Introduction

Why Picking the Right Accounting Software Matters

If you’re running a small business, you already know that time is your most valuable resource. Between chasing invoices, tracking expenses, and staying on top of client payments, it’s easy for finances to slip into chaos.

That’s why choosing the right accounting tool isn’t just a nice-to-have – it’s essential.

You don’t need a tool overloaded with features you’ll never use. You need something that makes invoicing fast, keeps your expenses organized, and helps you stay compliant without giving you a headache.

And that’s exactly where FreshBooks comes in.

Where FreshBooks Stands in 2025

FreshBooks started as a simple invoicing tool. But in 2025, it’s evolved into a full cloud-based accounting solution tailored for service-based businesses, freelancers, consultants, and creative teams.

It’s not trying to be all things to all people. Instead, it focuses on doing a few things exceptionally well: invoicing, time tracking, expense management, and getting paid fast.

FreshBooks competes with tools like QuickBooks, Xero, and Zoho Books, but its focus on simplicity, mobile access, and user experience sets it apart, especially if you’re not an accountant.

What You’ll Discover in This Review

In this deep-dive review, you’ll learn:

- Who FreshBooks is best suited for (and who it’s not)

- How its features actually work for small businesses

- Whether it’s worth the price tag

- What the user experience feels like, both on desktop and mobile

- How it integrates with tools like Stripe, Gusto, Trello, and more

- How it stacks up against competitors like QuickBooks and Zoho

Whether you’re switching from spreadsheets, upgrading from Wave, or just comparing options, this review will help you make a confident, informed choice.

Who Is FreshBooks Best For?

Find out if FreshBooks fits your business needs

FreshBooks isn’t built for everyone, and that’s actually a good thing. It excels when used by the people it was designed for.

Let’s break it down.

Ideal Business Sizes and Types

FreshBooks is best for:

🧑💻 Freelancers and solopreneurs

Graphic designers, consultants, writers, virtual assistants – if you bill clients and want an easier way to manage your money, FreshBooks is a great fit.

👩💼 Service-based businesses and agencies

From marketing firms to IT support providers, FreshBooks supports teams who need to track time, invoice by project, and manage multiple clients.

🌎 Remote-first teams and digital nomads

With robust mobile apps, FreshBooks helps you manage invoices, scan receipts, and log hours from anywhere – no desktop required.

When FreshBooks Might Not Be the Right Choice

Despite its strengths, FreshBooks isn’t for everyone. You might want to look elsewhere if:

❌ You sell physical inventory and need deep inventory management

❌ You run a large business with complex financial needs

❌ You want extensive reporting and custom dashboards

❌ You need full payroll features without relying on third-party apps

In these cases, platforms like QuickBooks Online, Xero, or even Zoho Books might be more suitable, especially if your business is scaling beyond the FreshBooks ecosystem.

Real Scenarios Where FreshBooks Shines

Here’s where FreshBooks truly excels:

- A web design agency billing by project and hourly rate

- A freelance coach who wants auto-reminders for invoice due dates

- A creative studio needing to track multiple team members’ hours

- A startup team juggling estimates, proposals, and invoicing all in one place

If any of these sound like you, FreshBooks will likely save you hours every week.

Software specification

Core Features That Matter in 2025

FreshBooks might not have the overwhelming feature set of enterprise software, but that’s actually one of its biggest strengths. Instead of drowning you in tools you’ll never use, it focuses on delivering what matters most to freelancers and small teams.

Here’s what makes it stand out in 2025.

Invoicing and Payments

This is where FreshBooks truly shines. You can create sleek, professional invoices in minutes, complete with your logo, personalized messages, and line items. It’s designed so you don’t need to wrestle with settings or formatting.

- Recurring invoices for retainer clients

- Late payment reminders you can automate

- Online payments via credit card, Stripe, Apple Pay, or ACH

- Automatic late fees if clients don’t pay on time

What’s more? FreshBooks will show you when a client has viewed the invoice – no more “I never got your email” excuses.

📸 Visual tip: include a screenshot of the invoice editor for higher engagement.

Expense and Bill Tracking

Say goodbye to shoeboxes of receipts. With the FreshBooks mobile app, you can snap a photo of any receipt, and it’ll automatically attach and categorize it for your records.

- Auto-categorization by vendor or type

- Recurring expenses support

- Link your bank or credit card for real-time import

- Mark expenses as billable and attach them to specific clients or projects

Everything stays organized for tax time – and you’re always audit-ready.

Time Tracking and Project Management

If you bill hourly or manage a service-based team, this feature can be a game-changer. Built-in time tracking means you no longer need separate apps like Toggl or Harvest.

- Track time by project, task, or client

- Start and stop timers directly from your desktop or phone

- Convert logged hours into invoices instantly

- Collaborate with teammates on shared projects

This is especially useful for agencies or consultants juggling multiple clients.

Proposals and Estimates

FreshBooks helps you win work, not just manage it. You can create professional estimates and proposals with breakdowns, timelines, and service descriptions.

Once approved, turn them into invoices in one click. This keeps your workflow efficient and eliminates double-entry.

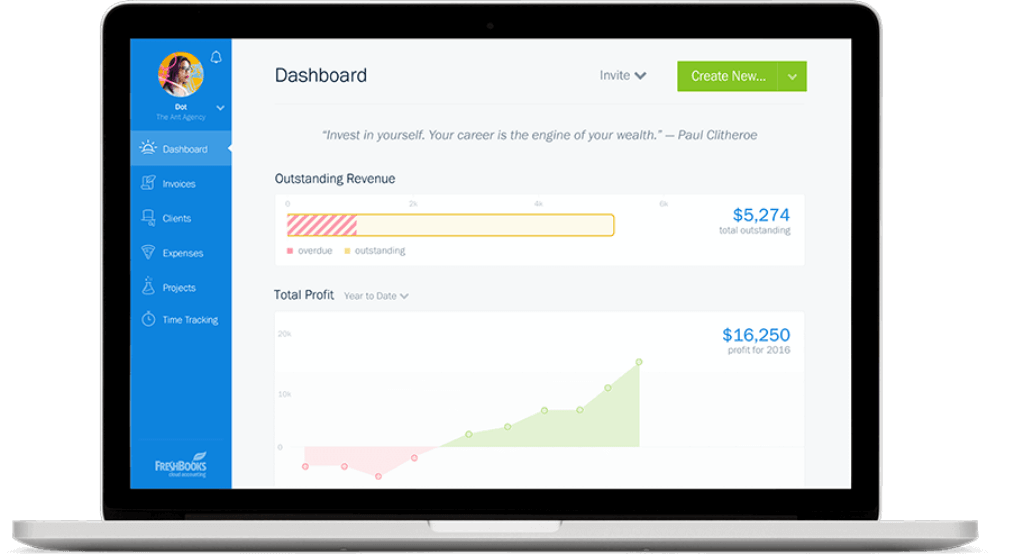

Financial Reports and Dashboards

You’re not an accountant, and FreshBooks doesn’t expect you to be. That’s why its reporting is simple, visual, and useful.

- Profit & Loss

- Expense reports

- Tax summaries

- Invoice aging

- Client payment history

These reports help you stay on top of your financial health without getting overwhelmed by technical jargon.

You won’t get the depth of custom dashboards like in QuickBooks or Xero, but for most solo or small team operations, the built-in reports are more than enough.

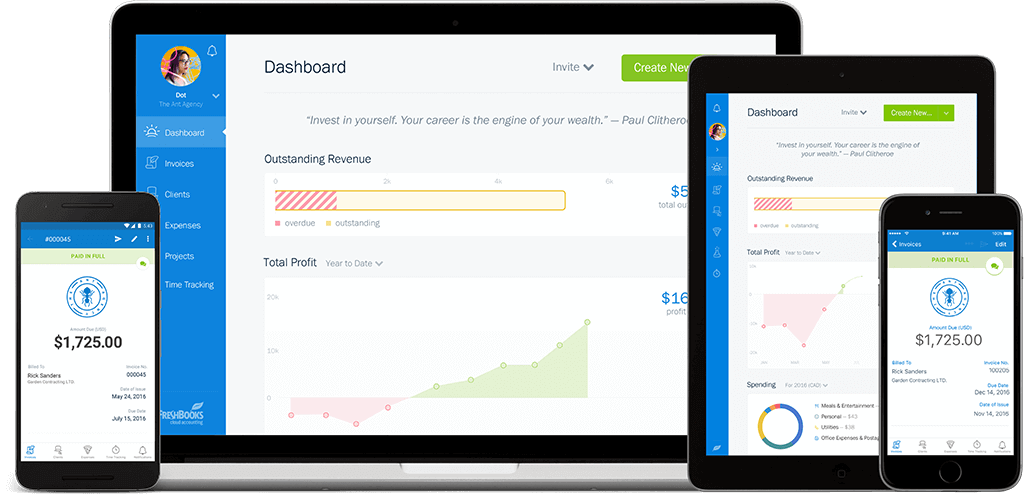

Mobile App and Cloud Access

Whether you’re working from a coffee shop, your car, or a client site, FreshBooks has you covered. The mobile app (available for iOS and Android) is fully featured – not just a stripped-down version.

From the app, you can:

- Send invoices

- Log hours

- Snap and attach receipts

- Get notifications for overdue payments

Everything is cloud-synced, so your data is always up to date, no matter where you log in.

Pros and Cons

A balanced view: what you’ll love and what to consider

Positive

✅ Ridiculously easy to use

✅ Invoicing that gets you paid faster

✅ Built-in time tracking and project billing

✅ Powerful mobile app

Negative

❌ Client limits on lower-tier plans

❌ Basic financial reporting

❌ Not ideal for inventory or product-based businesses

❌ Smaller app ecosystem

Every accounting platform has its strengths and trade-offs. FreshBooks isn’t trying to be an enterprise ERP; it’s built to solve the real problems of freelancers, solo professionals, and small service teams.

Here’s a clear, scannable breakdown of what you’ll love and what to watch out for when using FreshBooks in 2025.

✅ What You’ll Love About FreshBooks

Ridiculously easy to use

Even if you’ve never touched accounting software before, you’ll feel right at home. Everything is built with simplicity in mind, no jargon, no clutter, just intuitive tools that make sense.

Invoicing that gets you paid faster

Send professional invoices in seconds, automate late fees and reminders, and accept payments online via credit card, ACH, or PayPal.

Built-in time tracking and project billing

You don’t need extra tools like Toggl or Harvest. FreshBooks lets you track time per client, log billable hours, and convert them into invoices in one click.

Powerful mobile app

Run your business from anywhere. Log time, send invoices, scan receipts, and check your dashboard – all from your phone.

Top-tier customer support

FreshBooks is known for its responsive support team. You can get help via phone, email, or chat, and often speak to a real human within minutes.

Great integrations with business tools

Connect with Stripe, Gusto, Shopify, Trello, and more to streamline your workflow and automate repetitive tasks.

⚠️ What Could Be Better

Client limits on lower-tier plans

The Lite and Plus plans cap how many clients you can bill. If you’re scaling quickly or managing a large client base, you’ll need to upgrade to Premium or Select.

Basic financial reporting

Reports like Profit & Loss and Tax Summary are included, but they’re less customizable than what you’d find in QuickBooks or Zoho Books. Power users may feel limited.

Not ideal for inventory or product-based businesses

FreshBooks lacks native inventory management. If you need stock tracking or product costing, you’ll need to look elsewhere.

Smaller app ecosystem

While integrations are solid, the overall app marketplace isn’t as broad as competitors like Xero or QuickBooks. You may need Zapier or custom API workarounds for some connections.

Bottom Line:

If you’re a freelancer or a service-based small business, FreshBooks delivers exactly what you need, and almost nothing you don’t. But if you’re running a product-heavy or high-growth company with advanced accounting needs, you may outgrow it sooner rather than later.

User Experience

User Interface and Operational Simplicity

One of the biggest reasons business owners choose FreshBooks over more complex platforms is its simplicity. You don’t need an accounting background to get started. Everything is designed with clarity, speed, and usability in mind.

Let’s walk through what it’s like to use FreshBooks day to day.

🎯 First-Time User Experience

Getting started with FreshBooks is genuinely easy. The setup process guides you through the essentials:

- Add your logo and brand colors

- Connect your bank or payment processor

- Set up your first invoice or project in minutes

The welcome dashboard highlights tasks like creating an invoice or linking an account, so you’re never wondering what to do next.

You don’t get overwhelmed with settings or jargon. Instead, it’s clean, focused, and built for action.

🧭 Navigation and Onboarding

The main dashboard is visually driven. Tabs like “Invoices,” “Clients,” “Projects,” and “Expenses” are clearly labeled and always accessible. There’s zero fluff – everything is where you expect it to be.

Need help? FreshBooks offers in-app tutorials, tooltips, and a help center you can access from any screen.

The onboarding flow is beginner-friendly but also deep enough for experienced users who want to tweak more settings (like tax rates, late fees, and permissions).

📱 Mobile Experience (iOS and Android)

FreshBooks’ mobile app isn’t just an afterthought – it’s powerful enough to replace the desktop experience for many users.

From your phone or tablet, you can:

- Send or edit invoices

- Track time per client or project

- Attach and categorize expenses

- View dashboard reports

- Communicate with clients

The UI is touch-friendly and responsive, and everything syncs in real time with your desktop account. You can literally manage your entire business finances on the go.

For mobile-first freelancers or digital nomads, that’s a major win.

👥 Collaboration with Accountants and Teams

Even if you’re not doing your own bookkeeping, FreshBooks makes collaboration easy.

- You can grant your accountant read-only access to manage taxes, review reports, and export data

- Invite team members to log time, submit expenses, or collaborate on projects (depending on your plan)

- Use client portals to share invoices, proposals, and updates in one place

Everyone has the access they need, without exposing sensitive financial data unnecessarily.

If you’ve ever felt overwhelmed by platforms like QuickBooks or Xero, FreshBooks offers a refreshing alternative. It strips away complexity and focuses on helping you get work done fast, wherever you are.

Integrations and Ecosystem

Connect FreshBooks to your favorite apps

FreshBooks isn’t just a standalone tool – it plays well with others. Whether you use a CRM, ecommerce platform, payroll software, or project management tool, chances are there’s an integration ready to go.

🔌 Popular App Integrations

FreshBooks connects with dozens of popular apps to help you build a smoother workflow:

- Stripe & PayPal – for fast, secure client payments

- Gusto – for payroll and employee benefits

- Trello & Asana – to sync tasks and time tracking

- Shopify & WooCommerce – for ecommerce data integration

- HubSpot – for syncing client details between CRM and invoicing

These integrations allow you to manage key business operations without switching tabs or copying data manually.

⚙️ Automation with Zapier and APIs

If you want to get even more from FreshBooks, Zapier is your secret weapon. You can set up simple automations like:

- Send Slack alerts when invoices are paid

- Auto-add new clients to your email list

- Generate invoices based on project milestones in tools like ClickUp or Monday.com

For developers or power users, FreshBooks also offers an open API, making it easy to build custom connections or integrate with in-house tools.

🛒 FreshBooks App Store

FreshBooks maintains its own App Store where you can browse integrations by category, including:

- Time tracking

- Tax compliance

- Ecommerce

- Reporting & analytics

- Productivity tools

While its app ecosystem isn’t as vast as QuickBooks or Xero, it covers the essentials most small businesses and freelancers need. And the Zapier bridge closes any major gaps.

If your workflow already includes tools like Gusto, Stripe, or Shopify, FreshBooks can slot in with minimal setup, making it a flexible hub for running your business efficiently.

Pricing and Plans

How much does FreshBooks cost?

FreshBooks offers flexible pricing plans designed to fit the needs of freelancers, small businesses, and growing teams. Each tier includes essential features like invoicing, expense tracking, and time logging, but there are important differences to keep in mind as your client list and team size expand.

Here’s a breakdown of each plan, what you get, and who it’s best suited for.

💼 Plan Overview: Lite, Plus, Premium, and Select

FreshBooks follows a tiered pricing model, billed either monthly or annually (with a discount if you pay yearly). All plans include a 30-day free trial, no credit card required.

| Plan | Best For | Key Limits | Starting Price |

| Lite | Freelancers just starting out | Up to 5 billable clients | ~$17/month |

| Plus | Growing solo businesses | Up to 50 billable clients | ~$30/month |

| Premium | Established service-based teams | Unlimited billable clients | ~$55/month |

| Select | Large or custom businesses | Custom features & support | Custom pricing |

📦 What’s Included in Each Tier

All plans come with the following core features:

- Custom invoices & estimates

- Expense tracking

- Time tracking

- Payment integrations (Stripe, ACH, PayPal)

- Reporting dashboard

- Mobile access (iOS & Android)

As you move up the tiers, you unlock:

- Automated late fees & recurring billing (Plus and up)

- Client retainers and project profitability (Premium)

- Multiple users (Additional cost per user)

- Dedicated account manager & custom onboarding (Select)

💡 Is FreshBooks Worth the Price?

If you’re spending hours per week managing invoices manually or cobbling together tools like Excel, Trello, and PayPal, FreshBooks pays for itself quickly.

What you’re really buying is time and peace of mind:

- Get paid faster with automated invoices and online payments

- Track expenses without missing receipts or categorizing manually

- Generate reports for taxes or clients in just a few clicks

For solo professionals and agencies, the ROI is clear, especially if billing is a major part of your business model.

🎁 Free Trials and Promotional Discounts

FreshBooks offers:

- 30-day free trial with full access to all features

- Occasional promotions like 60% off for the first 6 months

- No setup fees and easy cancellation

You can try any plan without commitment, and upgrade or downgrade as your needs change.

Alternatives to FreshBooks

Compare top competitors

Choosing accounting software often comes down to this: how does it stack up against the other major players in the market?

While FreshBooks is known for its ease of use and invoicing capabilities, tools like QuickBooks and Zoho Books offer broader functionality for businesses with more complex needs.

Here’s a breakdown of how FreshBooks compares to its top competitors so you can see where it wins – and where it might fall short.

⚔️ FreshBooks vs QuickBooks

QuickBooks Online is one of the most widely used accounting platforms worldwide, with deeper accounting tools and industry recognition. But FreshBooks holds its ground in several key areas.

| Feature Type | FreshBooks | QuickBooks Online |

| Ease of Use | Beginner-friendly, intuitive | Steeper learning curve |

| Invoicing | Best-in-class templates & automation | Solid, but less design-friendly |

| Reporting | Simple reports only | Advanced, customizable reporting |

| Inventory Tracking | Not included | Available in higher tiers |

| Client Limits | Lite/Plus plans have caps | Unlimited clients on all plans |

| Pricing | Lower for small teams | Higher tiers needed for full tools |

Choose FreshBooks if you’re focused on invoicing, time tracking, and simplicity.

Choose QuickBooks if you need deeper accounting functionality and custom reports.

⚖️ FreshBooks vs Zoho Books

Zoho Books is part of the broader Zoho ecosystem and offers excellent value, especially for growing businesses with product inventory or advanced automation needs.

| Feature Type | FreshBooks | Zoho Books |

| User Experience | Simplified, visual UI | More structured, less intuitive |

| Time Tracking | Built-in and integrated with invoicing | Also included, but less seamless |

| Inventory Management | Not available | Full inventory module |

| Mobile App | Highly rated and powerful | Good but less fluid |

| Custom Workflows | Zapier or API needed | Native automation tools built-in |

| Pricing | Simple, flat tiers | More granular pricing with more features |

Choose FreshBooks if you want minimal setup and a mobile-first experience.

Choose Zoho Books if you need built-in inventory tracking, automation, or already use other Zoho products.

🏁 When FreshBooks Wins – and When It Doesn’t

Here’s a quick visual guide to help you decide.

| Use Case | FreshBooks | QuickBooks | Zoho Books |

| 🧾 Easy invoicing | ✅ | ✅ | ✅ |

| ⏱ Built-in time tracking | ✅ | ✅ (basic) | ✅ |

| 📊 Advanced reporting | ❌ | ✅ | ✅ |

| 📦 Inventory management | ❌ | ✅ | ✅ |

| 🛠 Workflow automation | 🔸 Zapier/API | ✅ | ✅ |

| 📱 Mobile-first features | ✅ | 🔸 | 🔸 |

| 🤓 For non-accountants | ✅ | ❌ | 🔸 |

| 🧠 Power-user tools | ❌ | ✅ | ✅ |

🔸 = Decent or limited

❌ = Missing or not ideal

In summary:

FreshBooks is your go-to choice if you want an easy, beautiful, and intuitive tool that simplifies your business finances without bogging you down in accounting complexity.

But if you need advanced inventory, customizable reports, or full double-entry bookkeeping, platforms like QuickBooks or Zoho Books may be a better fit.

Security and Compliance

Your financial data deserves top-tier protection

When it comes to accounting software, security isn’t optional – it’s a non-negotiable. You’re trusting the platform with sensitive client data, financial reports, tax info, and even payment details.

FreshBooks understands this responsibility and has built a system that prioritizes both security and compliance without making things complicated for you.

Let’s take a closer look at how your data is protected.

🔐 How FreshBooks Secures Your Financial Data

FreshBooks uses bank-grade encryption and cloud infrastructure to ensure your data stays safe at all times.

Here are the key protections in place:

- 256-bit SSL encryption on all data in transit

- Firewalled and monitored servers hosted in secure Tier 4 data centers

- Daily automatic backups, so you never lose your data

- Multi-factor authentication (MFA) for enhanced login protection

- Audit logs and activity tracking to monitor changes

Whether you’re on your phone, tablet, or laptop, your financial data is encrypted and protected end-to-end.

🌐 Compliance with Global Standards

FreshBooks is designed to meet key international data and privacy regulations:

- ✅ GDPR compliant for European users

- ✅ PCI-compliant for payment processing (via Stripe and other gateways)

- ✅ Data residency standards depending on your region

- ✅ Custom user permissions to control who can see what

These controls ensure that your business not only operates securely but also stays compliant with regulations around client data and accounting records.

👥 Access Controls and Team Permissions

Security isn’t just about encryption – it’s also about control.

FreshBooks gives you flexible permission settings so you can:

- Assign specific access levels to team members (e.g., contractor vs. admin)

- Invite your accountant with restricted, read-only access

- Grant clients access to view or comment on shared files, invoices, or proposals

- Remove or adjust user roles at any time

This is especially helpful for growing teams that need to collaborate while protecting sensitive financial information.

Bottom line:

FreshBooks takes data protection seriously. Whether you’re managing finances solo or with a team, you’ll have the right safeguards, compliance support, and role controls to keep your accounting operations secure and private.

Conclusion

Is FreshBooks the Right Accounting Tool for You?

So, after going through all the features, comparisons, and real-world feedback, you’re probably asking:

Is FreshBooks the right accounting tool for my business in 2025?

Let’s wrap it up with a clear summary based on what matters most to you as a business owner.

✅ Recap of Strengths and Weak Points

Here’s a quick overview of what stands out – and where it may fall short:

What FreshBooks Does Best:

- A user-friendly interface made for non-accountants

- Fast and professional invoicing

- Seamless time tracking built into your workflow

- Excellent mobile app and cloud sync

- Responsive customer support

- Integrations with tools you likely already use

Where FreshBooks Isn’t the Best Fit:

- No built-in inventory or product tracking

- Basic reporting tools may be too limited for some users

- Client caps on lower-tier plans

- Some automation and advanced features require workarounds

🎯 Our Recommendation Based on Business Type

If you see yourself in one of these categories, FreshBooks is an excellent choice:

- Freelancers & solopreneurs who bill by the hour or per project

- Service-based businesses like agencies, consultants, coaches, and creatives

- Remote teams that need time tracking, invoicing, and expense management in one place

- Non-accountants who want a simple, modern accounting experience

But if you’re a fast-scaling business with heavy product sales, complex reporting, or need advanced automation and inventory, a platform like QuickBooks Online or Zoho Books may offer better long-term flexibility.

Have more questions?

Frequently Asked Questions

1. Does FreshBooks have a free plan?

No, but it offers a 30-day free trial on all plans – no credit card required.

2. Can I use it to accept payments online?

Yes. FreshBooks integrates with Stripe, PayPal, and credit card payments to help you get paid faster.

3. Is it good for time tracking?

Absolutely. Time tracking is built into the platform and ties directly into projects and invoicing.

4. Does FreshBooks support recurring invoices?

Yes. You can automate recurring invoices and payment reminders, which is great for retainer-based services.

5. How secure is my data with FreshBooks?

Very secure. It uses 256-bit SSL encryption, daily backups, and complies with GDPR and PCI standards.

6. Can I invite my accountant to use it?

Yes. You can grant your accountant secure, read-only access to manage your books and reports.

7. What integrations does FreshBooks support?

Popular integrations include Stripe, Gusto, Trello, Shopify, HubSpot, and many more through its App Store and Zapier.

8. Can I track expenses on the go?

Yes. The mobile app lets you scan receipts, categorize expenses, and attach them to clients or projects.

9. Is there a limit to how many clients I can have?

Yes – lower plans (Lite and Plus) have client limits. You’ll need Premium or Select for unlimited clients.

10. Can I cancel my subscription at any time?

Yes. You can cancel, downgrade, or switch plans whenever you want. There are no cancellation fees.