Introduction

You’re juggling client meetings, compliance paperwork, performance reports, and market updates, often all in one day. Sound familiar?

That’s exactly why choosing the right CRM for financial advisors isn’t just smart, it’s essential. A purpose-built CRM helps you:

- Stay organized

- Build deeper client relationships

- Automate routine tasks

- Stay on top of compliance rules

Without a CRM in place, it’s easy to get lost in spreadsheets, scattered notes, and email overload. That kind of chaos doesn’t just waste time, it can cost you clients and credibility.

The Challenges You Face Without a CRM

When you’re not using a tool designed for advisors, you’re doing more work than necessary. Here’s what that looks like:

- Missed follow-ups that cost deals

- Disorganized records create compliance risk

- Relying on memory instead of a structured system

- Zero visibility into client pipelines or interactions

Manual processes slow you down. You should be focused on advising, not chasing paperwork or digging through your inbox.

What This Guide Will Help You Do

This article will walk you through:

- What a CRM for financial advisors is and why it matters

- The key features you should prioritize

- The top 5 CRM tools for financial advisors in 2025

- A comparison table for quick decision-making

- Pro tips for implementation and optimization

Whether you’re building your book of business or scaling your advisory firm, this guide will help you choose the best CRM for your growth goals.

What is a CRM and Why Financial Advisors Need One

You’ve probably heard the term CRM thrown around in every business webinar and software ad. But what does it really mean for you as a financial advisor?

📘 CRM, Explained Simply

CRM stands for Customer Relationship Management. It’s a platform that helps you track, manage, and grow your client relationships – all in one place.

Instead of flipping through spreadsheets, Post-it notes, or your memory, you get a smart, organized dashboard that holds:

- Contact details

- Meeting history

- Document storage

- Pipeline tracking

- Reminders and follow-ups

- Email logs and communication history

A CRM works like your digital assistant that never sleeps. It keeps you updated, helps you stay compliant, and makes your client feel like they’re your #1 priority, every single time.

💼 Why CRMs Are a Game-Changer for Financial Advisors

You’re not just managing numbers, you’re managing people’s life savings, goals, and dreams. That requires trust, responsiveness, and a ton of follow-up.

Here’s how a CRM can elevate your financial practice:

1. Streamlined Client Management

Stay on top of every client’s portfolio, preferences, and milestones. Easily pull up notes before meetings, track all past interactions, and segment clients for personalized communication.

2. Better Sales and Pipeline Tracking

Visualize your entire sales funnel. Know who’s in discovery, who’s ready to invest, and who needs a nudge – all from one dashboard.

3. Compliance and Documentation

Log every interaction and document in one place to stay audit-ready. Most CRMs offer encryption and permission controls to help you meet regulatory standards.

4. Automated Follow-Ups and Tasks

Set reminders and automate check-ins so no lead or opportunity slips through the cracks.

5. Stronger Client Relationships

With a CRM, you never miss birthdays, review meetings, or key milestones. That’s the kind of personal touch clients remember.

💬 Think of It Like This:

A CRM gives you the same advantages big firms have, without needing a big team. It’s your command center for growth, service, and efficiency.

Whether you’re a solo advisor or running a small firm, the right CRM helps you do more with less effort.

Key Features to Look for in a CRM for Financial Advisors

Not all CRMs are created equal, especially when it comes to managing high-value client relationships in the financial world.

Here are the must-have features you should look for when picking the right tool for your advisory practice:

User-Friendly Interface

You shouldn’t need a tech degree to use your CRM. Look for a clean, intuitive layout that makes it easy to access client data, track progress, and manage tasks, without getting lost in menus.

Scalability

Your CRM should grow with you. Whether you’re onboarding more clients or expanding your services, you need to handle more data, users, and workflows without slowing down.

Integration Capabilities

Make sure your CRM plays nice with the tools you already use, like email platforms, calendar apps, financial planning software, and document storage tools.

Automation Features

Time is money! Choose a CRM that automates repetitive tasks like:

- Follow-up emails

- Meeting reminders

- Task assignments

- Client check-ins

This saves you hours every week.

Affordability

The best CRM isn’t always the most expensive. Look for plans that match your current budget but offer the flexibility to upgrade as your practice grows 💸

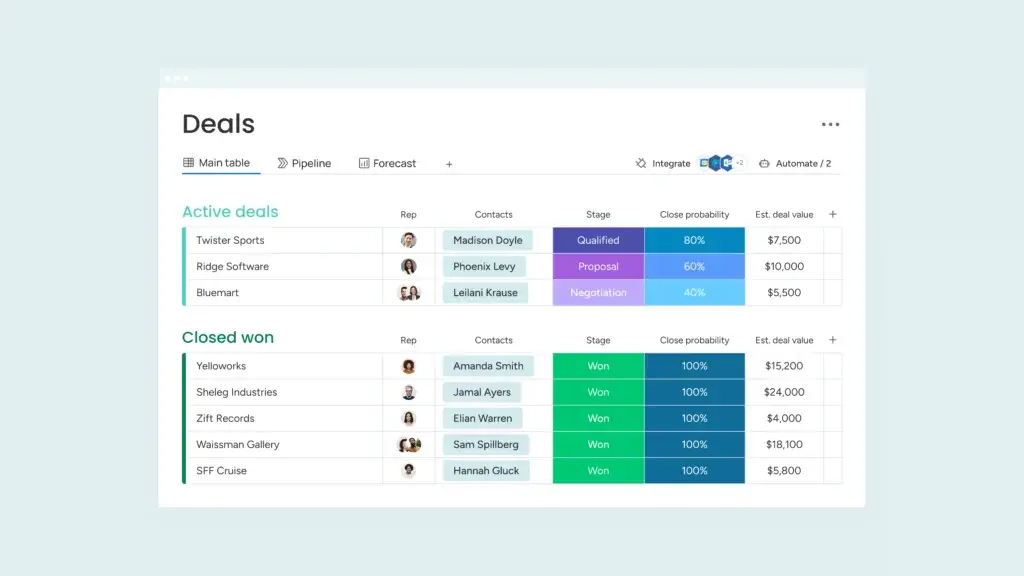

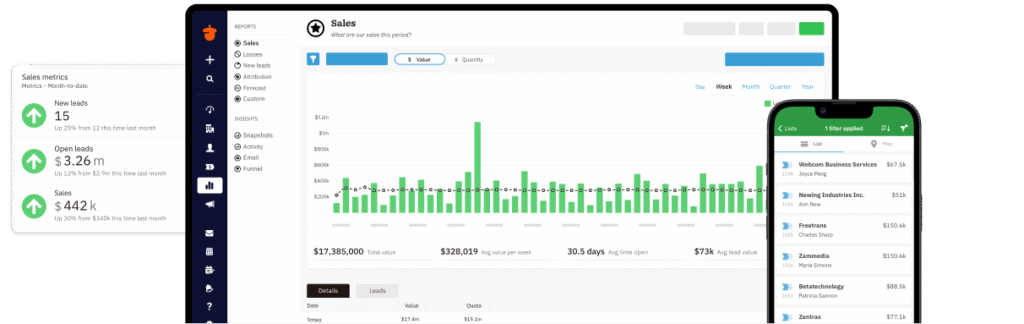

If you’re looking for a CRM that molds itself around your workflow instead of the other way around, monday CRM is the one 💡

Whether you’re managing client portfolios, automating reminders, or tracking referrals, monday CRM lets you build a visual CRM that fits your exact needs, without writing a single line of code.

🌟 Key Features

- Drag-and-drop visual dashboards

- Custom workflows for client onboarding, reviews, or renewals

- Automation rules like “Send follow-up 3 days after meeting”

- Email, calendar, and Zoom integrations

- Templates tailored for financial services and sales pipelines

- Advanced permissions to control who sees what

👍 Pros

- Super visual and easy to use

- Flexible enough to support any process

- Built-in automation to save time

- Integrates with tools like Gmail, Outlook, Excel, and DocuSign

👎 Cons

- Takes some setup time (but worth it)

- Some features are only available on higher-tier plans

💵 Pricing Overview

| Plan | Monthly Price (per user) | Key Features |

| Basic | $9 | Custom boards, unlimited items |

| Standard | $12 | Automation, integrations, timeline view |

| Pro | $19 | Time tracking, dashboards, formulas |

| Enterprise | Custom | Advanced security, multi-level permissions |

Tip: monday CRM offers a 14-day free trial so you can test it before committing.

💬 Why It’s #1: monday CRM combines simplicity with power. You can tailor every pipeline, checklist, and automation to your process, not someone else’s.

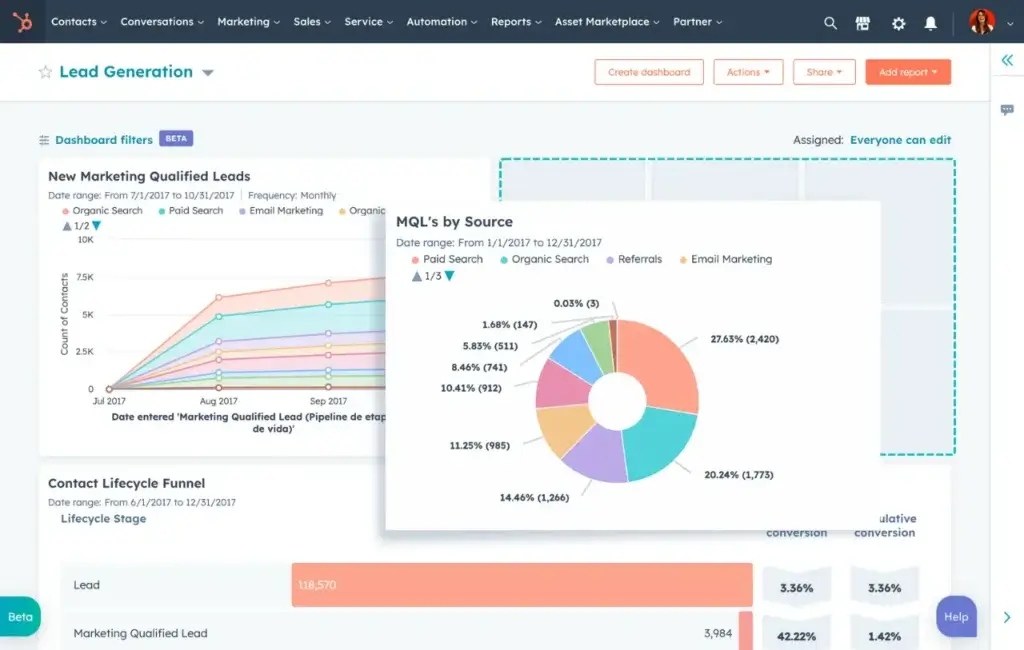

If you’re just starting out or looking to cut software costs, HubSpot CRM is a fantastic choice. It’s completely free to start, and still gives you tools powerful enough to manage clients, pipelines, emails, and reports – all without paying a dime 💸

🌟 Key Features

- Client database with rich contact profiles

- Email tracking to know when clients open your messages

- Task management and reminders

- Sales pipeline with deal tracking

- A meeting scheduler that syncs with your calendar

- Reporting dashboard for performance insights

All wrapped in a super clean, beginner-friendly interface.

👍 Pros

- Totally free to use for small teams

- Easy to learn and quick to set up

- Strong email and pipeline features

- Integrates with Gmail, Outlook, Zoom, Stripe, and more

👎 Cons

- Limited automation in the free plan

- Advanced tools require upgrades

- Not as customizable as monday CRM

💵 Pricing Overview

| Plan | Monthly Price | Best For |

| Free | $0 | Basic CRM needs and solo advisors |

| Starter | $20 (2 users) | Email marketing, automation |

| Professional | $500+ | Advanced automation, custom reports |

| Enterprise | $1,200+ | Scaling teams, full-suite integration |

Tip: Start with the free plan, then upgrade only if you need more power later.

💬 Why It’s #2: HubSpot CRM is perfect if you want something ready-to-go with no upfront cost. It’s clean, professional, and surprisingly powerful for a free tool.

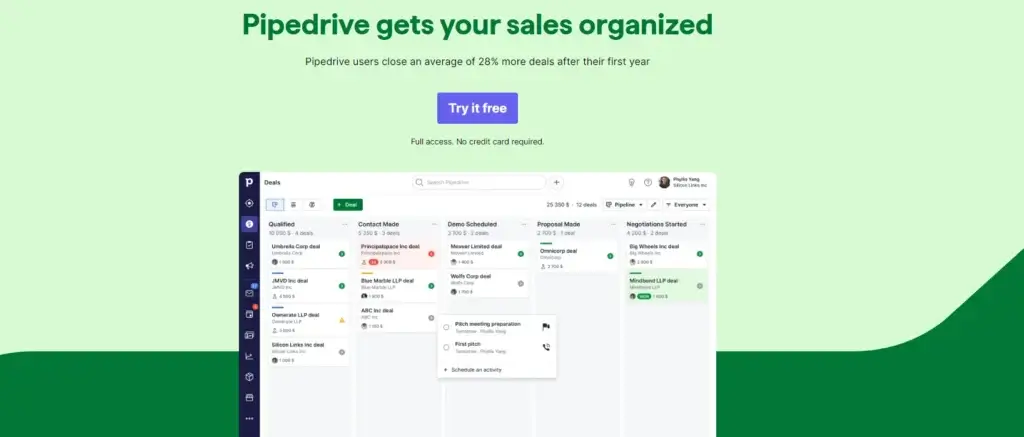

If you consider client acquisition a top priority, Pipedrive is your new best friend 🤝

This CRM is all about visualizing your sales funnel, tracking every step of the client journey, and making sure no lead slips through the cracks. It’s streamlined, smart, and built for closing more deals with less hassle.

🌟 Key Features

- Visual sales pipeline to track leads and opportunities

- Custom stages and workflows tailored to financial services

- Activity reminders and deal scheduling

- Built-in email templates and tracking

- Lead scoring and goal tracking

- AI-powered sales assistant to suggest next steps

👍 Pros

- Intuitive drag-and-drop interface

- Great for tracking new client prospects

- Excellent mobile app for on-the-go updates

- Powerful reporting to track close rates and bottlenecks

👎 Cons

- More sales-focused than relationship-focused

- Lacks some native tools for marketing automation

- Advanced features behind higher-tier plans

💵 Pricing Overview

| Plan | Monthly Price (per user) | Highlights |

| Essential | $14 | Lead and deal management |

| Advanced | $29 | Email automation, workflows |

| Professional | $49 | Sales forecasting, reporting |

| Power | $64 | Team collaboration, permissions |

| Enterprise | $99 | Full customization, dedicated support |

🌟 Why Pipedrive Is Perfect for Sales Teams

If your startup is laser-focused on revenue generation, Pipedrive is a no-brainer. 💡 It cuts out the noise and helps your team focus on what matters most – selling.

With its clear visual pipelines, built-in automation, and affordable plans, you get the sales power of a big CRM without the bloat. Many early-stage founders and SDRs rave about how Pipedrive keeps them moving quickly, without tech headaches.

If HubSpot is your all-in-one growth stack, Pipedrive is your lean, mean sales machine. 🏁

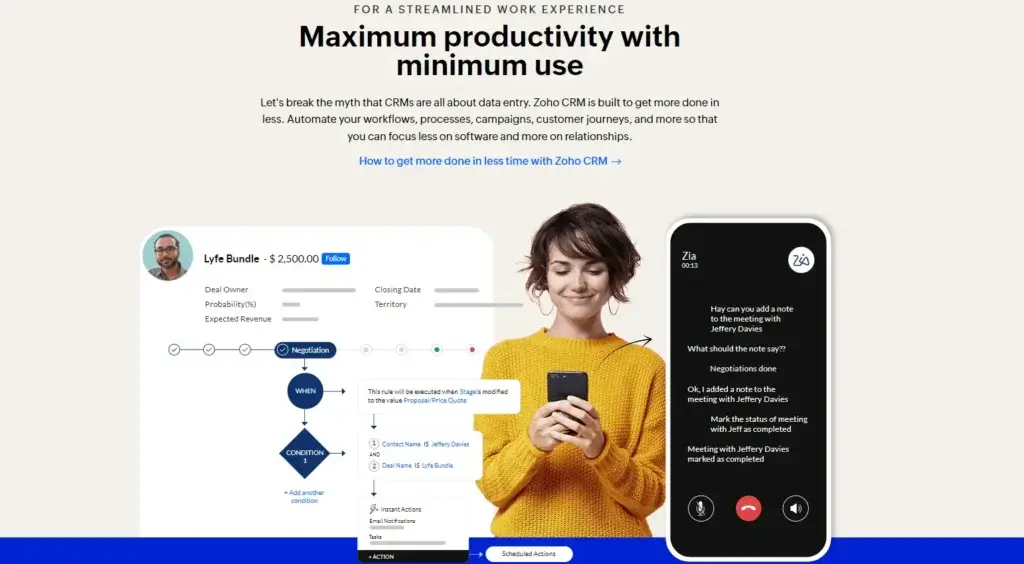

Looking for a feature-rich CRM that won’t max out your software budget? Zoho CRM offers an incredible suite of tools at one of the most affordable price points out there 🤑

It’s ideal for solo advisors and small teams who want multichannel communication, task automation, and analytics, without giving up core CRM power.

🌟 Key Features

- Lead and contact management

- Email, call, and social media integration

- Workflow automation for repetitive tasks

- AI-powered sales assistant (Zia)

- In-depth analytics and forecasting

- Custom dashboards and reports

Zoho even lets you tailor your CRM interface with custom modules and layouts. That’s rare for this price range 🎯

👍 Pros

- Very affordable with generous features

- Highly customizable dashboards and fields

- Strong automation for the price

- Built-in AI to help prioritize leads and actions

👎 Cons

- Interface isn’t as modern or visual as monday CRM

- It can feel overwhelming for beginners

- Occasional bugs or lags in the mobile app

💵 Pricing Overview

| Plan | Monthly Price (per user) | Best For |

| Free | $0 | Up to 3 users, basic CRM tools |

| Standard | $14 | Email insights, scoring rules |

| Professional | $23 | Blueprints, inventory management |

| Enterprise | $40 | AI (Zia), multi-user portals |

| Ultimate | $52 | Advanced analytics and sandbox |

Tip: Start with the Standard plan to unlock key CRM features, then scale as needed.

💬 Why It’s #4: Zoho CRM delivers robust tools at wallet-friendly prices. If you’re looking for value, flexibility, and AI-powered insights on a budget, Zoho makes a strong case 💪

If you want a CRM that’s easy to use, packed with essential features, and doesn’t take a week to learn, Nutshell is a top contender.

It’s designed for small to mid-sized teams that want powerful contact management, pipeline visibility, and marketing tools – all in a tidy, no-fuss interface.

🌟 Key Features

- Contact and pipeline management

- Built-in email sequencing and templates

- Sales automation with triggers and actions

- Reporting dashboards for deal tracking

- Team collaboration tools

- Email integration with Gmail and Outlook

Nutshell stands out by combining CRM and basic marketing automation in one place, so you don’t have to juggle multiple tools.

👍 Pros

- Super intuitive, fast onboarding 🏁

- Marketing tools built right in (email campaigns!)

- Affordable and transparent pricing

- Excellent U.S.-based support

👎 Cons

- Limited customization compared to others

- No native billing or invoicing tools

- Less advanced AI and analytics features

💵 Pricing Overview

| Plan | Monthly Price (per user) | Key Features |

| Foundation | $19 | CRM basics, contact, pipeline tracking |

| Pro | $35 | Sales automation, reporting, integrations |

| Power AI | $49 | AI-enhanced sales automation & insights |

| Marketing Add-On | +$5+ | Email marketing features |

Tip: The Pro plan is the sweet spot – enough power without complexity.

💬 Why It’s #5: Nutshell is perfect if you want a reliable CRM that “just works.” It’s user-friendly, focused, and backed by a responsive support team, ideal for advisors who want to keep things simple and effective ✨

Comparison Table

| CRM Tool | Best For | Key Features | Starting Price |

| monday CRM | Customization & Scalability | Visual workflows, automation, integrations | $9/user/month |

| HubSpot CRM | Free CRM with Strong Core Features | Contact mgmt, email tracking, deal pipeline | $0 (Free) |

| Pipedrive | Sales-Focused Advisors | Visual pipeline, email automation, AI assistant | $14/user/month |

| Zoho CRM | Budget-Conscious Firms | Multichannel tools, AI, deep customization | $0–$14/user/month |

| Nutshell | Simplicity & Smart Marketing | Pipeline + marketing tools, automation | $19/user/month |

How to Choose the Right CRM for Your Financial Advisory Practice

Choosing a CRM isn’t just about features; it’s about finding the right fit for the way you work. Here’s how to make the smartest choice:

1. Define Your Needs

Ask yourself:

- Are you focusing on client retention, new lead generation, or both?

- Do you need help with compliance tracking or automated follow-ups?

- How much client data do you manage daily?

Tip: List out your top 5 daily tasks and see which CRM supports them best.

2. Consider Your Team Size

- Solo advisor? Look for simplicity and affordability.

- Small firm? Go for CRMs that offer task delegation and internal communication tools.

- Growing team? Prioritize scalability, permission controls, and training resources.

3. Set Your Budget (But Think Long-Term)

CRMs range from free to hundreds per month. Don’t just look at price, factor in:

- ROI from automation

- Time saved

- Client satisfaction boosts

- Ability to scale

💡 A slightly higher investment can save you hours every week, and hours = billable time.

4. Test Before You Commit

Always try a free plan or trial first!

Most of the CRMs on this list offer:

- 14–30 day free trials

- Demos and onboarding guides

- Live chat or help center access

👉 Choose a CRM that feels natural and supports your daily flow.

Implementation Tips

You’ve picked the perfect CRM, now what?

Here’s how to make sure your setup leads to smooth sailing, not frustration 🚤

1. Start with a Clear Setup

Begin with the basics first:

- Import your existing contacts

- Create your sales or client onboarding pipeline

- Set up tags or segments for easy filtering

- Customize fields to match your service model

👉 Don’t overbuild too early. Start simple and scale.

2. Train Your Team (or Yourself)

Even the best CRM is useless if nobody knows how to use it

- Schedule a short training session

- Use built-in tutorials or knowledge bases

- Assign a CRM “champion” on your team to support others

🎓 Learning the tool = more productivity, fewer errors.

3. Integrate With Your Existing Tools

Save time by connecting tools you already use:

- Gmail, Outlook, or calendar apps

- Document signing platforms like DocuSign

- Planning or portfolio tools you trust

Integration makes everything feel seamless.

4. Monitor & Optimize

After the first few weeks:

- Review how your CRM is being used

- Look for bottlenecks or unused features

- Adjust workflows or automation as needed

📈 Your CRM isn’t static; it evolves with your business.

Conclusion

In the world of financial advising, your time is money, and your relationships are everything. The right CRM helps you protect both

Whether you need powerful customization (like monday CRM), a reliable free option (HubSpot), sales-centric tools (Pipedrive), budget value (Zoho), or simplicity with marketing built-in (Nutshell) – there’s a perfect fit for your firm.

A smart CRM will help you:

- Stay organized and compliant

- Keep clients engaged and impressed

- Save hours every week

- Grow your practice with confidence

Don’t just manage your client data, master it with the right CRM.

FAQ

1. What’s the best overall CRM for financial advisors?

monday CRM stands out for its flexibility, automation, and scalability – perfect for advisors who want to fully customize their workflows and grow over time.

2. Which CRM is best if I want a free option?

HubSpot CRM offers a generous free plan with contact management, deal pipelines, and email tracking, ideal for solo advisors or those just getting started.

3. Can I use a CRM for compliance tracking?

Yes! Most CRMs like monday CRM, Zoho, and HubSpot let you log every interaction, store documents securely, and set reminders to stay audit-ready.

4. What’s the easiest CRM to learn?

Nutshell is praised for its clean interface and user-friendly setup, a great choice if you want something simple yet effective.

5. Do these CRMs integrate with my email and calendar?

Absolutely. All five recommended CRMs support integrations with Gmail, Outlook, Google Calendar, and more.

6. Can CRMs help automate my follow-ups?

Yes! Tools like Pipedrive, monday CRM, and Zoho offer automation for tasks like sending reminders, emails, and assigning follow-ups based on rules.

7. Which CRM is best for client acquisition?

Pipedrive shines in client acquisition with its visual sales pipeline, automation, and lead tracking capabilities.

8. Do I need a team to use a CRM?

Not at all! Many CRMs like HubSpot and Zoho are great for solo advisors and scale easily when you’re ready to grow.

9. How much does a good CRM cost?

You can start for free (HubSpot, Zoho) or opt into paid plans ranging from $9 to $49 per user/month, depending on features and team size.

10. How long does CRM setup take?

With tools like monday CRM or Nutshell, you can be up and running within a day. Custom setups may take a bit longer, but most platforms offer templates and onboarding help to speed things up.