Why Accounting Software Is a Must-Have for Freelancers

📉 Still using spreadsheets to manage your freelance income?

You’re not alone, but you’re also missing out on time-saving automation, better tax prep, and peace of mind.

Whether you’re juggling multiple clients or trying to get paid on time, managing finances manually can quickly become overwhelming. And when tax season hits? You’ll either spend days playing catch-up or hand over a messy stack of receipts to your accountant (if you have one).

Accounting software built for freelancers simplifies all of this.

It helps you:

- Track income and expenses effortlessly

- Send professional invoices (and follow up automatically)

- Categorize expenses for tax time

- Stay on top of cash flow with real-time dashboards

- Make better decisions with clear financial reports

If you want to spend less time chasing numbers and more time growing your freelance business, now is the time to upgrade. The best part? You don’t need to be an accountant or spend a fortune to get started.

👉 For a broader overview of business-friendly tools, see our Top 10 Accounting Software guide.

What Makes Great Accounting Software for Freelancers?

Not all accounting platforms are created with freelancers in mind. Many tools focus on large teams or growing startups. But as a freelancer, you need something lean, easy to use, and designed to work solo.

Here’s what to look for in 2025:

✅ Must-Have Features

When evaluating accounting software, make sure it includes these essentials:

🧾 Invoicing and payment tracking

Create and send branded invoices, track client payments, and issue reminders automatically.

📥 Expense tracking

Snap receipts from your phone, connect bank feeds, and keep personal vs. business expenses separate.

💼 Tax prep and reporting

Look for Schedule C categorization, mileage tracking, and quarterly tax estimators, especially if you’re self-employed in the U.S.

📊 Simple dashboards and reports

You want visual insights into cash flow, profit, and client payments without needing to export spreadsheets.

📱 Mobile app access

A solid mobile experience lets you send invoices and track expenses while on the go.

🔁 Recurring tasks automation

Save time with features like recurring invoices, automatic reminders, and bank reconciliation.

💡 Nice-to-Have Extras (That Can Save You Time)

If your workflow is more complex or you bill by the hour, consider tools that also offer:

- Time tracking: Bill by the hour and turn hours into invoices

- Client portals: Give clients visibility into past invoices and project status

- Project costing: Understand which jobs are most profitable

- Integration with CRM or time tracking apps

🧠 Pro tip: Don’t overpay for features you won’t use. Simpler platforms like Wave or FreshBooks are perfect for solopreneurs. If you’re scaling or have contractors, Xero or Zoho Books might be a better fit.

Top 5 Accounting Software for Freelancers

💡 Every freelancer works differently. Whether you’re a consultant, designer, coach, or writer, you need software that supports how you get paid, file taxes, and track expenses.

Here are the top-rated tools for freelancers in 2025, handpicked based on usability, pricing, freelancer features, and scalability.

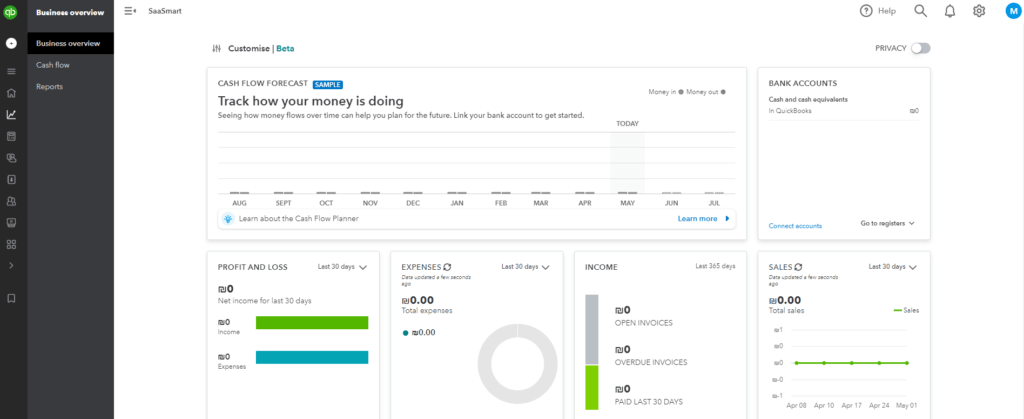

🟢 Why freelancers love it

QuickBooks Self-Employed is purpose-built for sole proprietors, gig workers, and 1099 contractors. It’s one of the few tools with built-in Schedule C categorization, estimated quarterly tax tracking, and automatic mileage logging through GPS.

📌 Key Benefits

- Auto-categorizes business vs personal expenses

- Real-time tax estimator

- Mileage tracker with mobile app

- Sends and tracks invoices

- Seamlessly integrates with TurboTax

💲 Starting at: $17/month (discounts available)

🆓 Free trial: 30 days

👍 Pros

- Tailored for self-employed professionals

- Clean dashboard, easy mobile use

- Strong tax tools

👎 Cons

- Limited features beyond taxes and invoicing

- No double-entry accounting

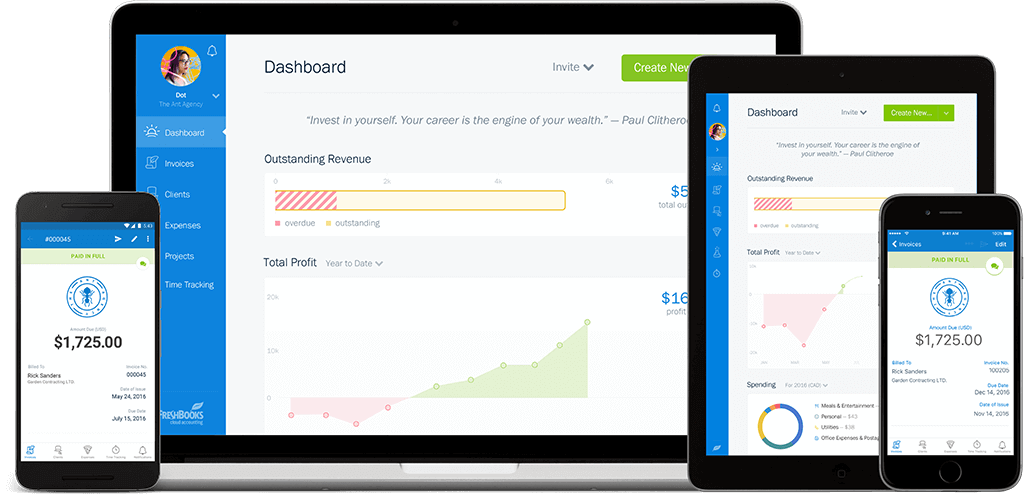

🟢 Why freelancers love it

If you bill clients by the hour or juggle multiple projects, FreshBooks simplifies everything. It includes built-in time tracking, project management features, and automated invoice reminders, making it perfect for consultants, designers, and marketers.

📌 Key Benefits

- Time tracking is linked directly to invoices

- Professional proposals and project tools

- Recurring billing & client payment reminders

- Strong mobile app support

💲 Starting at: $19/month (Lite plan)

🆓 Free trial: 30 days

👍 Pros

- Clean interface, super beginner-friendly

- Great for client communication & payments

- Excellent customer support

👎 Cons

- Limited reporting and tax features

- Costs increase if you manage many clients

🟢 Why freelancers love it

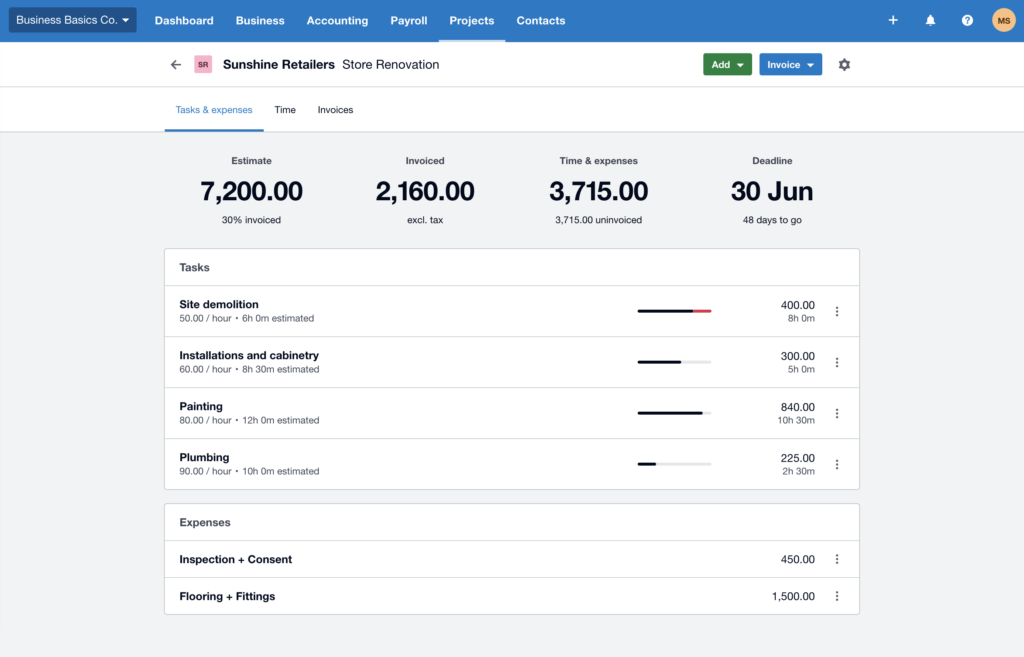

Xero is ideal if you’re planning to scale or already work with subcontractors. With features like multi-currency support, bank feed automation, and project cost tracking, Xero is a favorite among freelancers with growing needs.

📌 Key Benefits

- Clean dashboard with customizable reporting

- Real-time bank reconciliation

- Supports unlimited users, even on basic plans

- Integrates with 800+ third-party apps

💲 Starting at: $13/month

🆓 Free trial: 30 days

👍 Pros

- Scales with your business

- Strong automation and reports

- Excellent integrations

👎 Cons

- Basic plan limits invoices & bills

- Can be overwhelming for beginners

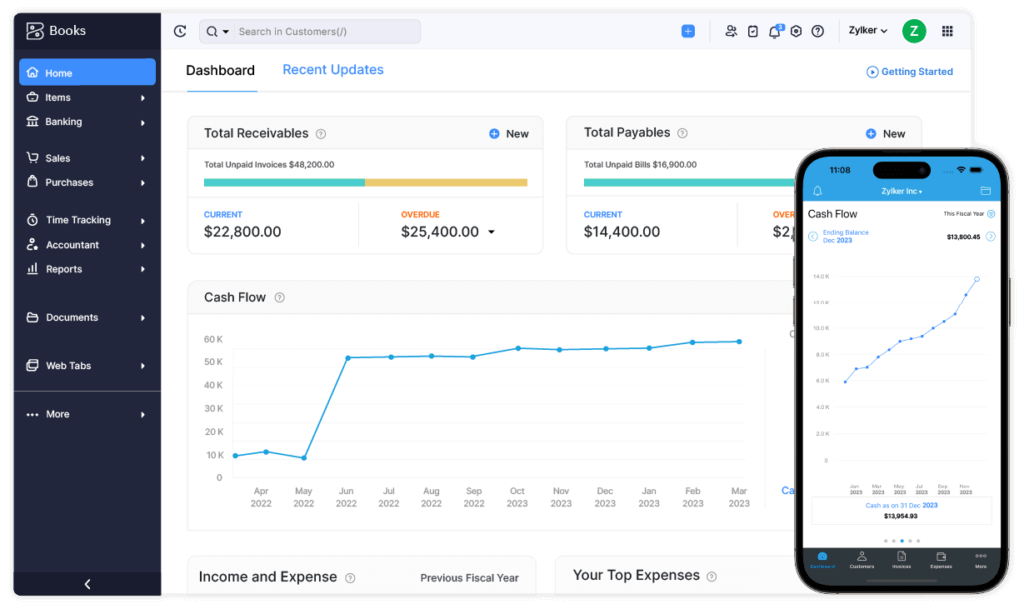

🟢 Why freelancers love it

Zoho Books offers the best value for money. With its free plan for businesses under $50K/year and a full suite of features even in paid plans, it’s a top pick if you’re looking for full accounting capabilities without breaking the bank.

📌 Key Benefits

- Free plan available

- Full double-entry accounting system

- Time tracking, project billing, and expense management

- Great if you use Zoho CRM, Invoice, or Projects

💲 Starting at: Free (then $15/month for Standard)

🆓 Free trial: Yes

👍 Pros

- Great value for solopreneurs

- Seamless Zoho ecosystem integration

- Highly customizable

👎 Cons

- Limited integrations outside Zoho

- Support is sometimes slow

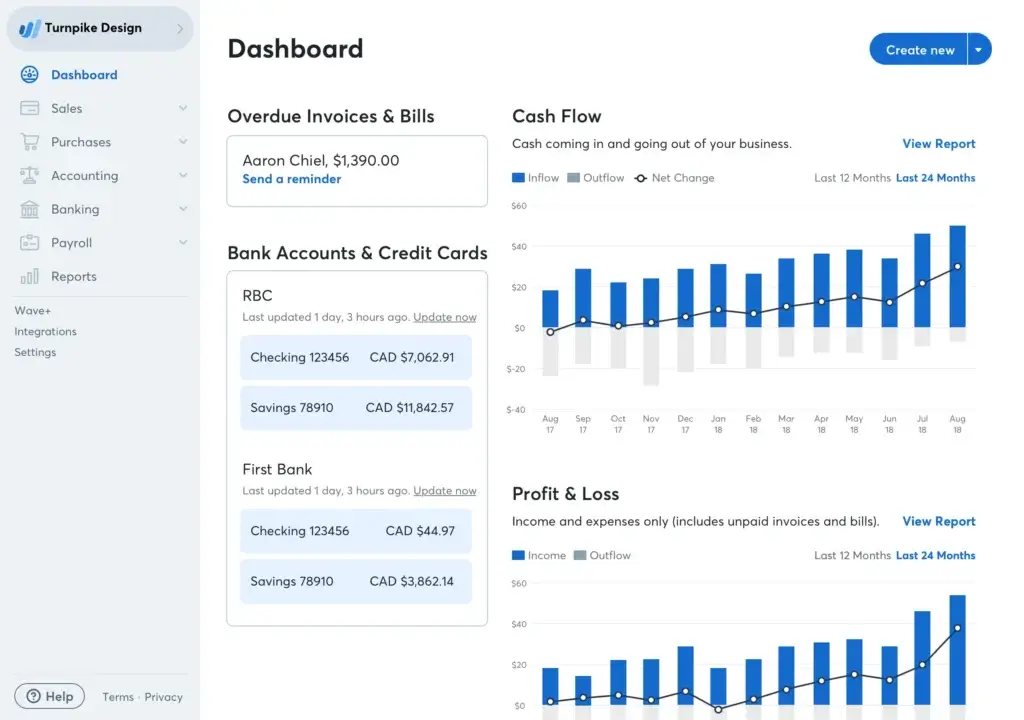

🟢 Why freelancers love it

Wave is a truly free accounting solution that covers invoicing, expense tracking, and basic reporting. It’s the perfect starting point for freelancers who want to manage their money with zero overhead.

📌 Key Benefits

- Totally free (no hidden fees for core features)

- Unlimited invoices and receipts

- Easy bank account sync

- Great UI for beginners

💲 Pricing: Free

🆓 Free trial: Not needed

👍 Pros

- Zero cost to start

- Perfect for new freelancers

- Includes mobile receipt scanning

👎 Cons

- No time tracking or project features

- Limited integrations

- Basic reporting only

Quick Comparison Table

| Software | Best For | Starting Price | Time Tracking | Tax Tools | Mobile App | Free Plan |

| QuickBooks Self-Employed | Tax reporting & mileage | $17/month | ❌ | ✅ | ✅ | ❌ |

| FreshBooks | Service-based freelancers | $19/month | ✅ | ⚠️ (basic) | ✅ | ❌ |

| Xero | Scalable freelance businesses | $13/month | ✅ (via add-on) | ✅ | ✅ | ❌ |

| Zoho Books | Budget-conscious freelancers | Free – $15/month | ✅ | ✅ | ✅ | ✅ |

| Wave | New freelancers & side hustlers | Free | ❌ | ⚠️ (manual) | ✅ | ✅ |

Which Accounting Software Fits Your Freelance Niche?

Accounting needs vary widely depending on what kind of freelancer you are. Here’s how to pick the right tool based on how you work:

🎨 Creative Freelancers (Designers, Writers, Artists)

You’ll need time tracking, client communication, and polished invoicing.

✅ Go with: FreshBooks

Why? It’s intuitive, tracks hours to specific projects, and sends branded invoices automatically.

👔 Consultants, Coaches & Professionals

You likely juggle multiple clients and need smart tax tracking and mileage logs.

✅ Go with: QuickBooks Self-Employed

Why? It simplifies quarterly taxes and mileage deductions while keeping business expenses separate from personal ones.

🌍 International Freelancers & Digital Nomads

Multi-currency invoicing and compliance across borders are your priorities.

✅ Go with: Xero

Why? It supports international payments, automates bank feeds, and offers robust reporting.

💸 Freelancers on a Tight Budget

You’re starting out, or your income varies seasonally. Cost is your biggest concern.

✅ Go with: Wave or Zoho Books Free Plan

Why? Both offer core accounting features for free, with no catch. Wave is better for simplicity; Zoho offers more features if you grow.

🚀 Freelancers Ready to Scale

You’re managing larger projects, maybe subcontracting work, and need full accounting functionality.

✅ Go with: Xero or Zoho Books (paid plans)

Why? These platforms grow with you and offer full double-entry accounting, project profitability tracking, and extensive integrations.

How to Choose the Right Accounting Software for You

Still not sure which platform fits your freelance workflow? Let’s break it down into a few simple steps.

🎯 1. Define Your Freelance Needs

Before choosing software, ask yourself:

- Do you bill by the hour or by project?

- Are you managing just income, or tracking expenses too?

- Do you need help with taxes or invoicing only?

- Are you planning to grow or keep things solo?

Understanding your workflow helps narrow the field fast.

💵 2. Set a Monthly or Yearly Budget

There’s no one-size-fits-all. Some freelancers are fine with free tools, while others need premium features to streamline their growing business.

- On a budget? Start with Wave or Zoho’s free plan.

- Mid-tier? FreshBooks and QuickBooks are great all-in-one choices.

- Growing fast? Consider Xero or a paid Zoho plan for scalability.

🧠 Tip: Look for annual discounts. Many tools offer 10–30% off for paying yearly.

⚙️ 3. Match Features to Your Day-to-Day Work

If you spend more time invoicing than tracking expenses, your needs are different than someone dealing with tax complexity.

Here’s a quick filter:

| If you… | You’ll want… |

| Bill by the hour | Time tracking + project invoicing |

| Travel for client work | Mileage tracker |

| Work with global clients | Multi-currency support |

| Want a hands-off system | Automation + recurring billing |

| Hate tax season | Tax estimator + expense categorization |

📱 4. Test Before You Commit

Almost every platform offers a free trial, so use it! Explore the dashboard, create a sample invoice, connect your bank account, and see how it feels.

🙌 You’re the boss. If the tool makes your life easier, it’s the right one.

How to Set Up Your Accounting Software the Right Way

Once you’ve chosen the right platform, setting it up properly from day one can save you hours down the road.

Here’s how to get started the smart way:

1. Connect Your Bank Accounts Securely

Most accounting tools let you sync your bank or credit card accounts. This lets transactions import automatically, so you don’t have to enter expenses manually.

💡 Tip: If you use a personal account for both business and personal spending, consider creating a separate bank account just for freelance work. It makes bookkeeping and tax season a lot easier.

2. Set Up Your Invoice Templates

Make sure your invoices look professional and consistent.

- Add your logo, brand colors, and contact info

- Include payment terms and accepted payment methods

- Set up automated payment reminders to get paid faster

Some tools (like FreshBooks and Zoho Books) let you build a library of services or rates, so you can add line items with one click.

3. Create Income & Expense Categories

Set up standard categories that reflect your freelance business. This helps with reporting, budgeting, and tax deductions.

Here are examples to start with:

- Income: Client payments, affiliate revenue, consulting

- Expenses: Software, subscriptions, travel, marketing, equipment

📌 Most software will auto-suggest categories, but customize them to match your workflow and country-specific tax codes.

4. Enable Mileage Tracking (If You Travel for Work)

If you drive to meetings or gigs, turn on mileage tracking in the app (QuickBooks and FreshBooks both have this built in). You’ll thank yourself during tax season.

5. Set Up Automations and Recurring Tasks

Use automation features to reduce your admin time:

- Recurring invoices for ongoing clients

- Automatic reminders for unpaid invoices

- Auto-categorize recurring expenses (like your Zoom or Canva subscription)

🧠 The goal? Spend less time managing money and more time earning it.

Making the Most of Your Software (Freelancer Best Practices)

Once your accounting software is up and running, it’s time to go beyond the basics. Here’s how to turn your tool into a real productivity and decision-making engine.

🔁 Automate the Repetitive Stuff

You’re a freelancer, not a bookkeeper. So let your software handle the tedious parts.

- Use recurring invoices for retainer clients

- Enable auto-reminders to follow up on unpaid invoices

- Set rules to auto-categorize recurring expenses (e.g., Spotify = “Software”)

⚡ Automation saves time and reduces errors, especially when you’re juggling clients and deadlines.

📅 Schedule a Weekly Money Check-In

Block 15 minutes each week to:

- Review income and expenses

- Categorize any new transactions

- Check for late payments

- Export a quick cash flow report

💡 Staying consistent helps you avoid last-minute tax stress and keeps your business on track.

📊 Use Reports to Spot Trends

Most accounting software for freelancers includes built-in reports like profit & loss, income by client, and unpaid invoices.

Look for:

- Which clients pay the fastest?

- Which months are your busiest (or slowest)?

- Are certain services more profitable than others?

📈 These insights help you plan better rates, focus on high-value work, and predict cash flow.

🔍 Revisit Your Setup Every 3–6 Months

As your freelance business grows, your needs might shift.

- Add new income categories

- Connect new payment accounts (e.g., Stripe, PayPal)

- Upgrade to a paid plan if your free tool starts to feel limiting

🧠 Don’t “set it and forget it.” Treat your accounting software like a living part of your business toolkit.

Pros & Cons of Using Accounting Software as a Freelancer

Accounting software isn’t just for big businesses; it’s one of the smartest tools you can invest in as a solo professional. But like any tool, it has strengths and limitations.

Here’s a balanced look:

| Pros | Cons |

| ✅ Saves time on invoicing, taxes, and tracking | ❌ Can feel overwhelming if you’re brand new to accounting |

| ✅ Reduces tax-time stress with built-in reports | ❌ Some tools charge monthly even if your income is seasonal |

| ✅ Helps you understand your cash flow better | ❌ Over-customizing categories or settings can create clutter |

| ✅ Automates reminders and recurring billing | ❌ Free versions may lack support or advanced features |

| ✅ Makes your business look more professional | ❌ Switching platforms later can be a hassle without planning |

💬 Bottom line? If you’re serious about freelancing and want to spend less time on spreadsheets and more time doing client work, accounting software is a no-brainer.

Final Thoughts: Freelance Smarter, Not Harder

As a freelancer, you’re wearing all the hats: creator, manager, marketer, and bookkeeper. But that doesn’t mean you should be buried in spreadsheets or chasing down payments every week.

With the right accounting software for freelancers, you gain:

- Clear visibility into your income and expenses

- Fewer headaches at tax time

- Faster payments and smoother cash flow

- More time to focus on client work and growth

Whether you’re just getting started or scaling up your solo business in 2025, the tools on this list can help you simplify your finances, stay compliant, and make smarter decisions.

✅ Choose the one that fits your style, your goals, and your workflow, and stick with it.

💡 You’ll thank yourself when tax season rolls around.

FAQs: Accounting Software for Freelancers

Here are answers to common questions freelancers ask when exploring accounting tools.

Can I use free accounting software as a freelancer?

Yes! Tools like Wave and Zoho Books (free plan) offer robust core features at no cost. They’re perfect for new or budget-conscious freelancers.

Is QuickBooks too advanced for freelancers?

Not at all. QuickBooks Self-Employed is designed specifically for solo professionals. It simplifies taxes, tracks mileage, and helps separate business vs. personal expenses.

What’s the best accounting software for freelance writers or designers?

FreshBooks is a top pick for creatives. It combines time tracking, project billing, and polished invoicing, ideal for service-based freelancers.

Do I really need accounting software if I only have a few clients?

Even with just a few clients, accounting software saves time and keeps you organized. It also ensures you’re tax-ready and helps you look more professional.

How do I track income from multiple platforms (Upwork, PayPal, Stripe)?

Most accounting tools let you connect multiple accounts. You can sync Stripe, PayPal, bank feeds, or import CSVs to keep everything in one place.

Can I use accounting software to estimate and pay quarterly taxes?

Yes. QuickBooks Self-Employed, Zoho Books, and others offer quarterly tax estimators based on your earnings and deductions.

What features help freelancers get paid faster?

Look for tools with automated invoicing, online payment links, and reminder emails. These features reduce client delays and improve cash flow.

Is it safe to connect my bank account to accounting software?

Reputable tools like QuickBooks, Xero, and Zoho use bank-grade encryption to protect your financial data. Just make sure you use a strong password and 2FA.

Can I switch tools later if I outgrow my current one?

Yes, but it’s easier if you start clean. Export your data regularly and avoid over-complicated setups. Many tools offer data migration help.

How often should I update my finances in the software?

Ideally, once a week. Doing small, regular updates saves you from a big, stressful mess later, especially during tax season.