Introduction

Choosing the right accounting software is a pivotal decision for any business owner or manager. The market is flooded with numerous options, making the selection process daunting. However, understanding the essential features that high-quality accounting software must possess simplifies this task. This comprehensive guide will delve into seven critical features to consider when selecting accounting software for your business needs.

7 Key Features For Accounting Software

1. Invoicing – Streamlining Financial Transactions Invoicing is more than just billing; it’s about managing the flow of income efficiently. Ideal accounting software should facilitate the creation, dispatch, and tracking of invoices with ease. This ensures a smooth cash flow and helps maintain a healthy financial state.

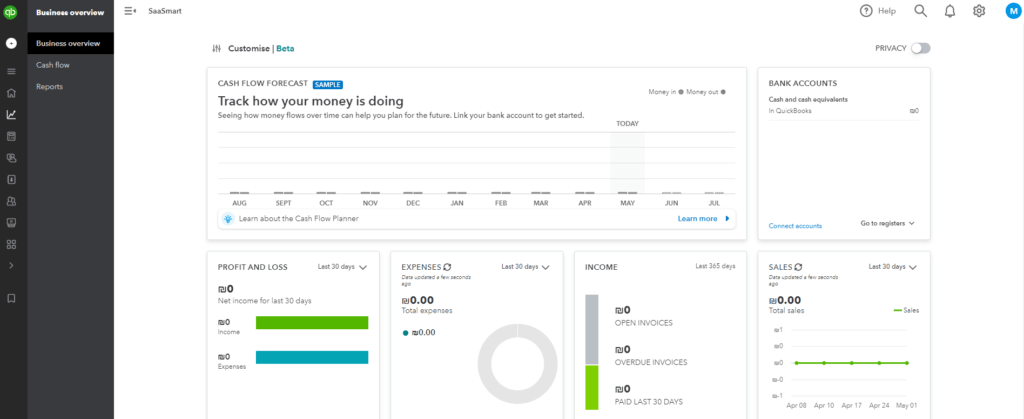

Example: QuickBooks stands out for its intuitive invoicing system, allowing businesses to manage invoicing with exceptional efficiency and ease.

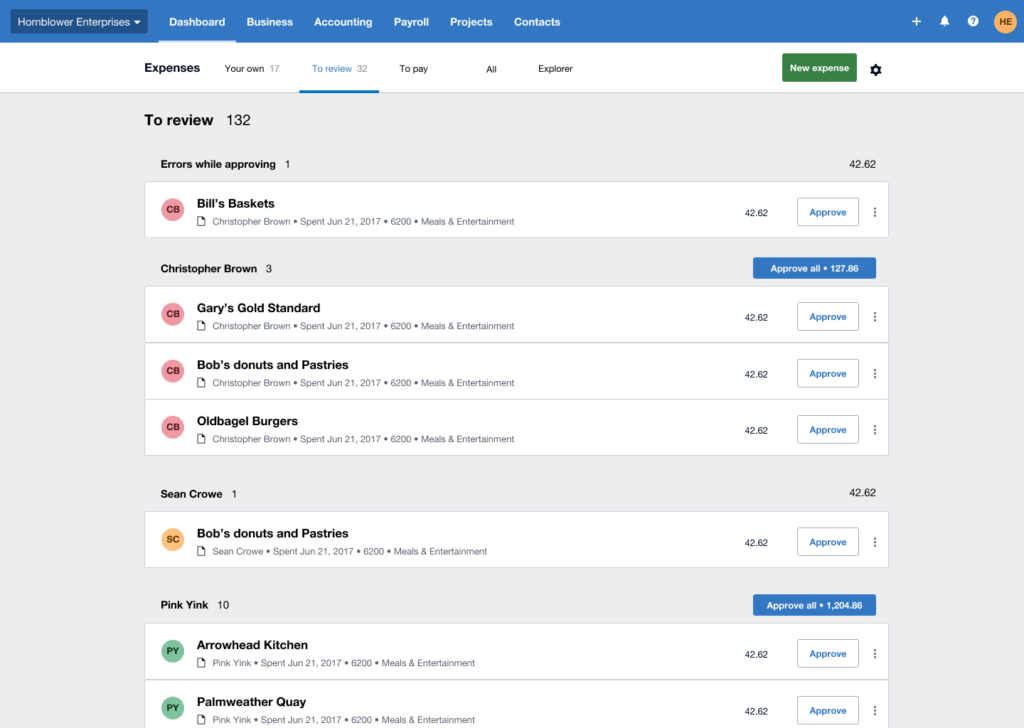

2. Expense Tracking – Mastery of Financial Outflows A comprehensive view of expenses is vital for controlling budgets and understanding financial health. Effective accounting software must allow users to record, categorize, and analyze expenses effortlessly. This functionality aids in pinpointing areas of high expenditure and opportunities for cost-saving.

Example: Xero excels in this regard, offering a user-friendly interface coupled with powerful expense tracking capabilities.

3. Payroll Management – Simplifying Employee Remuneration Handling payroll involves more than just paying employees; it encompasses managing benefits, deductions, and tax filings. Accounting software with an integrated payroll system automates these processes, reducing errors and saving time.

Example: Gusto is renowned for its comprehensive payroll features, automating complex processes and ensuring accuracy in employee payments.

4. Inventory Management – Optimizing Stock Handling For businesses handling physical products, inventory management is crucial. The right software should provide real-time insights into stock levels, facilitate reorder processes, and help manage inventory costs. This feature is essential for maintaining balance between surplus and shortage.

Example: Zoho Inventory offers robust inventory management tools that help businesses keep optimal stock levels efficiently.

5. Bank Reconciliation – Ensuring Financial Integrity Bank reconciliation is critical for verifying the accuracy of financial records. Accounting software should automate the matching of bank transactions with company records, highlighting discrepancies for quick resolution. This feature ensures financial integrity and aids in accurate reporting.

Example: Xero is particularly strong in this area, providing seamless integration with banks and facilitating effortless reconciliation.

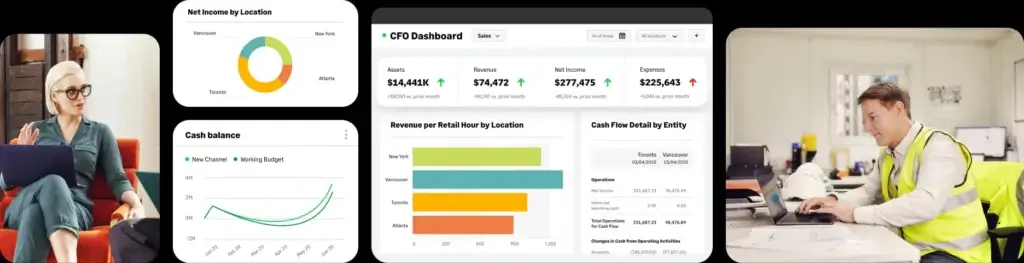

6. Reporting and Analytics – Driving Informed Decisions The ability to generate comprehensive reports and perform detailed analytics is a must-have in accounting software. This feature enables businesses to gain insights into their financial performance and make data-driven decisions. Customizable reports should provide clarity on income, expenses, cash flow, and overall financial health.

Example: QuickBooks Online offers extensive reporting and analytics features, allowing for detailed financial analysis and strategic decision-making.

7. Security – Protecting Sensitive Financial Data In an era of increasing cyber threats, the security of financial data cannot be overstated. Accounting software must include robust security measures such as data encryption, secure login protocols, and role-based access controls to safeguard sensitive information.

Example: FreshBooks excels in providing strong security features, ensuring that financial data remains confidential and protected.

- Invoicing: QuickBooks offers exceptionally intuitive invoicing features. Its ability to customize invoice templates and automate billing cycles puts it ahead of many competitors.

- Expense Tracking: Its expense tracking is user-friendly and highly detailed, allowing for categorization and linking to bank accounts, which is more advanced than some alternatives.

- Payroll Management: QuickBooks provides an integrated payroll solution that is both comprehensive and easy to use, surpassing many others in automation and tax compliance features.

- Inventory Management: While adequate, QuickBooks’ inventory management is less sophisticated compared to dedicated inventory systems.

- Bank Reconciliation: This is one of QuickBooks’ strongest features, offering seamless integration and real-time reconciliation, which is more advanced than some of its peers.

- Reporting and Analytics: QuickBooks excels here, offering a wide range of customizable reports and insightful analytics, making it superior in this aspect.

- Security: It has robust security features, including multi-factor authentication and data encryption, ranking it high in terms of data protection.

Further Exploration: There is much more to learn about QuickBooks. For an in-depth review, visit QuickBooks Review.

- Invoicing: Xero’s invoicing is highly efficient, with features like automatic invoice reminders, slightly edging out some competitors.

- Expense Tracking: The software offers strong expense tracking capabilities, though it may not be as user-friendly as QuickBooks.

- Payroll Management: Xero integrates well with various payroll systems but doesn’t offer as comprehensive a solution natively as QuickBooks or Gusto.

- Inventory Management: Xero provides good inventory management tools, suitable for small to medium-sized businesses, though not as detailed as specialized inventory software.

- Bank Reconciliation: Xero is exceptional in bank reconciliation, offering a more streamlined experience than many competitors.

- Reporting and Analytics: It provides robust reporting tools, but the customization and depth may not match QuickBooks.

- Security: Xero’s security is strong, with regular updates and strict data encryption, making it comparable to QuickBooks.

- Further Exploration: To discover more about Xero, check out the full review at Xero Review.

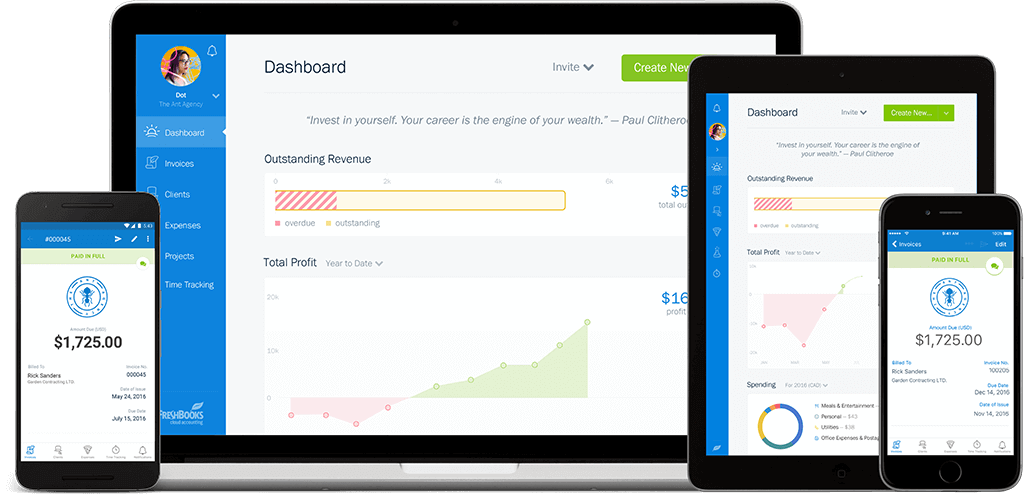

- Invoicing: FreshBooks stands out for its invoicing, particularly for freelancers and small businesses, with user-friendly and customizable options.

- Expense Tracking: The software offers good expense tracking, but it may lack some advanced features found in QuickBooks.

- Payroll Management: FreshBooks does not have an in-built payroll feature, which is a drawback compared to QuickBooks and Xero.

- Inventory Management: This is not a primary feature of FreshBooks, making it less suitable for businesses with extensive inventory needs.

- Bank Reconciliation: FreshBooks provides basic bank reconciliation features but lacks the depth of QuickBooks or Xero.

- Reporting and Analytics: The software offers useful reporting tools for small businesses, though not as comprehensive as QuickBooks.

- Security: FreshBooks has robust security, ensuring safe and secure financial management.

- Further Exploration: To delve deeper into FreshBooks, read the full review at FreshBooks Review.

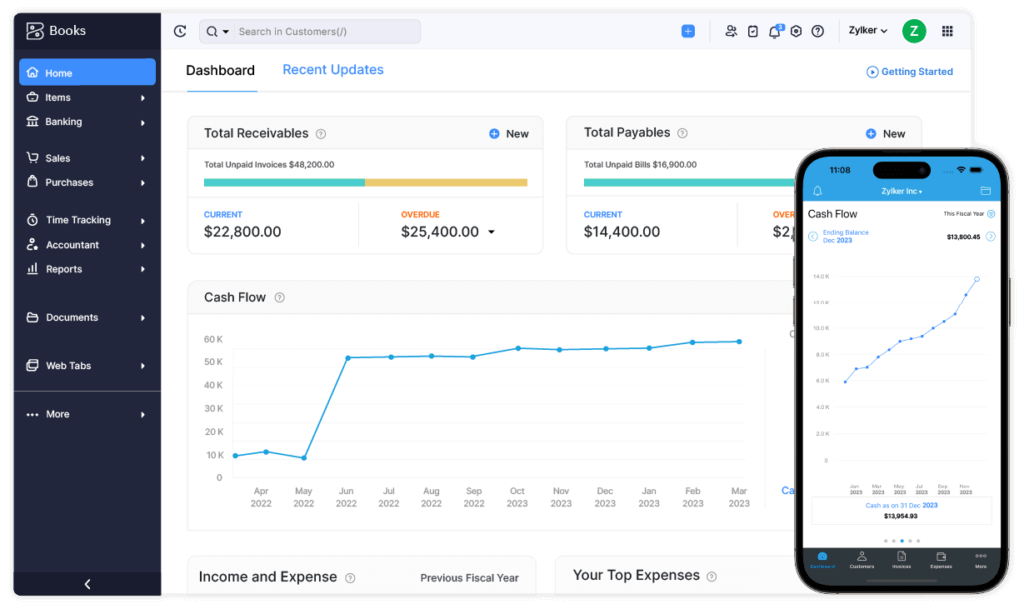

- Invoicing: Zoho Books provides excellent invoicing features, especially for those already using the Zoho ecosystem.

- Expense Tracking: The expense tracking is comprehensive and integrates well with other Zoho apps, offering a more holistic view than some standalone tools.

- Payroll Management: Zoho Books integrates with third-party payroll services, but it doesn’t offer an in-built solution like QuickBooks.

- Inventory Management: Its inventory management is one of the best, ideal for businesses that require detailed inventory tracking.

- Bank Reconciliation: Zoho Books offers efficient bank reconciliation, though it may not be as seamless as Xero’s.

- Reporting and Analytics: It provides excellent reporting capabilities, with a range of customizable options, though slightly less intuitive than QuickBooks.

- Security: Zoho Books has strong security features, on par with major competitors.

- Further Exploration: read the full review at Zoho Books Review.

- Invoicing: Sage offers solid invoicing capabilities, suitable for medium to large businesses, but might be less intuitive for smaller businesses.

- Expense Tracking: Its expense tracking is robust, but the user interface is less intuitive compared to QuickBooks and Xero.

- Payroll Management: Sage provides a comprehensive payroll solution, particularly strong in handling complex payroll requirements.

- Inventory Management: Sage’s inventory management is detailed and powerful, suitable for businesses with significant inventory needs.

- Bank Reconciliation: While efficient, Sage’s bank reconciliation feature may not be as user-friendly as that of QuickBooks or Xero.

- Reporting and Analytics: Sage offers extensive reporting tools, but they can be complex to use, catering more to users with advanced accounting knowledge.

- Security: It has strong security protocols, though user experience in managing security settings can be less straightforward than in some other software.

- Further Exploration: read the full review at Sage 50 Review.

Conclusion

In the realm of accounting software, each platform carves out its niche, offering a blend of features tailored to different business needs. Our exploration of QuickBooks, Xero, FreshBooks, Zoho Books, and Sage highlights the diverse capabilities of these leading solutions, especially when assessed against the seven critical features of invoicing, expense tracking, payroll management, inventory management, bank reconciliation, reporting and analytics, and security.

QuickBooks emerges as a frontrunner for small to medium-sized businesses, offering exceptional ease of use and comprehensive features across most categories, particularly excelling in invoicing, expense tracking, and payroll management. Xero stands out for its robust bank reconciliation capabilities and user-friendly interface, making it a strong contender for businesses seeking streamlined financial management.

FreshBooks is the go-to choice for freelancers and smaller enterprises, prioritizing simplicity and effectiveness in invoicing and basic expense tracking. However, it may fall short for businesses seeking more advanced payroll and inventory management features.

Zoho Books integrates seamlessly within the Zoho ecosystem, offering strong inventory management and reporting tools, ideal for those already utilizing other Zoho applications. Its comprehensive features cater well to small and medium-sized businesses looking for an all-in-one solution.

Sage, suited for medium to larger businesses, excels in handling complex accounting needs. Its robust inventory and payroll management features make it a viable option for businesses with intricate financial structures.

Ultimately, the decision on which accounting software to adopt hinges on a business’s specific requirements, scale, and the level of complexity in financial management. For a more detailed comparison and insights into additional software options, readers are encouraged to visit Top 10 Accounting Software, providing a broader perspective to aid in making an informed choice. This resource further enriches the decision-making process by offering a comprehensive overview of the top accounting software, ensuring businesses can select a solution that aligns seamlessly with their unique financial management needs.

FAQS

What are the main features to look for in accounting software?

The main features to consider are invoicing, expense tracking, payroll management, inventory management, bank reconciliation, reporting and analytics, and security. These features are essential for effective financial management in any business.

Which accounting software is best for small to medium-sized businesses?

QuickBooks is often considered the best choice for small to medium-sized businesses due to its user-friendly interface and comprehensive range of features, particularly in invoicing, expense tracking, and payroll management.

Can Xero handle complex bank reconciliations effectively?

Yes, Xero is particularly known for its robust bank reconciliation capabilities, offering streamlined and efficient financial management suitable for a range of business sizes.

Is FreshBooks suitable for freelancers and small businesses?

Absolutely. FreshBooks is designed with freelancers and small businesses in mind, focusing on simplicity and effectiveness in invoicing and basic expense tracking.

Does Zoho Books integrate well with other business applications?

Yes, Zoho Books integrates seamlessly within the Zoho ecosystem, making it an ideal choice for businesses already using other Zoho applications. It offers strong inventory management and reporting tools.

What makes Sage ideal for larger businesses?

Sage is well-suited for larger businesses due to its ability to handle complex accounting needs, especially with its detailed inventory and comprehensive payroll management features.

How important is security in accounting software?

Security is paramount in accounting software. It’s crucial to have robust security measures like data encryption, secure login protocols, and role-based access controls to protect sensitive financial information.

Can I customize reports and analytics in QuickBooks Online?

Yes, QuickBooks Online offers extensive reporting and analytics features with a high degree of customization, allowing for detailed financial analysis and strategic decision-making.

Are there free accounting software options that are reliable?

While this article focuses on paid software, there are reliable free options available like Wave. However, they may offer limited features compared to paid software and are typically best suited for very small businesses or freelancers.

Is it easy to switch to a different accounting software if my business needs change?

Switching accounting software can be manageable but requires careful planning. It’s important to consider data migration, user training, and the potential integration with other systems. Choosing software with scalability and flexibility can ease this transition as your business grows.