Introduction

Why Choosing the Right Accounting Software Really Matters

Running a small business means wearing many hats, and managing your finances shouldn’t be one that slows you down.

You need accounting software that works with you, not against you. Something simple, affordable, and powerful enough to cover the basics like invoicing, expense tracking, and bank reconciliation, without the complexity or cost of bigger tools like QuickBooks or Xero.

That’s where Wave comes in.

Wave is a cloud-based accounting platform designed for small business owners, freelancers, and solopreneurs who want to keep things lean but professional. Whether you’re sending invoices to clients, capturing receipts on the go, or checking your cash flow, Wave gives you the essentials for free.

In this review, we’ll help you decide if Wave is the right fit for your business in 2025. You’ll see how it stacks up against alternatives, what it does well, and where it may fall short.

🎯 By the end of this guide, you’ll know whether Wave is the accounting tool that simplifies your day or one you’ll eventually outgrow.

Where Wave Fits in Today’s Market

✅ Best For: Freelancers, consultants, micro-businesses

❌ Not Ideal For: Larger teams, inventory-heavy businesses, advanced reporting needs

Wave is one of the few truly free accounting platforms that doesn’t compromise on quality. Since being acquired by H&R Block, it’s evolved into a trusted solution in the financial software space, especially in the U.S. and Canada.

Unlike full-scale platforms like QuickBooks or Xero, which target larger teams with layered features and pricing tiers, Wave keeps it simple:

- One plan (free)

- Optional add-ons (like payroll and online payments)

- A clean interface, you don’t need an accounting degree to use

This makes it a smart starting point for many small businesses, especially service-based ones.

What You’ll Learn in This Review

- Who should (and shouldn’t) use Wave

- A breakdown of key features like invoicing, expenses, and reporting

- What real users say, the good and the bad

- Pricing, including add-ons and hidden costs

- A quick comparison with QuickBooks and Zoho Books

- Our expert takes on whether Wave is the best fit for you in 2025

Who Is Wave Best For?

Find out if Wave fits your business needs

Ideal Users – Freelancers, Solopreneurs, and Service-Based Businesses

If you’re running a one-person shop or small team, Wave is built for you.

It’s especially useful if your business:

- Sends client invoices regularly

- Tracks income and expenses without a bookkeeper

- Wants to keep costs low without sacrificing professionalism

- Operates in the U.S. or Canada (for full feature access)

Examples of ideal Wave users:

- Freelance designers, writers, and marketers

- Small agencies and consultants

- Online coaches and solo entrepreneurs

- Local service providers (plumbers, photographers, fitness coaches)

✅ If your accounting needs are simple, Wave is more than enough, and it won’t cost you a dime.

When Wave Might Not Be the Best Fit

Wave is not a one-size-fits-all solution. Here’s when you might want to look elsewhere:

- You need advanced inventory management

- Your business spans multiple currencies outside of North America

- You manage a growing team with complex permissions

- You rely on deep custom reports or financial forecasting

Tools like Xero or QuickBooks Online offer more advanced workflows, but they come with higher learning curves and costs.

Real-Life Scenarios Where Wave Works Best

Here are a few examples where Wave really shines:

🔹 A freelance writer who invoices clients monthly and tracks payments from one dashboard

🔹 A wedding photographer who uploads travel receipts and keeps costs organized at tax time

🔹 A solo consultant offering coaching packages and managing everything from quotes to payment in one tool

🔹 A side-hustle entrepreneur who doesn’t want to pay $30+/month just to invoice 5 clients

Wave removes the friction from basic accounting tasks so you can focus on what you do best, running your business.

Software specification

Core Features That Set Wave Apart

Wave keeps it simple, but not too simple. While it doesn’t have every advanced tool that large platforms offer, it covers the must-haves extremely well.

Here’s a breakdown of the most important features and how they make running your business easier in 2025.

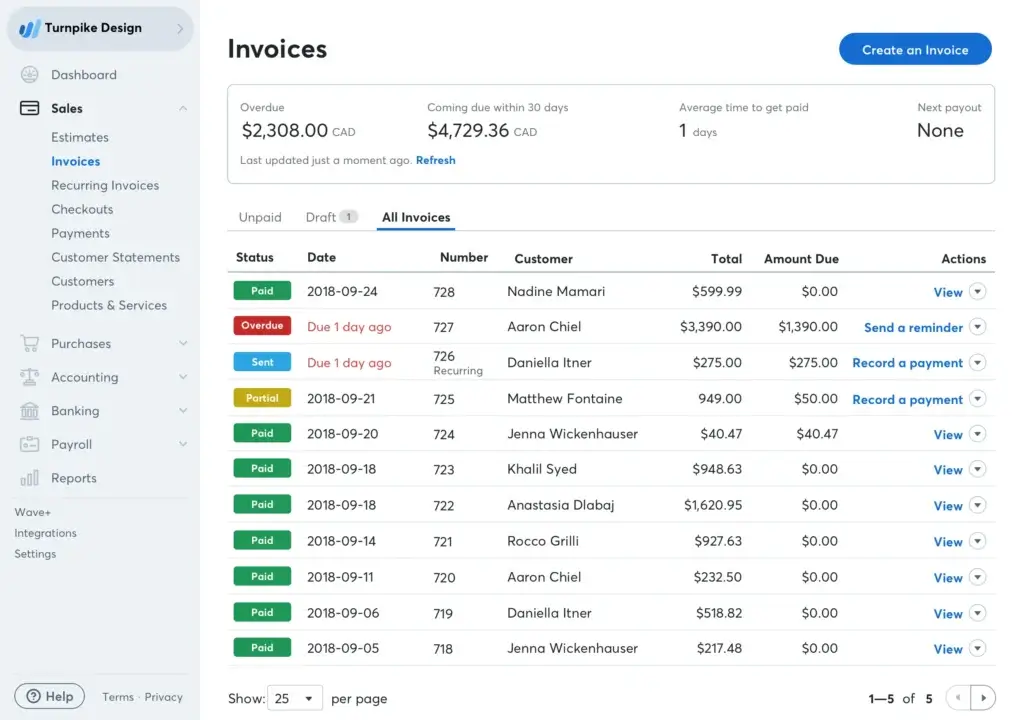

🧾 Invoicing and Payments

Wave’s invoicing tools are professional, flexible, and surprisingly powerful for free software.

What you can do:

- Send unlimited branded invoices

- Customize colors, logos, and templates

- Set up recurring invoices for ongoing clients

- Automate payment reminders (3, 7, or 14 days after due)

💳 Want to get paid faster? Add Wave’s built-in online payments to accept credit cards and ACH payments directly from your invoices. Payments are processed via Stripe with fees starting at 2.9% + $0.60.

📈 Businesses that use online payments get paid up to 3x faster.

💼 Expense and Receipt Tracking

Tracking your expenses is easy with Wave, especially on the go.

Key capabilities:

- Scan receipts via mobile app or desktop upload

- OCR technology auto-extracts data and logs expenses

- Categorize expenses for tax time and reporting

- Match receipts to transactions automatically

This is a huge time-saver for freelancers, consultants, and service providers who don’t want to drown in paper receipts or spreadsheets.

Bonus: Unlimited receipt scanning is included for free in the Starter Plan.

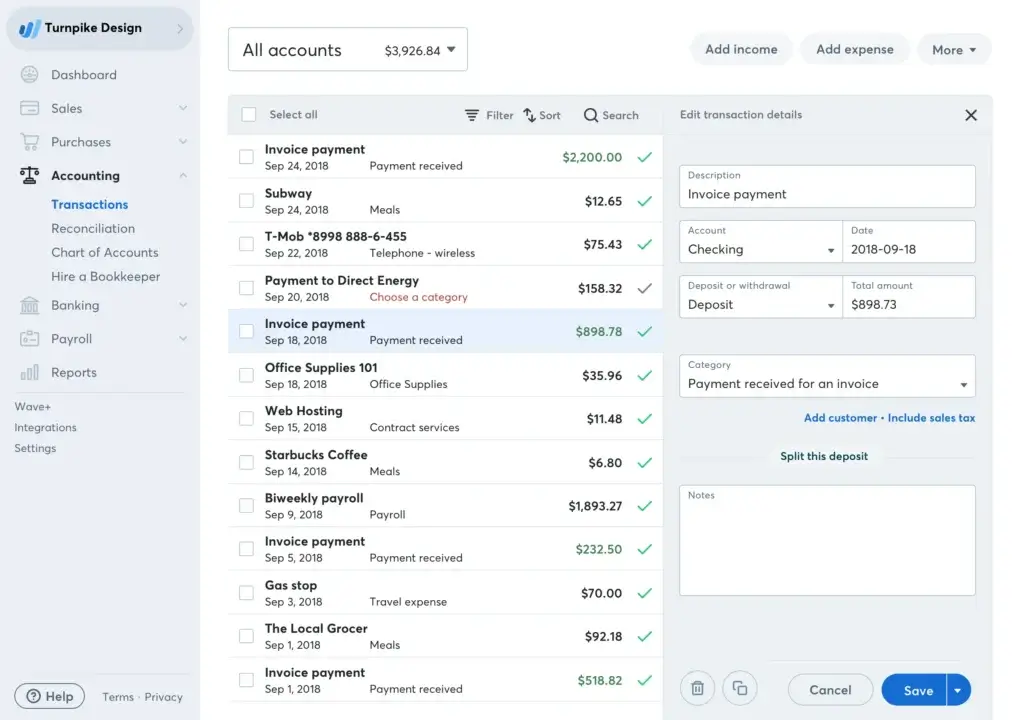

🏦 Bank Connections & Reconciliation

Wave connects to your bank account using Plaid for real-time transaction imports.

Benefits:

- Import expenses and income directly

- Smart transaction matching for reconciliation

- Auto-categorization to reduce manual work

- Easy-to-use reconciliation interface for accuracy

⚠️ Note: Auto-import is only available in the Pro Plan ($16/month). In the free version, you’ll need to upload bank statements manually or enter transactions by hand.

📦 Inventory and Project Tracking (Limitations)

Unlike Xero or QuickBooks, Wave doesn’t offer native inventory or job costing features.

- No project tracking, time billing, or profitability reports

- Limited to tracking income and expenses without item-level control

If you run an eCommerce or inventory-heavy business, this may be a deal-breaker.

📊 Real-Time Reports & Dashboards

Wave offers clean, easy-to-read reports with essential financial insights.

You’ll get access to:

- Profit and loss (P&L)

- Balance sheet

- Sales tax reports

- Customer statements

- Aged receivables and accounts payable

Wave’s dashboard also gives you a quick snapshot of your business health, showing:

- Total income vs. expenses

- Outstanding invoices

- Upcoming bills

🧠 Everything you need to stay organized, without needing a CPA to interpret it.

📱 Mobile App & Cloud Access

Wave is fully cloud-based and offers mobile apps for both iOS and Android.

What you can do from your phone:

- Send and edit invoices

- Snap and upload receipts

- View income/expense reports

- Get notifications when invoices are paid

Whether you’re working from your laptop, tablet, or phone, you’ll always have access to your books.

✅ Summary Table: Key Feature Highlights

| Feature | Available in Free Plan | Available in Pro Plan |

| Unlimited Invoicing | ✅ Yes | ✅ Yes |

| Online Payments Integration | ➕ Add-on | ➕ Add-on |

| Receipt Scanning | ✅ Yes | ✅ Yes |

| Auto-Import Bank Transactions | ❌ No | ✅ Yes |

| Real-Time Financial Reports | ✅ Yes | ✅ Yes |

| Payroll Services | ➕ Add-on | ➕ Add-on |

Benefits of Using Wave

Advantages and Disadvantages

Positive

✅ It’s completely free

✅ User-friendly and intuitive

✅ Professional invoicing tools

✅ Helpful mobile app

Negative

❌ Limited scalability

❌ No advanced reports or forecasting

❌ Bank auto-import is a paid feature

❌ Customer support is gated behind paid add-ons

Wave isn’t just attractive because it’s free; it’s genuinely useful for many small business owners. But like any tool, it has its strengths and limitations.

Let’s take an honest look at what you’ll love and where it may fall short.

✅ What You’ll Love About Wave

1. It’s completely free

Wave’s core accounting, invoicing, and receipt scanning features come at no cost. No trials. No hidden fees. You only pay for optional add-ons like payroll or online payments.

2. User-friendly and intuitive

The clean layout and step-by-step onboarding make it perfect for beginners. If you’re not an accountant, you’ll still feel right at home.

3. Professional invoicing tools

Send unlimited branded invoices, automate reminders, and accept online payments. It’s quick, simple, and polished.

4. Helpful mobile app

Scan receipts, track expenses, and send invoices from anywhere. The mobile app is powerful enough to manage your business on the go.

5. Strong security and compliance

Bank-level encryption, PCI-compliant payments, and secure data storage keep your financial information safe.

❌ What Could Be Better

1. Limited scalability

Wave is ideal for freelancers and very small teams. If your business grows, you may outgrow its capabilities, especially around inventory, project tracking, and advanced permissions.

2. No advanced reports or forecasting

You get basic financial reports, but there’s no budgeting, forecasting, or custom report builder.

3. Bank auto-import is a paid feature

In the free plan, you’ll need to upload bank statements manually. Automatic bank syncing is only included in the Pro plan ($16/month).

4. Customer support is gated behind paid add-ons

Free users rely on self-serve resources. To access live chat or email support, you need to subscribe to a paid plan or add-on.

⚠️ If you run a product-based business or need deep accounting automation, Wave may feel too limited over time.

User Experience

User Interface and Operational Simplicity

When it comes to accounting software, usability makes all the difference. You shouldn’t need an accounting degree to send invoices or check your cash flow. That’s where Wave shines.

From your very first login, you’ll notice how clean and beginner-friendly the platform is. Everything is where you expect it to be, and it stays out of your way when you don’t need it.

Let’s break down what it’s like to use Wave day to day.

🚀 First-Time Setup and Onboarding

Getting started with Wave is incredibly straightforward.

Here’s what you’ll do when you sign up:

- Create your free account

- Add your business name and currency

- Choose a business type (freelancer, LLC, etc.)

- Connect your bank or import statements manually

Wave guides you step-by-step without overwhelming you. There’s no upselling during onboarding, which is refreshing for a free product.

✅ Bonus: Wave offers helpful tooltips and a guided setup checklist to walk you through the essentials.

🧭 Dashboard and Navigation

The dashboard is the heart of your Wave experience, and it’s beautifully simple.

You’ll see:

- Cash flow trends

- Overdue invoices

- Outstanding bills

- Account balances

- Quick links to create invoices, log expenses, and view reports

The main navigation is always accessible on the left-hand side, with clear categories:

- Sales

- Purchases

- Accounting

- Banking

- Reports

🟢 No fluff, no clutter, just clean access to the tools you use most often.

📱 Mobile Experience (iOS and Android)

Wave’s mobile app isn’t just a companion; it’s a powerful tool in its own right.

With the mobile app, you can:

- Create and send invoices

- Record payments

- Scan and categorize receipts

- Monitor income and expenses on the go

It’s perfect for freelancers and field-based professionals who work from anywhere.

📲 The app is available for both iOS and Android, with 4.5+ star ratings across app stores.

👥 Collaboration with Your Accountant or Team

Wave makes it easy to share your books without giving away too much access.

You can invite:

- Accountants

- Bookkeepers

- Business partners or assistants

Each role comes with view or edit permissions, so you stay in control of what’s visible.

⚠️ However, if you’re managing a larger team with multiple departments or access levels, Wave may feel limited. There are no fine-grain user permissions like you’d find in QuickBooks or Xero.

✨ Final Thoughts on UX

Wave nails the user experience for its target audience, small business owners who want to save time, stay organized, and look professional. The dashboard is clean, the mobile app is powerful, and even non-finance users can find their way around easily.

If you’ve ever felt overwhelmed using other accounting software, Wave will feel like a breath of fresh air.

Integrations and Ecosystem

Connect Wave to your favorite apps

Wave is known for simplicity, and that extends to how it handles integrations and extensions. While it doesn’t have the vast ecosystem of tools like Xero or QuickBooks, it still offers the essential connections most small businesses need.

Let’s walk through what you can (and can’t) integrate with Wave in 2025.

🧩 Built-In Add-Ons

Wave offers a few native add-ons you can enable directly from your dashboard. These are designed to keep everything under one roof, no third-party platforms required.

Key add-ons:

- Wave Payments – Accept credit cards and ACH directly on your invoices

- Wave Payroll – Available in the U.S. and Canada; includes tax calculations, direct deposit, and year-end forms

- Wave Advisors – Hire a bookkeeping or tax expert to help manage your books (starts at $149/month)

These add-ons turn Wave from a basic tool into a more complete business platform, but you only pay for what you need.

🔌 Third-Party Integrations

Wave has a limited number of third-party integrations, but the essentials are covered:

Popular integrations include:

- Stripe – Accept payments online (used by Wave Payments)

- PayPal – Manually import PayPal transactions or use CSV

- Google Sheets – Export reports and financials for deeper analysis

- Zapier – Connect with 5,000+ apps like Slack, Gmail, Trello, and Shopify

Using Zapier, you can automate actions like:

- Sending Slack alerts for new invoices

- Adding customers to your CRM when a payment is received

- Saving receipts to Google Drive after scanning them in Wave

⚙️ Zapier is the best workaround if you need deeper workflow automation with Wave.

🏪 The App Marketplace: Not Yet There

Unlike competitors, Wave doesn’t have a traditional app marketplace where you can browse and install third-party extensions. Everything happens via Zapier or manual connections.

That means:

- No built-in integrations with tools like Gusto, HubSpot, or Zoho

- No app store for inventory, project management, or CRM add-ons

- Fewer opportunities to customize your experience beyond accounting

🔍 If you want full automation or a rich integration ecosystem, you might find Wave a bit too closed off.

🤝 Collaboration and Compatibility

Despite limited integrations, Wave plays well in a simple tech stack. You can:

- Export data to Excel or Google Sheets

- Invite your accountant or bookkeeper with restricted access

- Use it alongside separate tools for CRM, scheduling, or e-commerce

Who it’s best for:

- Solo entrepreneurs with light app usage

- Businesses already using Zapier or Google Workspace

- Users who prefer keeping accounting separate from other workflows

Pricing and Plans

How much does Wave cost?

Wave is one of the few accounting tools that offers real value for free. Whether you’re a freelancer, side hustler, or small business owner, it gives you a lot of functionality upfront, without a price tag.

But it also offers optional upgrades for those who need more automation, support, or payroll services.

Let’s break down what’s included in each plan and which one is right for you.

🟢 Wave Starter Plan (Free)

This is the core of what makes Wave so appealing. The free Starter plan includes:

- Unlimited invoicing

- Expense tracking

- Receipt scanning (mobile and web)

- Basic reports (P&L, balance sheet, etc.)

- Manual bank statement uploads

- Multi-business support under one login

You can run a fully functional accounting system at zero cost, ideal for solopreneurs and micro-businesses that don’t need advanced automation.

✅ If you’re just getting started or keeping things lean, the free plan is often all you need.

🔵 Wave Pro Plan ($16/month)

The Pro Plan unlocks extra features and convenience:

- Automatic bank transaction imports

- Auto-categorization and smart matching

- Live chat and email support

- Access to Pro-only features across the dashboard and automation

It’s a great upgrade if you:

- Want to save time with auto-imported transactions

- Need help and don’t want to rely only on articles

- Use Wave daily and want smoother workflows

🧠 $16/month is still cheaper than most competitors like QuickBooks ($30+) or FreshBooks ($22+).

🧩 Optional Add-Ons (Available in Any Plan)

Wave keeps its pricing modular, so you only pay for what you need.

| Add-On | Pricing | What You Get |

| Wave Payments | Starts at 2.9% + $0.60 per transaction | Credit card and ACH payment processing |

| Wave Payroll | From $20/month + $6 per employee | Payroll, direct deposit, tax filing (U.S. & Canada) |

| Wave Advisors | From $149/month | Hire a bookkeeping or tax expert |

💬 Is It Worth the Price?

Here’s the honest answer:

If you’re a solo operator or small team and your needs are straightforward, Wave’s free plan may be all you ever need. It covers the essentials of sending invoices, tracking expenses, and keeping your books clean.

But if you want automation, real-time bank syncing, and support access, the Pro Plan at $16/month is absolutely worth it.

Compare that to:

- QuickBooks Simple Start: $30/month

- FreshBooks Lite: $22/month

- Xero Starter: $15/month (but with invoice/bill limits)

Wave holds its own, and then some.

Alternatives to Wave

Compare top competitors

Wave offers unbeatable value with its free plan, but it’s not the perfect fit for everyone. If your business needs more advanced features or better scalability, it’s worth comparing Wave to other top accounting tools.

Here’s a quick breakdown of how Wave compares with key competitors:

| Software | Best For | Key Strengths | Where It Beats Wave |

| QuickBooks Online | Growing businesses | Advanced reporting, payroll, app ecosystem | More robust features and integrations |

| Xero | Multi-currency and inventory-heavy teams | Global compliance, inventory, project tracking | Better for international and product-based businesses |

| Zoho Books | Startups using Zoho ecosystem | Automation, multi-user support, client portals | More workflow automation and deeper customization |

| FreshBooks | Client-based freelancers and service pros | Time tracking, proposals, late fee automation | Better time billing and project collaboration |

| Sage 50 | Established, traditional businesses | Desktop access, job costing, audit trail | Stronger offline capabilities and compliance |

When You Should Stick With Wave

- You run a freelance, service-based, or solo business

- You want basic accounting and invoicing without monthly fees

- You don’t need inventory, advanced reports, or complex user roles

When to Consider an Alternative

- You need project tracking, budgeting, or custom workflows

- You want deeper integration with CRM, ecommerce, or POS tools

- You require multi-user controls, international currency support, or inventory management

Pro Tip: If you’re still unsure which platform fits best, check out our full Top Accounting Software Comparison for a detailed head-to-head breakdown.

Security and Compliance

Your financial data deserves top-tier protection

Wave takes your financial data seriously, using bank-level encryption and trusted industry standards to keep your information safe.

🔒 Data Encryption and Storage

Wave uses 256-bit TLS encryption to protect your data both in transit and at rest, just like your bank does. Everything is stored on secure servers with 24/7 monitoring and routine backups to prevent data loss.

💳 PCI Compliance for Payments

If you accept payments through Wave, you’re covered under PCI Level 1 compliance. That means:

- Credit card data is never stored

- Transactions are securely tokenized

- Systems are audited regularly to meet top-tier standards

👥 User Access and Permissions

You can invite accountants or team members with limited access controls. While basic, it works well for solo businesses and small teams.

⚠️ Advanced roles or audit trails are not available; larger teams may need more.

🌐 Data Privacy

Wave is GDPR-compliant and follows U.S. and Canadian data protection laws. However, it’s not HIPAA-compliant, so it’s not suited for healthcare businesses.

Bottom line? Wave offers solid, worry-free security for freelancers and small business owners who need reliable protection without the tech headaches.

Conclusion

Is Wave the Right Accounting Tool for You?

Wave isn’t trying to be everything for everyone. But for the people it does serve, freelancers, solopreneurs, and lean teams, it hits the mark.

💡 Recap of Wave’s Strengths and Weaknesses

What stands out:

- Truly free core features (invoicing, bookkeeping, receipt scanning)

- Clean, beginner-friendly interface

- Great for service-based businesses and solo operators

- Add-ons like payroll and payments are easy to plug in when needed

What’s missing:

- No advanced reporting, forecasting, or budgeting

- Limited scalability for growing teams or inventory-heavy businesses

- Fewer third-party integrations than top competitors

- Bank syncing is locked behind the Pro plan

🎯 Our Recommendation Based on Business Type

| Business Type | Is Wave a Good Fit? |

| Freelancers / Solopreneurs | ✅ Yes – ideal setup |

| Small service-based businesses | ✅ Yes – works beautifully |

| Growing startups with multiple users | ⚠️ Maybe – limited controls |

| Inventory or product-based businesses | ❌ No – lacks inventory tools |

| Global businesses needing multi-currency | ❌ No – better with Xero |

Next Steps

If you think Wave might be right for you, start with the free Starter Plan. You can upgrade only if needed.

Still exploring options? Compare Wave with other top tools in our Top Accounting Software Guide to find the best match for your business.

Have more questions?

Frequently Asked Questions

1. Is Wave really free to use?

Yes, the Starter plan is free and includes core features like invoicing, expense tracking, and receipt scanning without any subscription fees.

2. Does Wave offer online payment processing?

Yes, you can enable credit card and ACH payments for invoices. Processing fees apply per transaction, similar to other payment platforms.

3. Can I run payroll through Wave?

Payroll services are available as a paid add-on in select regions, offering features like direct deposit, tax filings, and year-end forms.

4. Is Wave suitable for large businesses?

It’s best for solo entrepreneurs and small teams. Larger companies may need more advanced features like inventory tracking, custom roles, and deeper integrations.

5. Can I access my Wave account on mobile?

Yes, there’s a mobile app available for both iOS and Android that supports invoicing, receipt scanning, and financial tracking on the go.

6. Does Wave support multi-currency transactions?

Not natively. If your business operates internationally, you may need to consider alternatives that offer built-in multi-currency support.

7. How secure is the data in Wave?

The platform uses bank-level encryption, PCI-compliant payment processing, and secure cloud storage to protect your financial information.

8. Can I invite my accountant to use Wave?

Yes, you can grant limited or full access to an accountant or bookkeeper, making collaboration easy without sharing sensitive login credentials.

9. Are there any hidden fees in Wave?

There are no hidden fees for the core plan. However, optional services like payments, payroll, and bookkeeping support come with separate pricing.

10. Can I migrate to another platform from Wave?

Yes, you can export your data in standard formats like CSV or PDF, which makes transitioning to another accounting system relatively straightforward.