Introduction

✅ Why Your Accounting Software Choice Matters

Choosing the right accounting tool isn’t just about tracking income and expenses.

It’s about saving time, avoiding tax headaches, and setting your business up for long-term success.

If you’re spending hours manually reconciling bank transactions or struggling to generate clear reports, your accounting software may be holding you back.

That’s where QuickBooks often enters the conversation.

As one of the most well-known names in small business accounting, QuickBooks Online offers a cloud-based suite designed to handle everything from invoicing and payroll to project costing and tax filing.

But is it the best option for your unique setup?

Let’s break it down, feature by feature, to help you find out.

📊 Where QuickBooks Stands in Today’s Market

QuickBooks Online (QBO) isn’t just a legacy tool from Intuit.

It’s an ever-evolving platform built to meet the needs of today’s fast-moving businesses.

With millions of users, it’s especially popular among:

- Freelancers and solopreneurs

- Small and mid-sized teams

- Service providers, retailers, and e-commerce shops

- Accountants and bookkeepers managing multiple clients

QuickBooks supports real-time reporting, automated bank feeds, and hundreds of integrations with tools like Shopify, Gusto, and HubSpot. Its ecosystem is massive, making it easier to scale or connect with third-party apps.

Still, it’s not a perfect fit for everyone.

In this review, you’ll get a clear, hands-on look at what QuickBooks does best, where it falls short, and how it stacks up to alternatives like Xero and Zoho Books.

🧠 What You’ll Learn in This Review

This isn’t just a feature list or sales pitch.

You’re going to get:

- A plain-English breakdown of QuickBooks’ top features

- Real-world use cases and business scenarios

- Pros and cons based on deep industry knowledge

- Current pricing plans (including hidden costs)

- Side-by-side comparisons with competing tools

- User insights from platforms like Trustpilot, G2, and Reddit

By the end, you’ll know whether QuickBooks is the right tool to manage your business finances or if another platform might serve you better.

Who Is QuickBooks Best For?

Find out if QuickBooks fits your business needs

QuickBooks is versatile, but it truly shines when matched with the right business setup.

Let’s explore who gets the most value out of it – and who might want to look elsewhere.

👔 Ideal Business Sizes and Industries

QuickBooks is built to support:

- Solo entrepreneurs and freelancers who want clean books and fast invoicing

- Small businesses managing projects, payroll, or inventory

- Medium-sized teams with multiple users and growing complexity

- Accountants or bookkeepers working across multiple clients

It’s especially strong in industries like:

- Retail: With inventory tracking and POS integrations

- Professional services: For project-based billing and time tracking

- E-commerce: Thanks to seamless Shopify, Square, and Amazon connections

- Construction or field services: Using job costing and mobile invoicing

⚠️ When QuickBooks Might Not Be Right for You

While QuickBooks is powerful, it’s not perfect for every use case.

You might want to explore other options if:

- You need multi-language or multi-currency support beyond U.S.-centric needs

- You’re running multiple companies under one login (QuickBooks handles this poorly)

- You’re looking for free or low-cost software (Zoho Books or Wave may suit you better)

- You require highly customizable reports or deep ERP-level analytics

Also, support limitations and cost escalations on higher-tier plans have been common complaints among users.

💡 Real-World Use Cases: Where QuickBooks Shines

✅ A marketing agency tracking billable hours and sending recurring invoices

✅ A boutique e-commerce brand syncing Shopify orders and managing inventory

✅ A freelance consultant automating tax estimates and payment reminders

✅ A general contractor managing job costs across multiple clients

If you fall into any of these buckets, you’ll likely benefit from what QuickBooks offers right out of the box.

Software specification

Core Features That Matter in 2025

When you’re evaluating accounting software, it’s easy to get lost in the feature lists.

So instead of overwhelming you, we’ve broken down the six core features that actually make a difference in how QuickBooks performs for real businesses like yours.

These are the tools that save time, reduce errors, and bring financial clarity to your workflow.

💸 Invoicing and Payments

Creating and sending invoices in QuickBooks is fast, flexible, and professional.

Here’s what makes it shine:

- Customizable templates with your branding

- Automated recurring invoices for retainer clients

- Payment links embedded right in the invoice

- Auto-reminders for unpaid invoices

- Accepts payments via credit card, ACH, PayPal, and more

You can also track which invoices are viewed, paid, or overdue at a glance. That visibility is key when you’re managing multiple clients.

Great for: Service businesses, consultants, and anyone billing clients regularly.

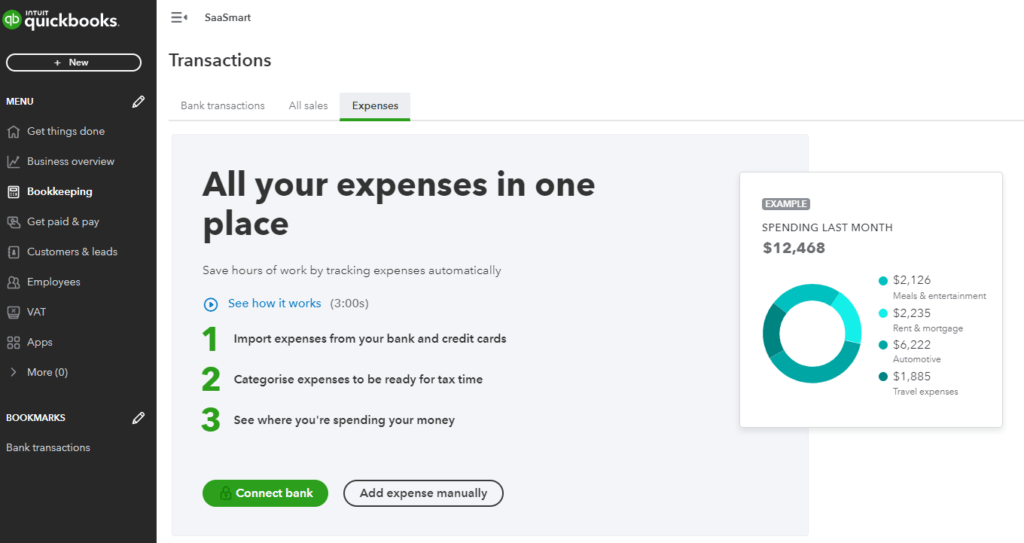

🧾 Expense Tracking and Receipt Capture

QuickBooks makes tracking expenses less painful with tools designed to automate the process.

- Link your business bank accounts and credit cards for automatic import

- Snap receipts via the mobile app

- Smart categorization of expenses using machine learning

- Tag expenses to clients or projects

- Bill approval workflows (available in higher plans)

No more shoebox full of receipts or digging through statements. Every expense stays clean and categorized for tax time.

🏦 Bank Reconciliation

Reconciling your accounts doesn’t have to be a monthly nightmare.

QuickBooks simplifies it with:

- Live bank feeds connected to over 20,000 banks

- Smart matching of transactions

- Instant alerts when something doesn’t match

- Real-time balance monitoring

By keeping your books up to date daily, you avoid end-of-month surprises and spot errors before they become problems.

📦 Inventory and Project Tracking (Higher Plans Only)

If you manage physical goods or work on projects with billable hours, these features will save you hours every month.

- Track inventory levels in real-time

- Set low-stock alerts and reorder points

- Assign expenses and hours to specific jobs or clients

- Monitor project profitability

- Generate job costing reports without spreadsheets

Available in: Plus and Advanced plans

Best for: Retailers, contractors, and creative agencies with multiple clients.

📈 Financial Reports and Dashboards

QuickBooks is known for its powerful reporting engine.

- Over 80 built-in reports: profit & loss, cash flow, balance sheet, etc.

- Customizable dashboards to track what matters to you

- Real-time updates so you’re never looking at outdated data

- Budget vs. actual comparison reports

Whether you’re presenting to investors or just trying to keep your margins in check, QuickBooks gives you the numbers you need.

📱 Mobile App and Cloud Access

QuickBooks is fully cloud-based, which means:

- You can access your books anywhere, anytime

- The mobile app lets you send invoices, snap receipts, and track mileage

- Your accountant can log in remotely to clean up or review transactions

- No need for backups – it’s all saved automatically in the cloud

Whether you’re in the office or on a job site, your financial data is always within reach.

⭐ Feature Summary Table

| Feature Type | Included In | Best For |

| Invoicing & Payments | All Plans | Freelancers, Service Firms |

| Expense Tracking | All Plans | All Business Types |

| Bank Reconciliation | All Plans | Any business with bank feeds |

| Inventory & Project Tools | Plus & Advanced | Retail, Agencies, Contractors |

| Financial Reporting | All Plans | Growth-focused companies |

| Mobile & Cloud Access | All Plans | On-the-go business owners |

Pros and Cons

A balanced view: what you’ll love and what to consider

Positive

✅ Trusted and Familiar

✅ Excellent Invoicing and Reporting

✅ Robust App Ecosystem

✅ Cloud-Based with Mobile Access

Negative

❌ Advanced Features Get Expensive

❌ Support Quality Can Vary

❌ Customization is Limited

❌ Bank Feed Glitches Happen

QuickBooks Online is powerful, flexible, and widely adopted, but like any software, it has its trade-offs.

Here’s a clear and honest breakdown of what you’ll love and what might frustrate you, so you can make an informed decision based on your actual business needs.

✅ What You’ll Love About QuickBooks

-

Trusted and Familiar

Millions of small businesses and accountants use QuickBooks. That means easier hiring, easier collaboration, and a wider pool of experts who know the platform. -

Excellent Invoicing and Reporting

From customizable invoices to real-time financial dashboards, QuickBooks makes it easy to keep tabs on your money. -

Robust App Ecosystem

With over 750 integrations, QuickBooks connects with payroll, e-commerce, time tracking, CRM, and beyond. You can tailor it to your exact needs. -

Cloud-Based with Mobile Access

Run your business from anywhere. The mobile app is reliable and feature-rich, perfect for on-the-go business owners.

❌ What Could Be Better

-

Advanced Features Get Expensive

If you need tools like inventory, project tracking, or advanced reporting, you’ll need to upgrade to higher-tier plans, some costing over $200/month. -

Support Quality Can Vary

While support is available, many users have reported long wait times or difficulty reaching a knowledgeable rep, especially on lower-tier plans. -

Customization is Limited

Invoices and reports are customizable to a point, but more advanced visual or formatting changes may require third-party tools or workarounds. -

Bank Feed Glitches Happen

Occasionally, connections to banks can break or duplicate transactions, requiring manual fixes or accountant help.

📌 Tip: If you’re a solo user with basic accounting needs, the lower-tier plans work great. But if you’re scaling or need team collaboration, be ready for a higher investment.

User Experience

User Interface and Operational Simplicity

You don’t need to be a CPA to navigate QuickBooks.

That’s one of its biggest strengths.

The platform is designed to work just as well for a freelancer as it does for a growing team, with onboarding tools, a clean dashboard, and mobile access that lets you manage your books from anywhere.

Let’s break down what the experience looks like, especially if it’s your first time using it.

👀 First-Time User Experience

Starting with QuickBooks is surprisingly smooth.

Once you create your account, you’re guided through a step-by-step onboarding flow:

- Set up your business profile

- Choose your industry

- Connect your bank accounts

- Customize your invoice templates

- Invite your accountant or team

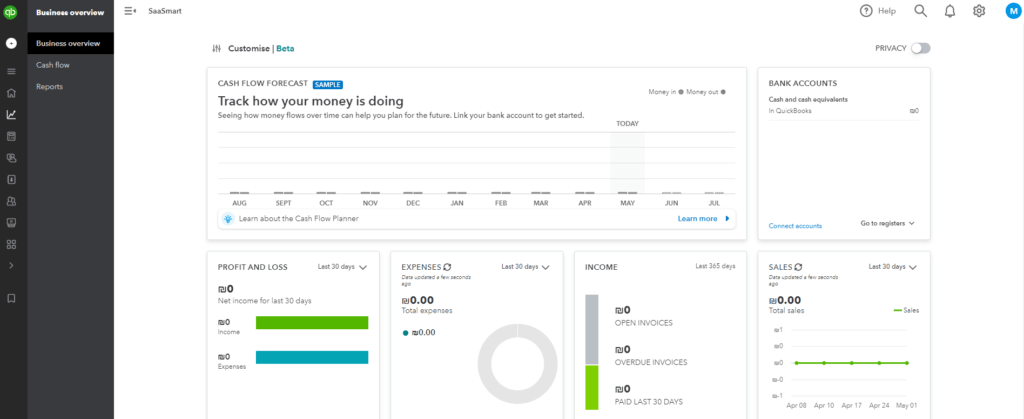

The dashboard feels intuitive, with sections like:

- Invoices

- Expenses

- Bank Accounts

- Reports

- Payroll (if enabled)

Each area has a guided tour, making it easier to understand where to start, even if you’ve never used accounting software before.

🔁 Navigation, Setup, and Customization

QuickBooks keeps things clean and focused.

- The left-hand menu is persistent, so navigation is easy.

- You can bookmark favorite tools, like profit & loss reports or your chart of accounts.

- Customize your dashboard widgets to focus on what matters most, whether it’s overdue invoices or upcoming bills.

For added personalization:

- Tailor your invoice layout and payment terms

- Add your logo and brand colors

- Set custom sales tax rules based on your location

It’s all drag-and-drop or dropdown-based, no code or clunky setup required.

📱 Mobile Experience (iOS & Android)

QuickBooks’ mobile app isn’t just a viewer. It’s fully functional.

You can:

- Send and edit invoices on the go

- Snap receipts with your camera

- Reconcile transactions right from your phone

- Track mileage automatically using GPS

- Receive alerts for payment updates

The app is available on both iOS and Android, and syncs instantly with your web dashboard.

Whether you’re in the office, on-site, or working remotely, your books stay in sync.

🤝 Collaboration with Accountants or Team Members

QuickBooks makes it easy to work with others while keeping control.

- Add users with custom permission levels (e.g., view-only, full access, reports-only)

- Your accountant can log in anytime to manage taxes, clean up your chart of accounts, or reconcile

- Multi-user access is smooth on mid and upper-tier plans (Essentials, Plus, Advanced)

You don’t need to export spreadsheets or email files back and forth. Just grant access, and let your accountant do the rest.

Integrations and Ecosystem

Connect QuickBooks to your favorite apps

QuickBooks doesn’t try to do everything on its own, and that’s a good thing.

Instead, it connects seamlessly with hundreds of other tools you may already use, allowing you to build a financial workflow that fits your business perfectly.

Whether you’re running payroll, selling products online, or managing projects, these integrations help you automate busywork and reduce data entry errors.

⚙️ Popular App Integrations

QuickBooks connects with 750+ apps, including top tools across payroll, e-commerce, CRM, and time tracking.

Here are some of the most useful integrations:

- Gusto – For full-service payroll

- Stripe – Accept payments directly from invoices

- Shopify & Amazon – Sync product orders and track inventory

- Square – Link in-person sales with online bookkeeping

- Expensify – Streamline expense management

- HubSpot & Salesforce – Connect customer data with billing

These integrations save hours each month and create a more automated accounting environment.

🔄 Workflow Automation via Add-Ons and APIs

QuickBooks supports automation in two powerful ways:

-

Built-in rules: You can set up automatic categorization for bank transactions, recurring invoices, or reminder emails.

-

Third-party tools & APIs:

-

- Zapier lets you create “if-this-then-that” automations (e.g., when an invoice is paid, send a Slack message).

- Developers can tap into the QuickBooks API to build custom integrations with CRMs, time trackers, or industry-specific tools.

Automation cuts down on repetitive admin tasks and reduces the risk of human error in your books.

🛒 The QuickBooks App Marketplace: What’s Worth Exploring?

The QuickBooks App Store is organized by category, rating, and compatibility. Some standout categories include:

- Payroll & HR: Gusto, QuickBooks Payroll, Justworks

- Time Tracking: TSheets by QuickBooks, Clockify, Toggl

- E-commerce: Shopify, BigCommerce, Webgility

- CRM: Insightly, HubSpot, MethodCRM

- Inventory & Fulfillment: SOS Inventory, Cin7, TradeGecko

- Professional Services: Bill.com, Dubsado, Harvest

You can filter apps by industry (e.g., construction, nonprofit, retail) to find tools tailored to your business model.

💡 Why These Integrations Matter

Here’s what you get when your tools talk to each other:

- No more duplicate data entry

- Clean books with fewer manual errors

- Better cash flow visibility from sales to banking

- Time saved from chasing invoices or expenses

- More accurate reports for smarter decisions

In short, QuickBooks becomes more than just accounting software; it becomes your financial command center.

Pricing and Plans

How much does QuickBooks cost?

QuickBooks Online offers four core pricing tiers, each designed to serve a different level of business complexity.

From solo entrepreneurs to multi-user teams, there’s flexibility, but also some gotchas in terms of feature limits and add-on costs.

Let’s break it down.

📌 Plan Overview: Simple Start, Essentials, Plus, and Advanced

You’ll get the basics, like invoicing, expense tracking, and bank reconciliation, on all plans.

However, things like multi-user access, project tracking, and inventory management are only available on the higher tiers.

Here’s how each plan compares:

| Plan | Best For | Monthly Price | Key Features |

| Simple Start | Freelancers, solo business owners | ~$30 | Invoicing, expenses, basic reporting, 1 user |

| Essentials | Small teams needing collaboration | ~$60 | Everything in Simple Start + 3 users, time tracking, bill management |

| Plus | Growing businesses with inventory or projects | ~$90 | Everything in Essentials + 5 users, project profitability, inventory tracking |

| Advanced | Mid-sized teams needing automation | ~$200 | Up to 25 users, advanced reporting, custom workflows, dedicated support |

🧾 What’s Included in Each Tier?

Here’s a quick summary of what you unlock as you go up:

- Simple Start: Great for sole proprietors, manage income, expenses, and taxes.

- Essentials: Add team members and track billable hours.

- Plus: Track inventory, manage projects, and run more advanced reports.

- Advanced: Designed for scaling teams with bulk automation, KPI dashboards, and priority support.

💡 Is QuickBooks Worth the Price?

If you’re billing clients, tracking projects, or managing a growing team, yes, the investment pays off in automation, accuracy, and time saved.

But if you’re early-stage or working solo, lower-cost tools like Zoho Books or Wave may meet your needs for less.

🎁 Trial Periods and Discounts

QuickBooks offers:

- A 30-day free trial (no credit card required), or

- Up to 50% off for the first 3 months if you skip the trial

Tip: If you’re sure about using it long-term, the discounted rate might save you more than the trial.

Alternatives to QuickBooks

Compare top competitors

QuickBooks is a leading choice, but it’s not the only option.

Depending on your business size, budget, and workflow needs, Xero or Zoho Books might be a better fit. Below, you’ll find a direct, jargon-free comparison to help you weigh the pros and cons.

🔄 QuickBooks vs Xero

Xero is a strong rival, especially popular among international businesses and firms that prioritize collaboration.

Where QuickBooks wins:

- More intuitive for first-time users in the U.S.

- Better support for U.S. payroll and tax filing

- Easier access to local CPAs and QuickBooks-certified pros

- Built-in time tracking (Xero requires third-party add-ons)

Where Xero wins:

- Unlimited users on all plans (QuickBooks limits to 1–25)

- Smoother bank reconciliation tools

- Better mobile UX for bank feeds and invoice management

- More flexible multi-currency and international support

Use Xero if you’re running a business with global clients or a remote finance team and don’t want to pay more for additional users.

🔄 QuickBooks vs Zoho Books

Zoho Books is a budget-friendly, feature-rich platform, especially appealing for solopreneurs or users already in the Zoho ecosystem.

Where QuickBooks wins:

- More integrations with U.S.-based banking and tax systems

- Larger app ecosystem for advanced accounting needs

- More accountant familiarity and third-party support

Where Zoho Books wins:

- Free plan for businesses under $50K/year

- Plans start at a lower price point (~$15/month)

- Built-in automation features at all tiers

- Deep native integration with other Zoho tools (CRM, Projects, etc.)

Use Zoho Books if you’re just starting out or want affordable automation and already use tools like Zoho CRM or Zoho Inventory.

✅ When QuickBooks Wins – and When It Doesn’t

Choose QuickBooks if you need:

- U.S.-based payroll, sales tax, and IRS-ready reporting

- A platform trusted by most bookkeepers and accountants

- Advanced reporting and cash flow tools for growing teams

- Seamless app integrations (Shopify, Gusto, Square, etc.)

Consider Xero or Zoho Books if you want:

- More user access at a lower cost

- Global compliance features and multi-currency

- A simpler plan structure with fewer upsells

- Tighter integration with a broader suite of business apps

📌 Takeaway: QuickBooks is the most full-featured choice for U.S.-based SMBs, but for budget-conscious startups or international teams, Zoho Books and Xero offer serious value.

Security and Compliance

Your financial data deserves top-tier protection

When it comes to accounting software, data security isn’t optional; it’s essential.

You’re trusting QuickBooks with sensitive financial information, customer records, tax data, and more. So, how secure is it?

Here’s how QuickBooks keeps your business protected in 2025.

🔒 How QuickBooks Secures Your Financial Data

QuickBooks Online is hosted on secure, cloud-based servers maintained by Intuit, one of the most trusted names in financial software.

Here’s what goes on behind the scenes to protect your data:

- 256-bit SSL encryption – The same standard used by banks and financial institutions

- Automatic data backups – Your files are backed up daily in case of loss or corruption

- Firewalls and multi-factor authentication (MFA) – Add an extra layer of protection on your account

- Data redundancy – Multiple copies of your data are stored across secure locations to prevent loss

You can also set login alerts, enable MFA, and restrict access by IP address or user role, a must for companies with teams.

🌐 Global Compliance Standards

QuickBooks isn’t just secure, it’s designed to comply with international standards.

- GDPR (General Data Protection Regulation): For businesses handling EU customer data

- SOC 2 Type II: Ensures that QuickBooks meets stringent data integrity, availability, and confidentiality standards

- PCI DSS Compliance: If you accept payments through QuickBooks, all transactions are protected under global payment security standards

QuickBooks is also regularly audited and tested for vulnerabilities by independent security experts.

👥 Access Controls and Permissions

As your team grows, you need to control who sees what.

QuickBooks lets you:

- Add users with custom access roles (e.g., accountant-only, sales-only, or admin)

- Restrict editing or viewing of certain financial data

- Track user activity logs, so you know who made changes and when

This ensures your financials are secure, auditable, and collaborative, all without sacrificing control.

Conclusion

Is QuickBooks the Right Accounting Tool for You?

After diving deep into QuickBooks’ features, pricing, strengths, and trade-offs, it’s time to answer the big question:

Is QuickBooks the right accounting software for your business?

Let’s break it down.

✅ Recap of Strengths and Weaknesses

What makes QuickBooks great:

- Powerful all-in-one platform for managing invoicing, expenses, inventory, and reporting

- Easy-to-use dashboard with strong automation and cloud access

- Massive app ecosystem with integrations across payroll, e-commerce, and CRM

- Widely supported by accountants and bookkeepers

What to watch out for:

- Can get expensive as your needs grow

- Support is limited unless you’re on a higher-tier plan

- Some users experience occasional bugs with bank feeds or account syncing

🎯 Our Recommendation Based on Business Type

✅ Freelancers & Solopreneurs

Start with Simple Start or Essentials. Great for tracking income, sending professional invoices, and organizing expenses without needing advanced features.

✅ Small to Mid-Sized Teams

Plus or Advanced is ideal if you need multi-user access, inventory management, and custom workflows to streamline operations.

❌ Tight Budget or Global Needs?

You may want to explore Zoho Books (affordable, with automation) or Xero (strong multi-user access and global compliance) as better-suited alternatives.

🚀 What to Do Next

- Still undecided? Compare the top 10 accounting tools for 2025

- Looking for an alternative? Read our full Xero Review or Zoho Books Review

- Ready to try QuickBooks? Start your free trial here and test it for 30 days risk-free

Have more questions?

Frequently Asked Questions

1. Does QuickBooks have a free plan?

No, it does not offer a free plan. However, you can either start with a 30-day free trial or opt for 50% off your first 3 months as a limited-time offer.

2. What’s the difference between QuickBooks Online and Desktop?

QuickBooks Online is cloud-based and accessible from any device. QuickBooks Desktop is locally installed and better suited for businesses that need more advanced industry-specific tools but don’t need cloud access.

3. Can I use QuickBooks for multiple businesses?

You can manage multiple businesses, but each business requires its own subscription. QuickBooks does not allow multi-entity support under one login.

4. Which QuickBooks plan includes inventory tracking?

Inventory tracking is available starting with the Plus plan. It lets you track stock levels, set reorder points, and manage COGS in real time.

5. Is QuickBooks good for freelancers or solo entrepreneurs?

Yes, the Simple Start plan is ideal for freelancers. It includes invoicing, expense tracking, tax prep tools, and simple reporting, all for one user.

6. Can QuickBooks do payroll?

Yes. QuickBooks offers optional payroll add-ons or integrates with third-party tools like Gusto. Full-service payroll features include W-2s, 1099s, tax filing, and direct deposit.

7. What banks work with QuickBooks?

QuickBooks integrates with over 20,000 U.S. and international banks, including Chase, Bank of America, Wells Fargo, and Capital One, enabling automatic transaction imports.

8. Does QuickBooks support multi-currency?

Yes, but only on Essentials, Plus, and Advanced plans. You can invoice and accept payments in multiple currencies and set exchange rates manually or automatically.

9. Is QuickBooks secure?

Yes. QuickBooks uses 256-bit SSL encryption, SOC 2 Type II compliance, and multi-factor authentication to protect your financial data.

10. Can I cancel or change my plan later?

Yes, you can upgrade, downgrade, or cancel your QuickBooks plan at any time from your account settings. Be aware that downgrading may result in data loss if you’ve used advanced features.