufacturing needs (look into NetSuite or Odoo ERP)

💬 Real-World Example

A design agency with five team members, working with international clients, uses Xero to:

- Send branded invoices in local currencies

- Automatically reconcile payments from Stripe and PayPal

- Share access with their accountant, no emailing spreadsheets back and forth

That’s where Xero really shines: giving you speed, control, and visibility without the complexity.

Software specification

Core Features That Set Xero Apart

Explore the key tools that make managing your finances simpler and smarter.

Xero isn’t just accounting software. It’s a modern platform designed to automate everyday tasks, connect your data, and give you real-time control over your business finances.

Here’s a breakdown of the features that matter most:

📄 1. Invoicing That Works for You

You can create, customize, and send professional invoices in just a few clicks. Set up automatic payment reminders, accept payments through Stripe or PayPal, and track what’s overdue.

- Send unlimited invoices (on most plans)

- Accept payments online with built-in integrations

- Add your logo and custom branding

Pro tip: Enable auto-reminders to reduce late payments without chasing clients manually.

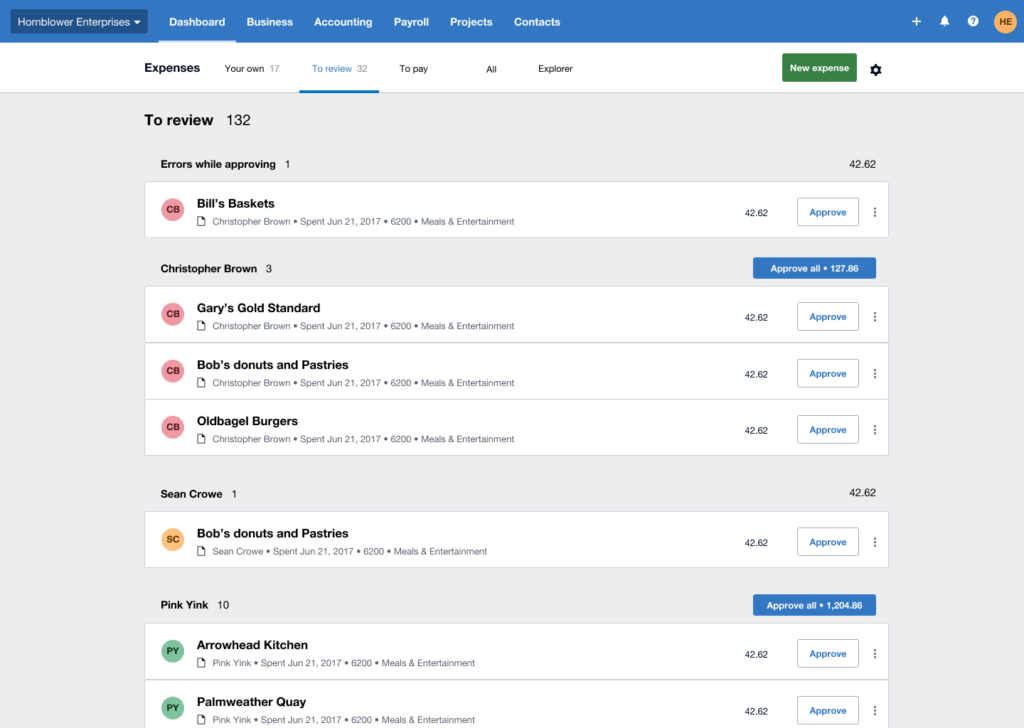

💳 2. Smart Expense Tracking

Keep your business spending under control. With Xero, you can upload receipts via mobile, categorize expenses, and approve employee claims, all in one place.

- Snap photos of receipts with the mobile app

- Track reimbursements and billable expenses

- Monitor budgets for teams or projects

🔁 3. Bank Reconciliation Made Easy

Xero connects directly to your bank account. Transactions flow in automatically, and smart matching suggests where each line item goes.

- Connect with 1,000+ banks and financial institutions

- Reconcile in bulk with just a few clicks

- Spot errors and duplicates instantly

Save hours each week by automating your bank reconciliation.

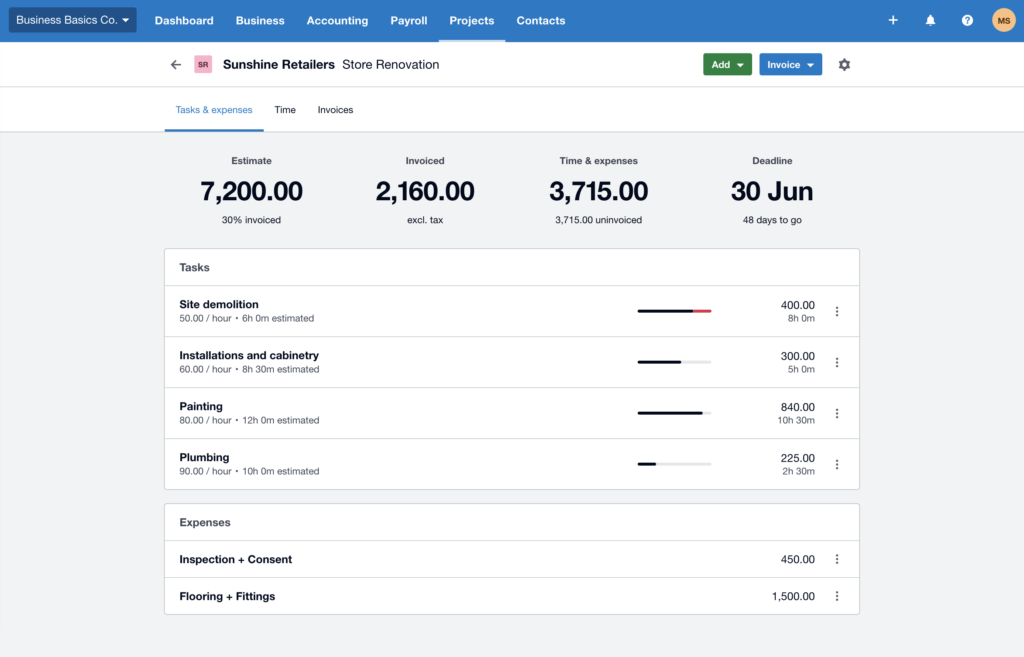

📦 4. Inventory and Product Tracking

Manage basic inventory and stock levels with ease. This is perfect for retail, service, or product-based businesses that need to stay on top of what’s selling.

- Track inventory quantities and values

- Add items directly to invoices and quotes

- Get real-time inventory updates as you sell

🧾 5. Real-Time Reporting and Dashboards

No more waiting for month-end spreadsheets. Xero gives you real-time visibility into your cash flow, profits, and outstanding invoices.

- Visual business dashboard

- Customizable financial reports

- Short-term cash flow forecasting

📉 Know exactly where your money is going at any moment.

📱 6. Access Anywhere with the Xero Mobile App

You don’t need to be at your desk to stay on top of things. The Xero mobile app brings full functionality to your pocket.

- Send invoices and approve expenses on the go

- Reconcile transactions from your phone

- Use Face ID or fingerprint login for quick access

Pros and Cons

A balanced view: what you’ll love and what to consider

Positive

✅ Intuitive, Modern Interface

✅ Strong Integrations and App Ecosystem

✅ Real-Time Data and Reporting

✅ Cloud-Based and Mobile-Friendly

Negative

❌ No Free Plan

❌ Limited Custom Reports

❌ Phone Support Not Available

❌ Inventory and Payroll Add-ons

No software is perfect, and Xero is no exception. While it excels in many areas, there are a few things to keep in mind, especially depending on your business needs and workflows.

Here’s a quick breakdown:

✅ What You’ll Love

Intuitive, Modern Interface

Even if you’re new to accounting, Xero is easy to use and navigate.

Strong Integrations and App Ecosystem

Connects seamlessly with over 1,000 tools, no need to change your entire tech stack.

Real-Time Data and Reporting

Get instant insights into your cash flow, profits, and outstanding invoices.

Cloud-Based and Mobile-Friendly

Access your books from anywhere, anytime, with full functionality on mobile.

Unlimited Users

Unlike many competitors, Xero doesn’t charge per user on most plans.

👎 What Could Be Better

No Free Plan

Xero doesn’t offer a forever-free version, only a 30-day trial.

Limited Custom Reports

Advanced reporting options are more restricted compared to tools like QuickBooks Advanced or Zoho Books.

Phone Support Not Available

Support is online-only, which may be a downside if you prefer phone assistance.

Inventory and Payroll Add-ons

Some features, like advanced inventory or full-service payroll, require third-party integrations or upgrades.

User Experience

User Interface and Operational Simplicity

Xero’s user experience is one of the reasons it stands out from older, more complex accounting tools. Whether you’re just getting started or managing multiple accounts, Xero is built to make things feel intuitive, not overwhelming.

Here’s what you can expect when using it day to day:

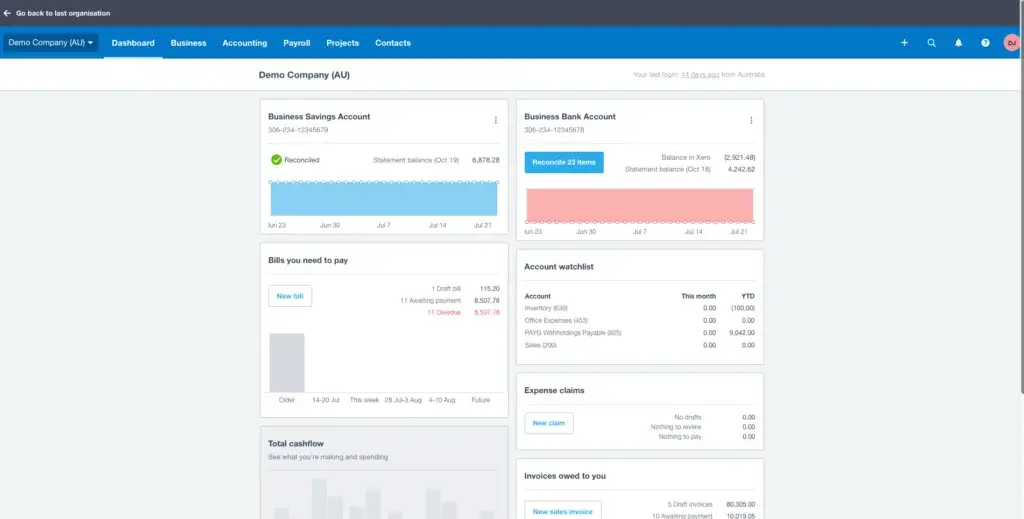

Clean, Intuitive Dashboard

When you first log in, you’re greeted with a simple, visual dashboard showing your bank balance, cash flow, invoices, and bills.

Everything is clickable, interactive, and designed to get you where you need to go with just a few clicks.

- View unpaid invoices, bills, and bank balances in real time

- Quick access to key reports, reconciliations, and shortcuts

- Drag-and-drop menus that are easy to navigate

👀 You don’t need to be an accountant to find your way around.

Designed for Non-Accountants

If you’re not a financial pro, don’t worry. Xero speaks your language.

Most accounting software is built for bookkeepers. Xero is different. It’s clean, friendly, and less cluttered than tools like QuickBooks Desktop or Sage.

- Guided setup with helpful tooltips

- Smart suggestions for reconciliation and categorization

- Search bar and filters that actually work

Seamless Collaboration with Your Team

Want to invite your bookkeeper or business partner? Xero makes it easy to give different users different access levels, so everyone gets what they need, nothing more, nothing less.

- Invite unlimited users (on most plans)

- Set custom permissions for team members or accountants

- Share real-time access instead of emailing spreadsheets

🔐 Your accountant will thank you for not sending monthly PDFs anymore.

A Smooth Mobile Experience

The Xero mobile app mirrors the desktop experience, letting you manage the essentials from your phone or tablet.

You can:

- Snap and upload receipts

- Reconcile transactions on the go

- Send quotes and invoices in real time

It’s fast, secure, and designed for business owners who don’t sit still.

Learning Curve? Minimal.

If you’re switching from another system or starting fresh, the learning curve with Xero is gentle.

- Tutorials, onboarding guides, and walkthroughs

- A robust help center with real use cases

- Free courses via Xero Central and their YouTube channel

Even if you hit a snag, there’s plenty of support to help you get back on track quickly.

Bottom line: Xero is one of the most accessible accounting platforms out there. It’s intuitive for beginners, powerful enough for growing businesses, and collaborative by design. Whether you’re working solo or managing a team, the user experience is built to help you stay in control, without feeling lost.

Integrations and Ecosystem

Connect Xero to your favorite apps

One of Xero’s biggest strengths is how well it plays with other tools. Instead of trying to do everything, Xero focuses on being your financial hub and lets other apps handle the rest.

Whether you’re using a payment gateway, an eCommerce platform, or a CRM, Xero has hundreds of integrations that can save you time and reduce manual work.

🌐 Connect to 1,000+ Apps

Xero integrates with tools across multiple categories:

- Payments: Stripe, Square, PayPal

- Payroll: Gusto, Deel, ADP

- eCommerce: Shopify, WooCommerce, Amazon

- CRM & Sales: HubSpot, Pipedrive, Salesforce

- Inventory: Cin7, Unleashed, DEAR Inventory

- Time Tracking & Projects: Harvest, WorkflowMax, Trello

These integrations let you sync data automatically, cut down on manual entry, and maintain a clean audit trail.

🔄 Built-in Automation

You can automate workflows between Xero and other apps using:

- Zapier or Make.com for no-code automation

- Bank feeds to sync transactions in real time

- Auto-matching for invoices, receipts, and bank rules

This means you spend less time on admin and more time running your business.

🛒 Xero App Store

The Xero App Store makes it easy to explore, compare, and install tools by category or business function.

💡 Use filters like “Industry” or “Staff size” to find the perfect add-on for your team.

👥 Built for Collaboration

Xero also connects directly with your accountants and advisors. They can access your books in real time, reducing the back-and-forth.

- No more downloading spreadsheets

- Easy-to-use collaboration tools

- Add unlimited users (on most plans)

If you’re already using digital tools to run your business, Xero makes it easy to integrate, automate, and scale with minimal friction.

Pricing and Plans

How much does Xero cost?

Choose the plan that fits your business stage and growth.

Xero offers three main pricing plans, each designed for different business sizes and needs. All plans include access to Xero’s core features like invoicing, bank reconciliation, reporting, and mobile access.

Here’s a quick breakdown of what you get with each one:

📦 Xero Pricing Plans

| Plan Name | Best For | Monthly Price | Key Features Included |

| Early | Freelancers or very small teams | $15 | 20 invoices, 5 bills, bank reconciliation, Hubdoc, short cash flow |

| Growing | Small businesses with steady work | $42 | Unlimited invoices & bills, bulk reconciliation |

| Established | Expanding businesses or global teams | $78 | Everything in Growing, plus multi-currency, expense claims, projects |

💡 Which Plan Should You Choose?

- Go with Early if you’re just starting out and send fewer than 20 invoices/month.

- Choose Growing if you handle more clients and want unlimited billing.

- Upgrade to Established if you work across countries or need built-in project tracking and expense claims.

Keep in mind that payroll is not included directly in U.S. plans. Instead, Xero integrates with trusted payroll partners like Gusto.

Alternatives to Xero

Compare top competitors

While this platform is powerful, it’s not the only accounting software worth considering. Depending on your budget, industry, and feature needs, another option might serve you better.

Let’s look at the four top alternatives, and when you might choose them instead.

QuickBooks Online

Best for: Businesses needing advanced reporting and built-in U.S. payroll.

QuickBooks is often seen as the most direct competitor. It offers more granular reporting and native payroll integration, especially beneficial for U.S.-based teams. However, it charges per user and can get expensive as you scale.

Why choose it:

- You want powerful custom reports and analytics

- You prefer built-in payroll rather than a third-party add-on

- You need deep integrations with industry-standard tools (e.g., Intuit ecosystem)

Zoho Books

Best for: Startups and small businesses looking for value and customization.

Zoho Books is highly affordable and ideal if you’re already using the Zoho ecosystem (CRM, Projects, etc.). It offers generous features, including automation, time tracking, and client portals, often at a lower cost.

Why choose it:

- You need a free or low-cost solution to get started

- You use Zoho CRM or Zoho Projects and want a unified platform

- You want more control over invoice design, custom fields, and workflows

FreshBooks

Best for: Freelancers and service-based businesses focused on invoicing and time tracking.

FreshBooks is designed for simplicity. It’s perfect if you bill clients by the hour, need clean invoices, and want to track time easily. It’s user-friendly but may lack depth for complex financial tasks.

Why choose it:

- You’re a solo consultant or freelancer billing hourly

- You want fast, mobile-friendly invoicing

- You don’t need inventory or complex reporting

Wave

Best for: Solopreneurs and very small businesses on a tight budget.

Wave stands out as one of the few truly free options. It includes invoicing, receipt capture, and basic accounting, all without monthly fees. Just be aware that support and features are more limited.

Why choose it:

- You want to keep costs as close to zero as possible

- You only need core accounting and invoicing tools

- You’re okay with email-based support and fewer integrations

Choosing the Right Alternative

Here’s a quick rule of thumb:

- Use QuickBooks if you need robust reporting, payroll, and a well-established ecosystem.

- Go with Zoho Books if you’re budget-conscious but want advanced automation and flexibility.

- Choose FreshBooks if you’re a solo service provider who values simplicity and clean invoicing.

- Pick Wave if you need a reliable, zero-cost solution for basic bookkeeping.

| Feature | Xero | QuickBooks Online | Zoho Books | FreshBooks | Wave |

| Starting Price | $15/month | $30/month | Free (limited), $20+ | $19/month | Free |

| Multi-Currency Support | Yes (Established plan) | Yes (Essentials+) | Yes (Standard plan) | No | No |

| Built-in Payroll (U.S.) | ❌ (via Gusto) | ✅ | ✅ (India, UAE only) | ❌ (via Gusto) | ❌ (paid add-on) |

| Free Plan Available | ❌ | ❌ | ✅ | ❌ | ✅ |

| Users Included | Unlimited (on most plans) | 1 included, add more at cost | Tier-based user limits | 1 user (add-ons extra) | 1 user |

| Time Tracking | ✅ | ✅ | ✅ | ❌ | |

| Inventory Management | ✅ (basic) | ✅ (Plus+ plans) | ✅ (Pro plan) | ❌ | ❌ |

| Mobile App | ✅ | ✅ | ✅ | ✅ | ✅ |

Security and Compliance

Your financial data deserves top-tier protection

When you’re handling sensitive business data like invoices, payroll, and bank transactions, security isn’t just a feature; it’s a necessity. Xero takes this responsibility seriously by using enterprise-grade protections that are trusted by over 3.5 million users worldwide.

Here’s what you can count on when it comes to staying secure and compliant with Xero:

🔒 Bank-Level Encryption

Xero uses 256-bit SSL encryption, which is the same level of protection that is used by major banks. This keeps your financial data safe while it’s moving between your device and Xero’s servers.

- Secure login and data transfer

- Encrypted communication protocols

- TLS for all browser sessions

🔐 Your connection to Xero is always encrypted, no exceptions.

🔑 Two-Step Authentication (2SA)

To prevent unauthorized access, Xero offers two-step authentication (also known as two-factor authentication) for all users.

- Requires both a password and a verification code

- Strongly recommended (and sometimes required) for users in sensitive roles

- Optional authenticator app or SMS code for added flexibility

🌍 Global Compliance Standards

Xero is built to comply with international data and financial regulations, helping your business stay ahead of the curve:

- GDPR compliant for EU-based data handling

- ISO/IEC 27001 certified (recognized global standard for information security)

- Aligned with SOC 2 principles for cloud service security

🧠 Smart User Permissions

You stay in control of who sees what. Whether you’re working with a bookkeeper, accountant, or team member, you can customize access permissions for each user.

- Limit access by role or function (e.g., read-only, invoice-only)

- Track activity with audit trails

- Revoke access instantly when needed

🛡️ Real-Time Monitoring and Backups

Xero continuously monitors for unusual activity across its platform and has dedicated security teams ready to respond.

- 24/7 monitoring and incident response

- Regular backups across multiple data centers

- Disaster recovery systems to prevent data loss

🧾 Audit Logs and Recordkeeping

Need to verify who did what, and when? Xero maintains detailed audit logs, helping you meet accounting and compliance obligations.

- Timestamped records of user activity

- Helps with audits and internal accountability

- Keeps your business fully transparent

Bottom line: Xero has built a reputation on trust, and their security architecture backs it up. Whether you’re a small business or a growing enterprise, you can rest easy knowing your financial data is well-guarded, fully compliant, and always under your control.

Conclusion

Is Xero the Right Accounting Tool for You?

If you’re looking for a cloud-based accounting solution that grows with you, Xero is absolutely worth considering. It offers a balance of powerful features and intuitive design, making it suitable for solo entrepreneurs, growing businesses, and even international teams.

Here’s a quick recap:

✅ Easy to use, even if you’re not an accountant

✅ Real-time insights into cash flow and performance

✅ Unlimited users on most plans, no hidden costs

✅ Strong integrations with payment, CRM, and eCommerce tools

✅ Secure, compliant, and mobile-ready

While it doesn’t offer a free plan and advanced reporting can feel limited, Xero excels in automation, flexibility, and usability. It’s a smart choice for businesses that want modern financial management without complexity.

Want to explore more options before deciding? Visit our Top Accounting Software guide for side-by-side comparisons.

Have more questions?

Frequently Asked Questions

What is Xero used for?

It helps you manage your business finances, such as invoicing clients, tracking expenses, syncing bank feeds, and generating reports.

Is Xero easy for beginners?

Yes. The platform is built to be intuitive, even if you’re new to accounting or switching from spreadsheets.

Does Xero offer a free plan?

There’s no forever-free version, but you can start with a 30-day free trial to explore all features without commitment.

Can I use Xero on mobile?

Yes. You can send invoices, upload receipts, and reconcile transactions right from your phone or tablet using the mobile app.

How does Xero compare to QuickBooks?

It’s more flexible for teams that need unlimited users and international support. However, QuickBooks may offer deeper reports and built-in U.S. payroll.

What integrations does Xero support?

You can connect it with over 1,000 apps, including Stripe, PayPal, HubSpot, Shopify, Gusto, and many CRM or eCommerce platforms.

Is my financial data safe in Xero?

Yes. Your data is protected with bank-level encryption, two-step authentication, and compliance with global security standards like ISO 27001 and GDPR.

How many users can I add to my Xero account?

Most plans allow unlimited users with no extra cost. You can also control access permissions for each team member or advisor.

Can I manage payroll with Xero?

In the U.S., payroll is handled through a partnership with Gusto. You can integrate the two seamlessly to run payroll and stay compliant.

Who is Xero best suited for?

It’s a strong fit for freelancers, small to mid-sized businesses, agencies, and remote teams looking for automation, collaboration, and control over finances.