Introduction

Why You Might Be Ready to Move On From QuickBooks

If you’re here, chances are you’re either frustrated with QuickBooks or just curious if there’s something better out there.

And you’re not alone.

In 2025, thousands of business owners, finance managers, and freelancers are rethinking their accounting software. Maybe QuickBooks has gotten too expensive. Maybe it’s more complex than it needs to be. Or maybe you’re simply tired of paying extra for every little feature or user.

The truth is: while QuickBooks is still a solid tool, it’s no longer the only player in the game. And for many small businesses, freelancers, and even mid-sized companies, better-suited options exist, some are more affordable, easier to use, and even free.

In this guide, you’ll discover the 5 best QuickBooks alternatives for 2025, including tools like Xero, Zoho Books, and Wave. Each one is analyzed not just by features, but by what you actually need, whether you’re a solo entrepreneur or managing a growing team.

📌 Need more accounting options?

Explore our Top 10 Accounting Software for a broader list of solutions across different business types.

Quick Comparison

Top QuickBooks Alternatives at a Glance

| Tool | Best For | Starting Price | Free Plan | Standout Features |

| 🌀 Xero | Growing teams and automation lovers | $13/month | No | Unlimited users, real-time bank feeds, 800+ integrations |

| 📦 Zoho Books | Startups and Zoho CRM users | $0–$15/month | Yes (under $50K revenue) | Automation, client portal, inventory management |

| 🧾 FreshBooks | Freelancers and service-based businesses | $19/month | No | Time tracking, proposals, simple UI |

| 💸 Wave | Simpler needs and tight budgets | Free | Yes | Invoicing, expense tracking, clean interface |

| 🏢 Sage Intacct | Mid-sized companies with complex finances | By quote | Free demo | Multi-entity, advanced financial reporting, deep compliance |

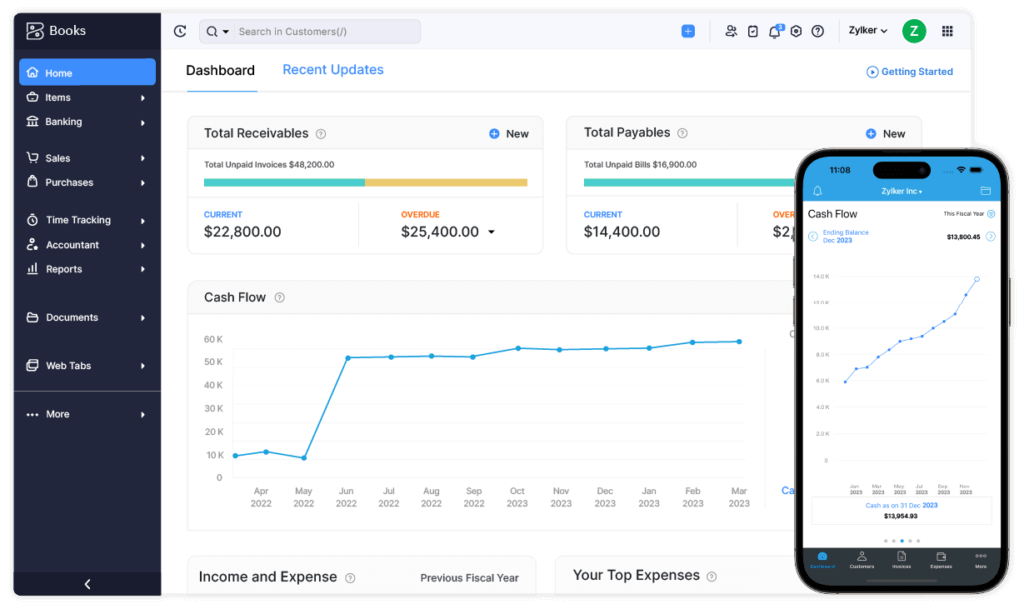

✅ Key Features That Make Xero Stand Out

- Unlimited users on all plans with role-based permissions

- Real-time bank reconciliation from 20,000+ global banks

- 800+ third-party integrations including Stripe, Shopify, Gusto, and HubSpot

- Mobile apps for iOS and Android with invoice, expense, and receipt management

- Multi-currency support and consolidated reporting (Premium plan)

🔁 Xero vs. QuickBooks: Which Is Right for You?

| Feature | Xero | QuickBooks |

| 👥 User Access | Unlimited users on all plans | Limited, requires higher-tier plans |

| 🎛️ Ease of Use | Clean, modern UI with simple navigation | Feature-rich but more cluttered |

| 🔌 Integrations | 800+ third-party apps | 750+ integrations |

| 📱 Mobile App | Highly rated iOS and Android apps | Strong mobile support |

| 📦 Inventory Management | Included in all paid plans | Only available in Plus and Advanced plans |

| 💱 Multi-Currency Support | Premium plan includes it | Available only in Advanced plan |

| 📞 Customer Support | Email and live chat (no phone) | Phone support in most paid tiers |

Xero may be a better choice if you:

- Need multiple team members to access the system without extra cost

- Value a modern, minimalist interface

- Rely heavily on integrations and automated workflows

Stick with QuickBooks if:

- You’re already deep into the Intuit ecosystem (QuickBooks Payroll, TurboTax, etc.)

- You want robust U.S.-based phone support at every plan level

👥 Who Should Use Xero?

- Small-to-mid-sized businesses with multiple users or departments

- Agencies and remote teams collaborating on finances from different locations

- Accountants and bookkeepers managing multiple clients through Xero HQ

- International businesses that need multi-currency and global tax support

👉 Want a closer look?

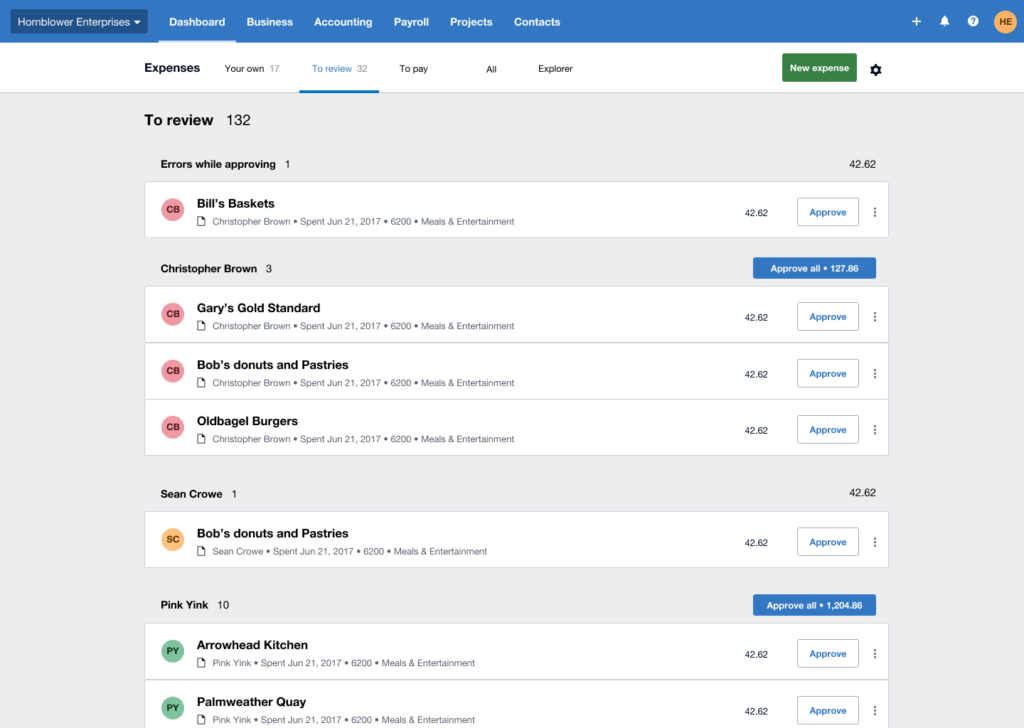

✅ Key Features That Make Zoho Books a Top Choice

- Free plan available for businesses under $50K annual revenue

- Seamless integration with Zoho CRM, Inventory, Projects, and more

- Automated workflows for invoicing, payment reminders, and recurring bills

- Client portal for sharing estimates, invoices, and payment history

- Advanced inventory management, even in mid-tier plans

- Built-in tax compliance (e.g., GST, VAT, local sales tax)

🔁 Zoho Books vs. QuickBooks: Which Should You Pick?

| Feature | Zoho Books | QuickBooks |

| 💰 Pricing | Free for businesses under $50K revenue, paid from $15/month | Starts at $30/month with limited features |

| 🔄 Workflow Automation | Included even in lower tiers | Available in higher tiers |

| 🔗 Ecosystem Integration | Deep integration with Zoho suite (CRM, Projects, etc.) | Strong, but mostly limited to Intuit products |

| 🌎 Global Tax Compliance | Built-in GST/VAT compliance in many countries | Strong U.S. focus, limited for international tax needs |

| 📦 Inventory | Available in Standard and above | Only available in Plus and Advanced plans |

| 💳 Client Portal | Included in all plans | Only basic customer-facing options |

| 💬 Support | Email, live chat, and call-back options | Phone support included in most tiers |

👥 Who Should Use Zoho Books?

- Small businesses and startups looking for affordable automation

- Consulting, creative, or service-based firms that want invoicing + time tracking

- Zoho CRM users who want everything under one ecosystem

- Retail or inventory-based businesses needing multi-location stock tracking

If you’re already using Zoho tools, Zoho Books is a natural fit. It saves time, reduces manual entry, and provides real-time financial data that syncs with your CRM, project timelines, and sales pipeline.

👉 Want to learn more?

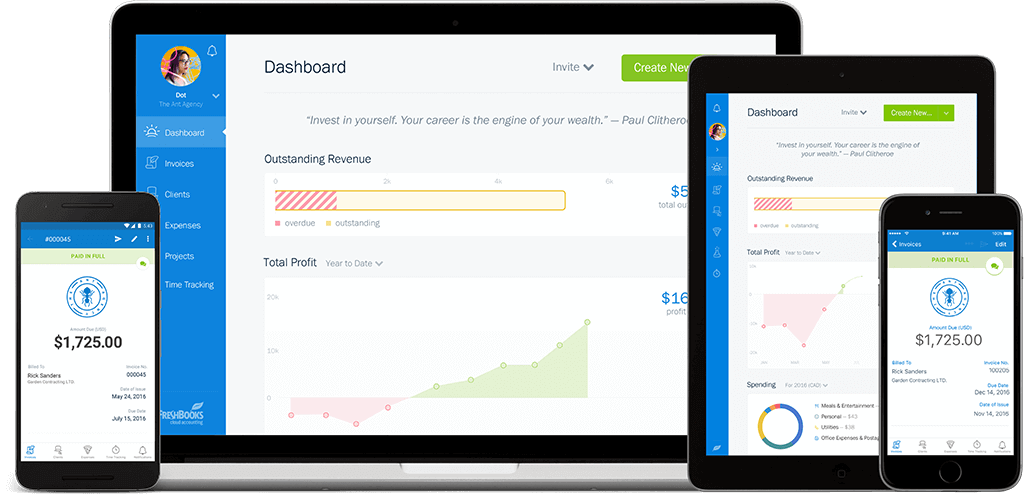

✅ Key Features That Make FreshBooks Freelancer-Friendly

- Built-in time tracking and billable hour logging

- Professional invoicing with recurring billing and auto reminders

- Client portal for quick communication and payment tracking

- Project management tools for assigning tasks, deadlines, and team collaboration

- Expense tracking via receipt capture and auto-categorization

- Proposals & estimates with e-signature support

🔁 FreshBooks vs. QuickBooks: Which Is Better for You?

| Feature | FreshBooks | QuickBooks |

| 🕒 Time Tracking | Built-in on all paid plans | Available in higher-tier plans |

| 📤 Invoicing | Polished, recurring, auto-payment reminders | Strong, but lacks built-in proposal tools |

| 📂 Project Management | Simple collaboration & task tools | Basic project tracking only |

| 💼 Proposals & Estimates | Custom proposals with e-signatures | Estimates only, no proposals |

| 👥 Client Portal | Integrated for all customer communication | Limited interaction options |

| 📱 Mobile App | Highly rated, built for freelancers | Feature-rich, but more business-oriented |

| 💬 Support | Phone, chat, and email support | Varies by plan level |

👥 Who Should Use FreshBooks?

- Freelancers and solopreneurs who bill hourly or per project

- Creative agencies looking for time + project tracking in one place

- Consultants or coaches needing simple proposal and invoice workflows

- Service-based businesses with recurring clients and billable hours

FreshBooks isn’t trying to be a massive ERP; it’s designed for people who work with clients and want to get paid faster without messing around with spreadsheets.

👉 Want the full breakdown?

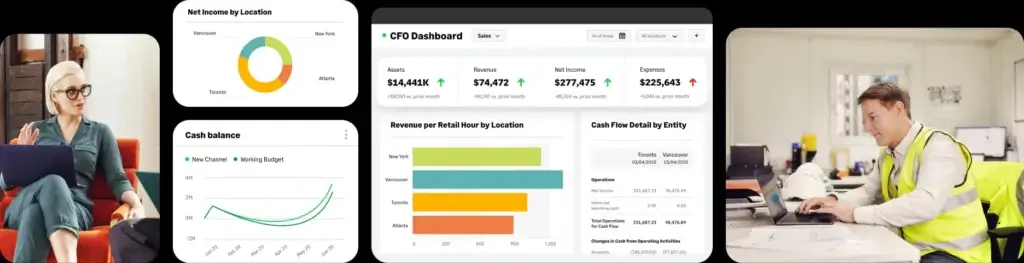

✅ Key Features That Set Sage Intacct Apart

- Advanced financial management across departments and locations

- Multi-entity, multi-currency, and global consolidation support

- Granular user permissions for finance teams and auditors

- Custom dashboards and real-time financial reporting

- AICPA-endorsed and built for GAAP compliance

- Strong API for ERP-level integrations with Salesforce, Expensify, and more

🔁 Sage Intacct vs. QuickBooks: A Powerhouse vs. a Generalist

| Feature | Sage Intacct | QuickBooks |

| 🏢 Business Size Fit | Mid-sized and scaling enterprises | Sole proprietors to small businesses |

| 🌐 Multi-Entity Support | Built-in with intercompany reporting | Only in Advanced tier with limits |

| 💱 Multi-Currency | Yes (global-ready) | Advanced plan only |

| 📊 Financial Reporting | Custom dashboards, drill-down analytics | Good, but less customizable |

| 📚 GAAP Compliance | Yes (AICPA-endorsed) | Basic accrual accounting only |

| ⚙️ Integrations | ERP-grade APIs (Salesforce, etc.) | Broad, but more SMB-focused |

| 📞 Support | Dedicated account management and training | Tiered support by plan |

👥 Who Should Use Sage Intacct?

- Mid-sized businesses with complex operations or multiple legal entities

- Financial teams requiring audit-ready reports and controls

- Organizations scaling internationally or managing multiple currencies

- Companies needing deep automation and ERP-level features

Sage Intacct is a significant step up from QuickBooks. It’s not just accounting software, it’s a financial management platform for serious operations. If you’ve hit the ceiling with QuickBooks Advanced, Intacct is likely your next move.

Just keep in mind: it requires setup, training, and a higher budget. But for what it offers, the ROI is real.

👉 Explore our full evaluation

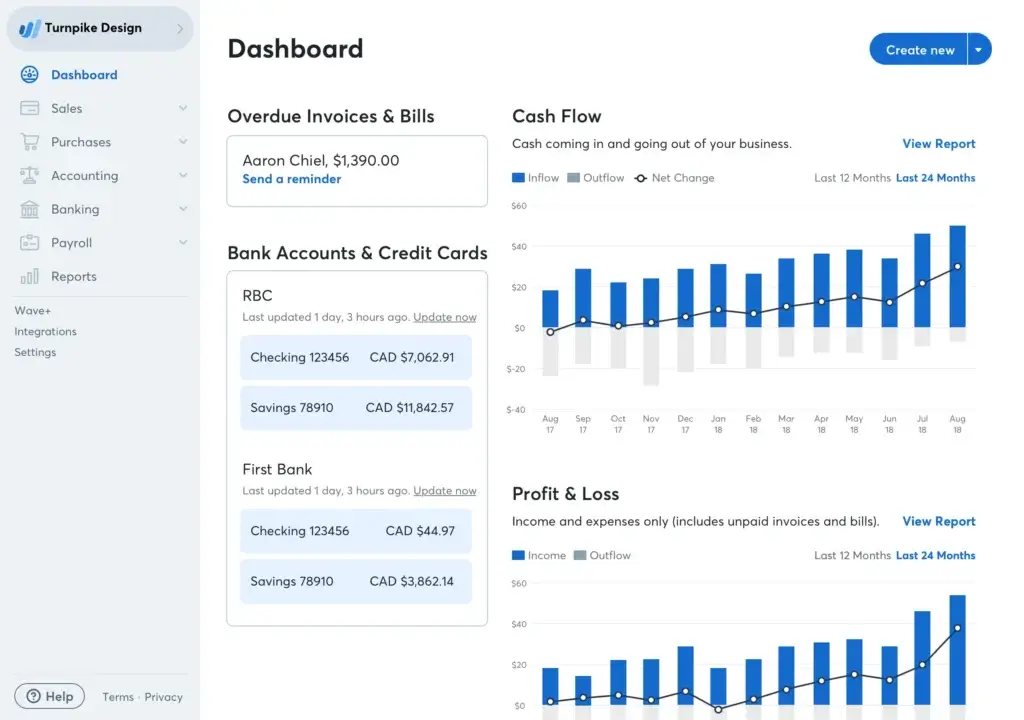

✅ Key Features That Make Wave a Solid Free Option

- 100% free accounting tools for invoicing, expense tracking, and reporting

- Unlimited income and expense tracking with no user caps

- Customizable invoices with payment links and automatic reminders

- Receipt scanning via mobile app

- Basic reporting, including profit & loss, sales tax, and cash flow

- Optional paid add-ons like payroll and payments (if you need them)

🔁 Wave vs. QuickBooks: Is Free Too Good to Be True?

| Feature | Wave | QuickBooks |

| 💵 Cost | Free core features | Starts at $30/month |

| 📤 Invoicing | Customizable, unlimited, free | Strong, but only in paid plans |

| 📱 Mobile App | Basic app with invoicing & receipts | More advanced functionality |

| 📦 Inventory | Not available | Available in Plus & Advanced |

| 🧾 Reporting | Basic financial & tax reports | Advanced reporting features |

| 💳 Payment Processing | Optional add-on with fees | Included via QuickBooks Payments |

| 📞 Support | Email only (chat/paywall support optional) | Phone and chat on paid plans |

👥 Who Should Use Wave?

- Freelancers and side hustlers looking for no-cost tools

- Micro-businesses that send invoices and track expenses

- Entrepreneurs just starting out with limited cash flow

- Nonprofits or seasonal businesses with low accounting complexity

If you’re just getting started or only need the basics, Wave offers unbeatable value. It’s clean, simple, and helps you stay organized without spending a dime.

That said, if you outgrow it, you’ll likely want to move to something like Xero or Zoho Books.

👉 See more in our full review

When Should You Switch from QuickBooks?

QuickBooks is a well-known choice for a reason, but it’s far from perfect for every business. Depending on your needs, it might be too expensive, too limited, or just too complex for what you’re trying to achieve.

Here are some clear signs that it might be time for a change:

1. You’re Paying More Than You Should

QuickBooks charges per user on most plans, and essential features like inventory, time tracking, or multi-currency are only available at higher tiers. If you’re constantly hitting upgrade walls, a tool like Xero (unlimited users) or Zoho Books (more value per dollar) could save you money.

2. You Need Better Integrations

If you rely on tools like CRM, project management, or e-commerce platforms, you may find QuickBooks’ ecosystem limiting. Tools like Xero, Zoho Books, and Sage Intacct offer far more flexibility through deeper native and API integrations.

3. You’re Growing – and QuickBooks Isn’t

As your business scales, QuickBooks can feel cramped. Multi-entity reporting, custom dashboards, or global consolidation? QuickBooks Advanced helps, but Sage Intacct is built from the ground up for complex businesses.

4. It’s Just Too Complicated (or Too Much)

QuickBooks is powerful, but it can feel bloated if you’re a freelancer or solo entrepreneur. If you only need to send invoices, log expenses, and track a few clients, Wave or FreshBooks will feel way lighter without sacrificing professionalism.

5. You’re Not Getting the Insights You Need

Reports in QuickBooks are good, but not very customizable unless you’re on the Advanced plan. If you’re constantly exporting to Excel or building manual dashboards, Xero or Sage Intacct might be a better fit.

If any of these scenarios sound familiar, don’t worry. You’re not stuck with QuickBooks. The right alternative can save you time, money, and even headaches.

Final Thoughts

Which QuickBooks Alternative Is Right for You?

Switching from QuickBooks isn’t just about saving money. It’s about finding the right tool for the way you work.

Here’s a quick recap of your best options:

-

🌀 Xero – Best if you need unlimited users, strong automation, and deep integrations. Great for growing teams and finance-savvy users.

-

📦 Zoho Books – Perfect if you’re already using other Zoho apps or want full-featured accounting on a tight budget.

-

🧾 FreshBooks – A top choice for freelancers, agencies, and consultants who value clean invoices, time tracking, and simple client management.

-

💸 Wave – Free, easy, and ideal for side hustles or solo businesses that just need the basics.

-

🏢 Sage Intacct – Built for companies with complex operations, multiple entities, or enterprise-level reporting needs.

Still unsure? Don’t rush your decision.

Most of these platforms offer free trials, and a few, like Wave and Zoho Books (for small businesses), have forever-free plans. You can start small, test the fit, and scale up as your business grows.

💡 Looking to compare more options?

Head over to our full Top 10 Accounting Software comparison for a broader view of the market.

The right accounting tool should work for you, not the other way around.

FAQs

1. What is the best free alternative to QuickBooks?

Wave is the best free QuickBooks alternative for freelancers, solopreneurs, and small businesses. It offers invoicing, expense tracking, and basic reporting with no monthly fees. However, it lacks inventory and multi-user support.

2. Is Xero better than QuickBooks for small businesses?

Xero is often better for small businesses that need unlimited users, powerful automation, and access from anywhere. It offers more flexibility than QuickBooks, especially for teams with multiple users or international operations.

3. Can I migrate data from QuickBooks to another accounting tool?

Yes, most alternatives like Xero, Zoho Books, and Sage Intacct offer migration tools or import options. You can transfer the chart of accounts, customer data, invoices, and more, but be sure to back everything up before switching.

4. Which QuickBooks alternative works best with Zoho CRM?

Zoho Books is the top choice if you’re already using Zoho CRM. It integrates natively with Zoho’s full suite of business apps, giving you a unified system for accounting, sales, and operations.

5. Do any QuickBooks alternatives support multi-currency?

Yes. Xero, Zoho Books, and Sage Intacct all support multi-currency transactions. QuickBooks only includes this feature in its Advanced plan, whereas others may offer it in lower tiers.

6. Is FreshBooks good for freelancers and consultants?

Absolutely. FreshBooks is built for service-based professionals who need clean invoices, time tracking, and simple expense management. It’s ideal for solo workers, agencies, and client-focused businesses.

7. How does Sage Intacct compare to QuickBooks Advanced?

Sage Intacct is more powerful than QuickBooks Advanced, offering enterprise-level features like multi-entity consolidation, GAAP-compliant reporting, and deep customization. It’s best for finance teams in growing or mid-sized businesses.

8. Are QuickBooks alternatives safe and secure?

Yes. Tools like Xero, Zoho Books, and Sage Intacct offer bank-grade encryption, two-factor authentication, and audit trails. Make sure any alternative you choose complies with your country’s data security standards.

9. Can I use QuickBooks alternatives on my phone?

Yes. All major alternatives have mobile apps. Xero, FreshBooks, and Zoho Books have full-featured apps for iOS and Android, making it easy to send invoices, track expenses, and view reports on the go.

10. What’s the easiest accounting software to use instead of QuickBooks?

If simplicity is your top priority, Wave and FreshBooks are the easiest to get started with. Their interfaces are beginner-friendly, and they focus on essential tools like invoicing, payments, and expense tracking.