Introduction

Choosing the right accounting software in 2025 isn’t just about balancing the books. It’s about finding a tool that simplifies your workflow, helps you stay compliant, and gives you clear financial visibility without overwhelming your team.

Whether you’re a solo freelancer juggling invoices or a growing company managing payroll, there’s an ideal solution for your needs. But with so many tools claiming to be the “best,” how do you actually choose?

This guide was built to make that decision easier. You’ll get:

- Expert reviews of top-rated tools from real use cases

- Side-by-side comparisons of features, pricing, and pros & cons

- Clear recommendations tailored to different business sizes and industries

So if you’re tired of spreadsheets or juggling disconnected tools, keep reading. This list is designed to help you find accounting software that works for your goals, your budget, and your future.

Top Picks at a Glance

Here’s a quick look at the top-performing accounting software in 2025, sorted by use case so you can narrow your options right away:

| 📌 Best For | 🏆 Top Pick | 💸 Starting Price |

| All-Round SMB Accounting | QuickBooks Online | $35/month |

| Freelancers & Creatives | FreshBooks | $19/month |

| Enterprises & Scaling Teams | Oracle NetSuite | Custom Pricing |

| Free Option for Starters | Wave | $0 |

| Automation & Integrations | Zoho Books | Free–$60/month |

| Modern Interface & UI | Xero | $15/month |

| Localized for ANZ Markets | MYOB Business | $28/month |

| Inventory-Focused Accounting | Sage 50cloud | $58.92/month |

| Simple for Solo Users | Kashoo | $20/month |

| Advanced ERP Features | Sage Intacct | Custom Pricing |

The Elite 10: Unveiling the Best Accounting Software

⭐ Top Traits

✔️ Trusted by Accountants – Most pros already use or support it

✔️ Scalable Features – Works for startups and multi-user teams

✔️ Deep Integration Ecosystem – Easily connects with other business tools

🌟 Unique Features

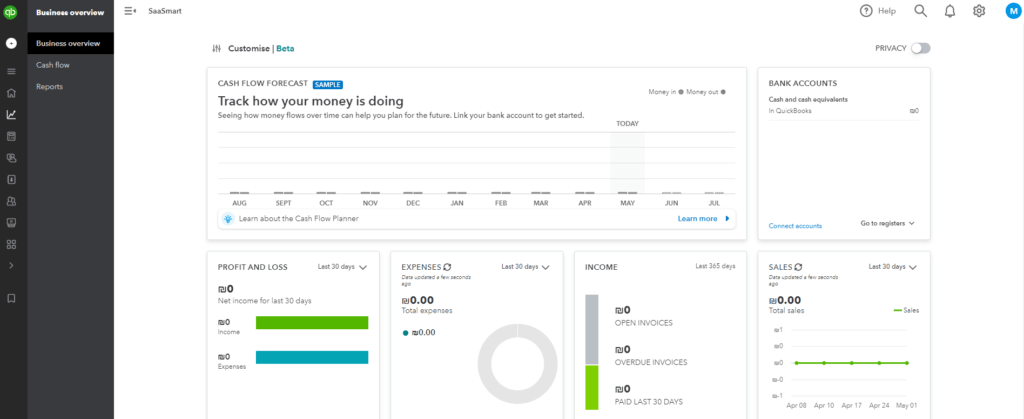

- Real-Time Financial Dashboard – Get instant visibility into your cash flow, income, and expenses

- 750+ Integrations – Sync with tools like Shopify, Gusto, Zapier, and many CRMs

- Automated Invoicing & Payments – Set up recurring billing and accept online payments

- Built-In Tax Tracking – Categorizes expenses and calculates sales tax automatically

- Advanced Reporting Tools – Run P&L, balance sheet, and cash flow reports in a few clicks

🔍 In-Depth Analysis

QuickBooks Online is one of the most complete and flexible accounting platforms available in 2025. If you’re looking for a system that can scale with your business and handle everything from invoicing to payroll and reporting, this is a top-tier option.

You get a modern dashboard that shows where your money is going in real-time. The setup process is straightforward, especially with the guided onboarding steps.

Where QuickBooks really shines is in automation and depth. You can automate recurring invoices, categorize transactions from your bank, and even integrate with payroll and time tracking.

It’s also incredibly popular among accountants and bookkeepers, which means less friction if you’re outsourcing or collaborating with professionals.

However, it may be overkill for very small or non-financial users. The sheer number of features can feel overwhelming if you just need to track expenses or send basic invoices.

✅ Top Benefits and Features

- Saves time through automation, bank sync, and recurring billing

- Keeps you compliant with built-in sales tax tracking and audit logs

- Improves decision-making with detailed financial reports and forecasting tools

- Works anywhere thanks to its robust mobile app (iOS + Android)

💡 Why Choose QuickBooks Online?

If you want powerful accounting software that’s still accessible, QuickBooks Online strikes a strong balance.

It’s especially helpful if you:

- Plan to grow your business and scale your finance team

- Need to collaborate with your accountant or bookkeeper

- Want an ecosystem that works with your CRM, ecommerce platform, or payroll system

This isn’t just a digital ledger; it’s a complete financial command center for your business.

⚖️ Pros and Cons

Positive

✅ Trusted and Familiar

✅ Excellent Invoicing and Reporting

✅ Robust App Ecosystem

✅ Cloud-Based with Mobile Access

Negative

❌ Advanced Features Get Expensive

❌ Support Quality Can Vary

❌ Customization is Limited

❌ Bank Feed Glitches Happen

💸 Pricing and Plans

| Plan | Price (Monthly) | Best For |

| Simple Start | $35 | Freelancers and sole proprietors |

| Essentials | $60 | Small teams with vendor tracking |

| Plus | $90 | Inventory tracking and project profitability |

| Advanced | $200 | Growing businesses with analytics and workflows |

⭐ Top Traits

✔️ Excellent for Invoicing & Payments

✔️ Simple, modern interface

✔️ Designed for service-oriented professionals

🌟 Unique Features

- Customizable Invoicing – Professional, branded invoices with recurring and auto-reminder options

- Time Tracking Built-In – Log hours directly to projects and convert time to invoices in one click

- Client Portal – Clients can view, comment, and pay invoices online

- Payment Processing – Accept credit cards and ACH payments directly from invoices

- Retainer Management – Track time and billing against pre-set retainer limits

🔍 In-Depth Analysis

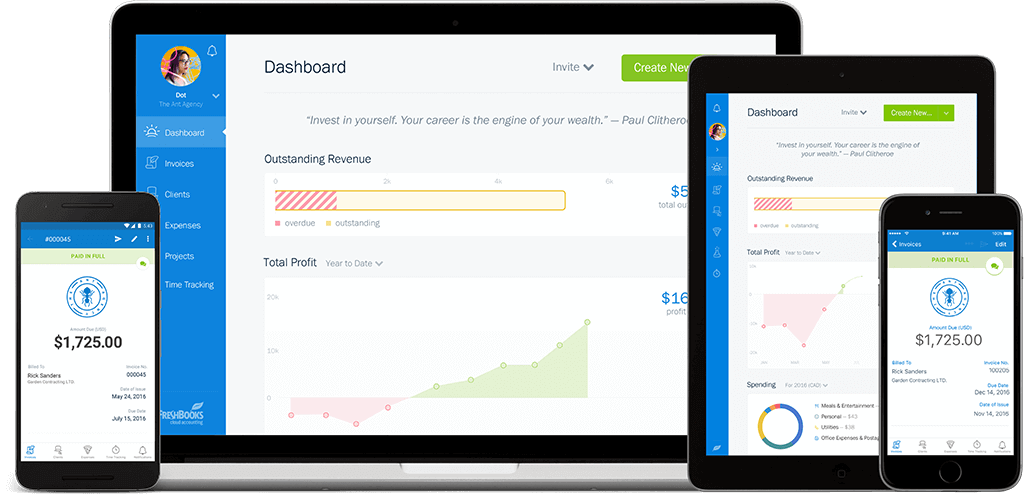

FreshBooks stands out as the friendliest option for non-accountants. It’s designed with simplicity in mind; you don’t need a finance degree to understand how it works.

This platform is built around service businesses. Whether you bill hourly, send project-based invoices, or work on monthly retainers, FreshBooks makes it all feel seamless.

Its time tracking feature is especially strong; you can track time per client, task, or project, then automatically convert those hours into ready-to-send invoices. The mobile app lets you run your business from anywhere, and the client portal improves communication by keeping everything in one place.

Where it falls short is in areas like inventory management and deep financial forecasting; this is not built for complex product-based businesses or large-scale teams. But for solo entrepreneurs or boutique agencies? It’s one of the best.

✅ Top Benefits and Features

- Professional invoicing helps you get paid faster with online payments

- Built-in time tracking streamlines hourly billing

- Client-friendly experience improves communication and satisfaction

- Customizable templates give your brand a polished, consistent look

- Automated reminders reduce manual follow-ups for overdue invoices

💡 Why Choose FreshBooks?

If you’re running a freelance business or creative studio, FreshBooks offers everything you need in one neat, easy-to-use package.

It’s a strong fit if:

- You track time and invoice clients regularly

- You need to manage retainers or recurring billing

- You want a simple way to accept payments and log expenses

- You’re looking for software that feels less “corporate” and more tailored to solo work

It’s not just accounting – it’s client and cashflow management in one place.

⚖️ Pros and Cons

Positive

✅ Ridiculously easy to use

✅ Invoicing that gets you paid faster

✅ Built-in time tracking and project billing

✅ Powerful mobile app

Negative

❌ Client limits on lower-tier plans

❌ Basic financial reporting

❌ Not ideal for inventory or product-based businesses

❌ Smaller app ecosystem

💸 Pricing and Plans

| Plan | Price (Monthly) | Best For |

| Lite | $19 | Freelancers with up to 5 clients |

| Plus | $33 | Growing freelancers with up to 50 clients |

| Premium | $60 | Established service businesses with unlimited clients |

| Select | Custom | Larger teams needing advanced support |

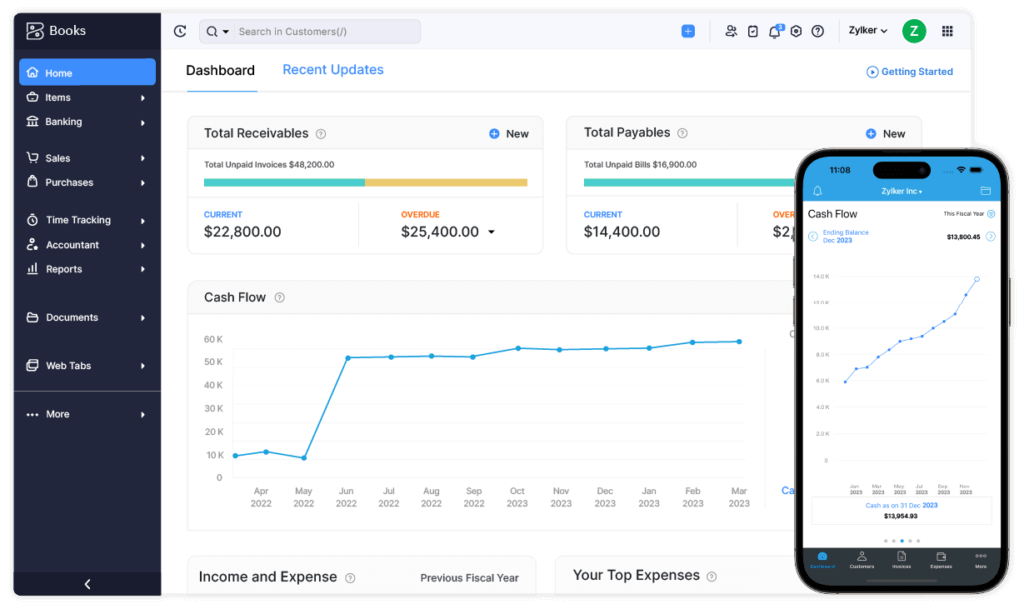

⭐ Top Traits

✔️ Best-in-Class Automation Tools

✔️ Strong tax compliance and audit trails

✔️ Seamless Zoho app integrations

🌟 Unique Features

- Workflow Automation – Automate tasks like reminders, approvals, and journal entries

- Client Portal – Share quotes, invoices, and get feedback in one place

- End-to-End Tax Compliance – GST, VAT, and sales tax automation (region-specific)

- Zoho App Ecosystem Integration – Works natively with Zoho CRM, Projects, Inventory, etc.

- Custom Reports & Schedules – Generate and email reports automatically on a schedule

🔍 In-Depth Analysis

Zoho Books is a powerful accounting platform built for modern businesses that want to automate processes and save time. It’s part of the larger Zoho ecosystem, which includes everything from CRM to project management, so if you’re already using any of those tools, Zoho Books fits in seamlessly.

Its biggest strength is automation. You can set up custom rules that trigger when certain actions happen (like sending payment reminders, auto-tagging expenses, or generating reports). This means less manual work and fewer chances for errors.

Zoho Books also does a great job with tax compliance. Whether you need automated VAT, GST, or sales tax calculations, the system stays updated with regional rules, ideal for international teams or businesses in regulated industries.

The interface is clean, but not as beginner-friendly as FreshBooks. You’ll need some setup time and familiarity with accounting terms. But once you’re in the groove, it’s an incredibly efficient and customizable solution.

✅ Top Benefits and Features

- Save hours per week with smart automation for billing, reminders, and workflows

- Collaborate better with client portals and approval flows

- Stay compliant with accurate, real-time tax reports for multiple regions

- Centralize operations by connecting Zoho CRM, Inventory, and Projects

- Customize everything from invoice templates to workflows and reports

💡 Why Choose Zoho Books?

If your business is growing, and you’re looking for a tool that can grow with it, Zoho Books is a strong choice.

It’s a great fit if you:

- Want to automate repetitive finance tasks

- Use or plan to use other Zoho tools

- Work in industries with complex tax needs or multiple teams

- Need more control over reporting and internal approvals

It may not be the simplest tool on this list, but it’s one of the smartest once it’s set up.

⚖️ Pros and Cons

Positive

✅ User-Friendly Interface

✅ All-in-One Ecosystem Integration

✅ Affordable Pricing, Including a Free Plan

✅ Automation at Every Level

Negative

❌ Limited Third-Party Integrations

❌ Advanced Features Locked Behind Higher Plans

❌ Not Ideal for Complex Enterprises

❌ Fewer Accountants Support It

💸 Pricing and Plans

| Plan | Price (Monthly) | Best For |

| Free | $0 | Small businesses with revenue under threshold |

| Standard | $15 | Basic automation and compliance |

| Professional | $40 | Time tracking and retainer management |

| Premium | $60 | Advanced automation and analytics |

| Elite | $120 | Inventory + multi-branch management |

| Ultimate | $240 | Custom reporting and Zoho Analytics |

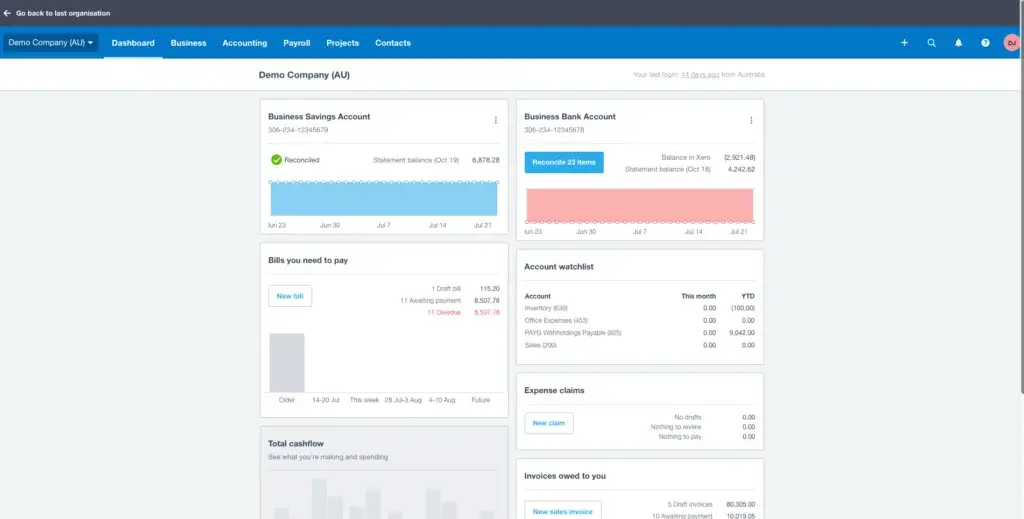

⭐ Top Traits

✔️ Clean, intuitive user interface

✔️ Real-time collaboration with your accountant

✔️ Built-in automation and bank feeds

🌟 Unique Features

- Bank Reconciliation in Real Time – Sync and categorize transactions automatically

- Project Tracking & Time Logs – Monitor billable hours and costs per project

- Custom Invoice Templates – Style and brand your invoices easily

- Multi-Currency Support – Ideal for international businesses

- Inventory Tracking – Real-time inventory updates and reordering

🔍 In-Depth Analysis

Xero offers a cloud-first experience tailored for small businesses that want both simplicity and sophistication. The interface is clean and user-friendly, making it a top choice for teams without in-house accountants.

One standout feature is its live bank feed and reconciliation; transactions are imported, and suggested matches are offered automatically. If you’re tracking time, invoicing clients, or working across currencies, Xero handles it smoothly.

It’s also designed for collaboration. Your bookkeeper or accountant can access your books in real time, eliminating back-and-forths and improving transparency.

That said, it’s not the best option if you need advanced forecasting or heavy inventory control. Xero focuses more on ease of use than enterprise-level power.

✅ Top Benefits and Features

- Modern interface makes navigation effortless

- Live bank feeds save hours of reconciliation

- Project tools help manage time and profitability

- Global-ready features like multi-currency and tax compliance

💡 Why Choose Xero?

If you’re a small business owner looking for accounting software that’s easy to use but not lacking in features, Xero is a compelling choice.

It’s particularly useful if you:

- Want to collaborate easily with your accountant

- Work with international clients or suppliers

- Need invoicing, expenses, and reporting in one place

- Prefer clean design and logical workflows over complexity

⚖️ Pros and Cons

Positive

✅ Intuitive, Modern Interface

✅ Strong Integrations and App Ecosystem

✅ Real-Time Data and Reporting

✅ Cloud-Based and Mobile-Friendly

Negative

❌ No Free Plan

❌ Limited Custom Reports

❌ Phone Support Not Available

❌ Inventory and Payroll Add-ons

💸 Pricing and Plans

- Early – $15/month: Limited invoices and bills

- Growing – $42/month: Unlimited billing, invoices, and bank recs

- Established – $78/month: Includes multi-currency, project tracking, and expenses

🎯 Tip: Xero often offers a 30-day free trial and partner discounts through accounting firms.

⭐ Top Traits

✔️ 100% Free core accounting features

✔️ Simple interface for non-accountants

✔️ Built-in invoicing and payments in one dashboard

🌟 Unique Features

- Invoicing & Estimates – Create and send unlimited professional invoices

- Online Payments – Accept credit cards and bank transfers (fees apply)

- Expense Tracking – Auto-import bank transactions and categorize expenses

- Basic Financial Reports – Profit & loss, cash flow, and balance sheet

- Multi-Currency Support – Send invoices and accept payments globally

🔍 In-Depth Analysis

Wave is one of the best free accounting platforms on the market, and not just because it’s free. It delivers real functionality for small businesses, freelancers, and side hustlers who don’t need advanced features.

You can send unlimited invoices, connect your bank account, track expenses, and view essential reports, all without paying a monthly fee. The platform is especially intuitive for non-finance folks and is often the first step away from spreadsheets.

Its weaknesses are in scaling. If you need things like inventory tracking, payroll outside the US/Canada, or integrations with third-party apps, you may outgrow Wave quickly.

But if your needs are basic and you want to keep costs low, it’s one of the smartest ways to start.

✅ Top Benefits and Features

- Completely free for core accounting, invoicing, and reporting

- Simple dashboard that even beginners can use confidently

- Online payments make it easy for clients to pay quickly

- No contracts or upgrade pressure, great for lean startups

💡 Why Choose Wave?

Wave is perfect for you if:

- You’re a freelancer or a very small business with basic needs

- You want to avoid monthly software fees

- You’re just starting and not ready for complex systems

- You need clean invoices and basic reporting in one place

Just remember, while it’s free, you trade off some flexibility and integrations.

⚖️ Pros and Cons

Positive

✅ It’s completely free

✅ User-friendly and intuitive

✅ Professional invoicing tools

✅ Helpful mobile app

Negative

❌ Limited scalability

❌ No advanced reports or forecasting

❌ Bank auto-import is a paid feature

❌ Customer support is gated behind paid add-ons

💸 Pricing and Plans

- Core Accounting – Free: Invoicing, expenses, reports, and bank sync

- Payments – Pay per transaction: 2.9% + 60¢ for credit cards

- Payroll (US & Canada only) – Starts at $40/month + $6/employee

- Advisory Services – Available as add-ons (bookkeeping, tax help)

🎯 Tip: Wave’s real value comes from staying free, just pay for what you use, like payroll or payment processing.

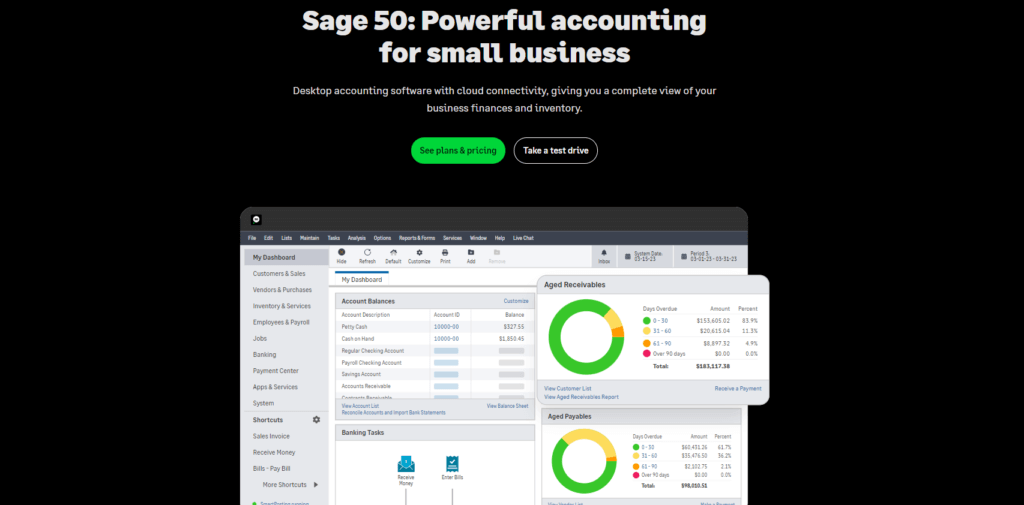

⭐ Top Traits

✔️ Advanced desktop functionality

✔️ Strong reporting and compliance tools

✔️ Payroll and inventory built-in

🔍 Overview

Sage 50cloud combines the power of desktop software with optional cloud access. It’s built for businesses that need control over inventory, fixed assets, and detailed reporting, especially those with strict compliance needs.

It’s not as intuitive as cloud-native tools, but it’s incredibly feature-rich and secure for teams that prefer on-premise control.

✅ Why Choose Sage 50cloud?

Choose Sage 50cloud if:

- You need detailed reporting and audit trails

- Your business relies on inventory and payroll

- You want desktop reliability with cloud backups

It’s not ideal for users seeking a lightweight, modern UI.

💸 Pricing

- Pro Accounting – $58.92/month

- Premium – $96.58/month (adds inventory, job costing)

- Quantum – Custom pricing for multi-user setups

⚖️ Pros and Cons

Positive

✅ Deep Accounting Power

✅ Customizable Reports and Financial Insights

✅ Advanced Inventory Control

✅ Data Ownership and Control

Negative

❌ Mobile Access Is Limited

❌ User Interface Feels Outdated

❌ Steeper Learning Curve

❌ Higher Cost at Scale

⭐ Top Traits

✔️ Localized tax and payroll tools

✔️ Built-in timesheets and superannuation

✔️ Desktop + cloud hybrid access

🔍 Overview

MYOB is built for compliance-heavy Australian and Kiwi businesses. It covers GST, BAS, STP Phase 2, and superannuation reporting, making it easy to meet ATO and IRD standards.

Its hybrid model lets you manage your books from a desktop or online, making it ideal for teams who want the best of both worlds.

✅ Why Choose MYOB?

Choose MYOB if:

- You operate in Australia or New Zealand

- You want ATO/IRD-compliant payroll and tax features

- You prefer software with both desktop and cloud access

It’s less relevant if your business operates outside these regions.

💸 Pricing

- Business Lite – $28/month

- Business Pro – $55/month

- AccountRight Plus – $140/month (desktop + cloud + payroll)

Positive

✅ All-in-One Accounting + Payroll

✅ Best-in-Class for AU/NZ Compliance

✅ Inventory + Time Billing Built In

✅ Desktop + Cloud Flexibility

Negative

❌ Limited Global Relevance

❌ Outdated Interface in Some Areas

❌ Add-Ons Can Drive Up Cost

❌ Smaller Integration Ecosystem

⭐ Top Traits

✔️ End-to-end ERP with accounting

✔️ Real-time financial visibility

✔️ Scales globally with multi-entity support

🔍 Overview

NetSuite is more than just accounting software; it’s a full cloud-based ERP platform. It centralizes finance, CRM, inventory, and procurement under one roof, making it ideal for businesses managing multiple entities, currencies, and teams.

With powerful automation, audit trails, and customizable dashboards, NetSuite offers deep visibility into every corner of your operations. But it comes with enterprise-level pricing and complexity, so it’s best suited for companies with a dedicated finance team.

✅ Why Choose NetSuite?

Choose NetSuite if:

- You manage complex operations or multiple subsidiaries

- You need real-time financial data across global teams

- You want advanced automation, compliance, and control

It’s overkill for small teams, but better for scaling companies with structured finance workflows.

💸 Pricing

- License + Setup – Custom pricing (starts ~$999/month)

- Add-ons – Vary by module (CRM, inventory, HR, etc.)

- Implementation – Requires an onboarding partner or NetSuite support

⚖️ Pros and Cons

Positive

✅ Comprehensive ERP solution

✅ Real-time financial management

✅ Scalable cloud platform

Negative

❌ High cost

❌ Complex for small businesses

❌ Resource-intensive implementation

⭐ Top Traits

✔️ Easy setup and use

✔️ Automatic bank reconciliation

✔️ Unlimited users on all plans

🔍 Overview

Kashoo is a minimalist accounting platform made for freelancers and solopreneurs who want something straightforward. You get automatic bank feeds, income and expense tracking, and simple invoicing, all without the clutter of complex features.

It lacks deep integrations or advanced reports, but for basic bookkeeping? It’s fast, reliable, and beginner-friendly.

✅ Why Choose Kashoo?

Choose Kashoo if:

- You want simplicity over bells and whistles

- You’re a solo user or small team

- You need basic accounting features that “just work”

It’s not ideal for users who need project tracking, inventory, or advanced analytics.

💸 Pricing

- Trulysmall Accounting – $20/month

- Kashoo Plan – $30/month (adds multi-currency, customization)

- Payroll Integration – Not included (requires 3rd-party setup)

⚖️ Pros and Cons

Positive

✅ Easy-to-use interface

✅ Automatic reconciliation

✅ Unlimited users

Negative

❌ Basic accounting features

❌ Limited reporting capabilities

❌ Few third-party integrations

⭐ Top Traits

✔️ Full-featured desktop software

✔️ Built-in payroll and inventory tools

✔️ One-time license option

🔍 Overview

AccountEdge Pro is old-school, in a good way. It’s one of the few accounting platforms that still offers a desktop-first experience with powerful tools for managing payroll, inventory, and job costing, all without needing a cloud connection.

It’s packed with functionality, but requires installation and may feel dated compared to modern cloud platforms. Great for users who prefer local control and rich offline features.

✅ Why Choose AccountEdge?

Choose AccountEdge if:

- You prefer a desktop-first experience

- You manage inventory or in-depth job costing

- You want a one-time license instead of monthly billing

It’s not ideal for mobile teams or businesses needing real-time cloud collaboration.

💸 Pricing

- AccountEdge Pro – $599 one-time (or $15/month via subscription)

- Payroll – Included in U.S. version (additional fee for updates)

- Cloud Collaboration – Optional add-on with AccountEdge Connect

⚖️ Pros and Cons

Positive

✅ Advanced inventory management

✅ Integrated payroll billing

✅ Comprehensive toolset

Negative

❌ Desktop-only solution

❌ Complex implementation

❌ Limited accessibility

Side-by-Side Comparison

Top Accounting Software in 2025

| Software | Best For | Starting Price | Free Plan | Key Features |

| QuickBooks Online | All-around SMB accounting | $35/month | ❌ | Reports, Invoicing, Payroll, 750+ integrations |

| FreshBooks | Freelancers & creatives | $19/month | ❌ | Invoicing, Time tracking, Payments, Client portal |

| Zoho Books | Automation & Zoho users | $15/month | ✅ (under revenue cap) | Workflows, Client portal, Tax, Custom reports |

| Xero | Small business simplicity | $15/month | ❌ | Bank feeds, Projects, Invoicing, Multi-currency |

| Wave | Free accounting | $0 | ✅ | Invoicing, Reports, Payments, Expense tracking |

| Sage 50cloud | Desktop + compliance | $58.92/month | ❌ | Inventory, Payroll, Fixed assets, Audit trail |

| MYOB Business | ANZ-based businesses | $28/month | ❌ | BAS/GST tools, Timesheets, Payroll, Hybrid access |

| Oracle NetSuite | Enterprise ERP | Custom | ❌ | Real-time insights, Global ops, Compliance, Full ERP |

| Kashoo | Solopreneurs needing simplicity | $20/month | ❌ | Auto bank feeds, Invoicing, Reports, Unlimited users |

| AccountEdge Pro | Offline desktop control | $599 one-time | ❌ | Inventory, Payroll, Desktop-first, Job costing |

How to Choose the Right Accounting Software

When you’re picking accounting software, it’s easy to get overwhelmed by features, pricing, and technical jargon. But the truth is, you don’t need the most popular tool; you need the right one for your business.

Let’s walk through how to evaluate your options and focus on what really matters.

📊 Understand Your Business Needs

Before you compare software, take a step back and think about your workflow. Ask yourself:

- Are you a freelancer, a small business, or part of a growing team?

- Do you bill by the hour or sell physical products?

- Do you handle payroll or work with contractors?

- Do you have an accountant or manage finances yourself?

Knowing where you are now and where you’re headed will shape your ideal tool.

🧩 Examples:

-

Freelancer with a service business? You’ll want simple invoicing, time tracking, and expense categorization.

-

Running a small eCommerce store? Look for inventory management and sales tax automation.

-

Managing a growing company with a team? You may need advanced reporting, payroll, and multi-user permissions.

⚙️ Core Features That Matter

Here’s a breakdown of the must-have features that make a difference in real-world use:

✅ Essentials You Shouldn’t Skip:

- Invoicing & Billing – Automate and track client payments with ease

- Expense Tracking – Sync with bank accounts or credit cards

- Financial Reporting – Generate P&L, cash flow, and balance sheet reports

- Bank Reconciliation – Match transactions without manual work

- Tax Tools – Automatically categorize deductions and generate tax summaries

🎯 Bonus Features (based on your needs):

- Multi-user Access – Invite your accountant or team with role-based permissions

- Time Tracking – Essential for billing hourly projects

- Inventory Management – Track product quantities, reorder levels, and costs

- Recurring Invoices & Subscriptions – Great for SaaS and retainer-based businesses

- Multi-Currency Support – Helpful if you invoice globally

☁️ Cloud vs. Desktop vs. ERP Systems

Accounting platforms come in different formats. Your choice here affects cost, access, and flexibility.

💡 Cloud-Based (SaaS)

- Accessible from anywhere

- Always up to date

- Ideal for modern teams and remote work

✔ Best for: Most freelancers and SMBs

💻 Desktop Software

- Installed on your local device

- May offer stronger offline security

- More traditional and often complex

✔ Best for: Local businesses with no need for cloud sync

🏢 ERP Systems (Enterprise Resource Planning)

- Combines accounting with inventory, HR, CRM, etc.

- Expensive and complex to implement

- Offers massive scalability and automation

✔ Best for: Midsize to large businesses with multiple departments

🧪 Test Before You Commit

Most tools offer a free trial, and you should take full advantage of it. Here’s what to do:

- Set up a test invoice or two

- Link a bank account (if possible)

- Upload some expenses and run a report

- Ask your bookkeeper/accountant to take a look

Don’t just click around; mimic real tasks. It’s the best way to know if the software fits your process.

💡 What Makes a Tool “Right” for You?

At the end of the day, the best accounting software is the one you’ll actually use consistently. Look for something that:

- Matches your current and future business size

- Offers features you need (without overwhelming you with extras)

- Fits your budget and gives you room to grow

- Makes your accounting feel easier, not more complicated

If it saves you time, reduces stress, and keeps your finances organized, that’s your winner.

Final Recommendation

Choosing the Best Accounting Software for Your Business

The truth is, there’s no one-size-fits-all “best” accounting software. The right tool depends on your business size, complexity, and growth plans.

Here’s how to make the smartest choice moving forward:

✅ Go With a Tool That Matches Your Workflow

- If you’re a freelancer or service-based solo pro, tools like FreshBooks or Wave will keep things simple and affordable.

- For small to mid-sized businesses looking to scale, QuickBooks Online, Zoho Books, and Xero offer more advanced features with plenty of automation.

- Running a compliance-heavy business or inventory operation? Look into Sage 50cloud, MYOB, or AccountEdge Pro.

- Need enterprise-level automation and cross-entity visibility? You’ll want an ERP like Oracle NetSuite or Sage Intacct.

Frequently Asked Questions

1. What is the best accounting software for small businesses in 2025?

QuickBooks Online is a top choice for small businesses due to its powerful features, scalability, and wide adoption. Zoho Books and Xero are also excellent, depending on your budget and needs.

2. Is there any truly free accounting software?

Yes. Wave offers a 100% free plan for invoicing, expense tracking, and reporting, no monthly fee required. It’s ideal for freelancers, startups, or side hustles with basic needs.

3. Which accounting software is best for freelancers?

FreshBooks is built specifically for freelancers and consultants. It includes time tracking, client portals, and easy invoicing. Wave is another strong (and free) option.

4. Can I do accounting without hiring an accountant?

Yes, many platforms like Xero, QuickBooks, and Zoho Books are designed to be user-friendly for non-accountants. However, it’s still smart to consult an accountant for tax season or complex reporting.

5. Is cloud accounting software secure?

Yes. Most modern platforms use bank-grade encryption, automatic backups, and two-factor authentication to keep your data safe. Cloud tools are also more disaster-resilient than local backups.

6. How much should I expect to spend on accounting software?

Costs range from $0 (Wave) to $20–$60/month for most SMB tools. ERP systems like NetSuite can run over $1,000/month depending on your configuration and team size.

7. What’s the difference between accounting software and bookkeeping software?

Bookkeeping software focuses on recording financial transactions, while accounting software includes reporting, compliance tools, tax tracking, and often payroll and automation features.

8. Which tool is best for inventory and product-based businesses?

Sage 50cloud, Zoho Books (Elite/Ultimate), and AccountEdge Pro offer solid inventory tracking. For advanced needs, look at ERP options like NetSuite or Odoo.

9. Can I switch to another accounting platform later?

Yes, most platforms allow you to export data as CSV or PDF, and some offer migration services. Still, it’s best to switch at the start of a fiscal period to avoid confusion.